Grab broke even in its deliveries segment for the first time in five years during the third quarter.

The company's adjusted earnings before interest, taxes, depreciation and amortization loss was $161 million, a 24% improvement from the same period a year ago. Earnings before interest, taxes, depreciation and amortization, orEBITDA, is a measure of profitability

Grab has a wide range of services including ride-Hailing, food delivery, package delivery, grocery delivery, and mobile payments through GrabPay.

The company said that its delivery business broke even three quarters ahead of expectations due to the use of incentive spend. Grab acquired a majority stake in a Malaysian supermarket chain in order to speed up its expansion into grocery delivery.

Two quarters ahead of its previous guidance, food deliveries reported positive adjustedEBITDA in the third quarter.

Core food deliveries and overall deliveries segment-adjusted EBITDA breakeven were both achieved ahead of guidance. Anthony Tan, Grab co-founder and group CEO, said in a statement that they achieved this by staying laser focused on their cost structure and incentive.

The U.S.-listed shares of Grab rose 0.64% to close at $3.15 a piece in Wednesday's trade, which was better than the S&P 500's and the Nasdaq's decline.

In December 2021, Grab went public. Year to date, the stock has plummeted.

The average active driver-partners in the quarter was 80% of their pre-covid levels. The company said incentives fell to 9.4% of GMV from 11.4% for the same period last year and 10.4% for the previous quarter.

Tan said that this shows their commitment to growing profitable and sustainable.

Grab raised its full-year forecast and now expects revenue between $1.32 billion and $1.35 billion, up from the previous range of $1.25 billion to $1.30 billion The company now expects a loss of $315 million in the second half of the year, compared to the $380 million it previously predicted.

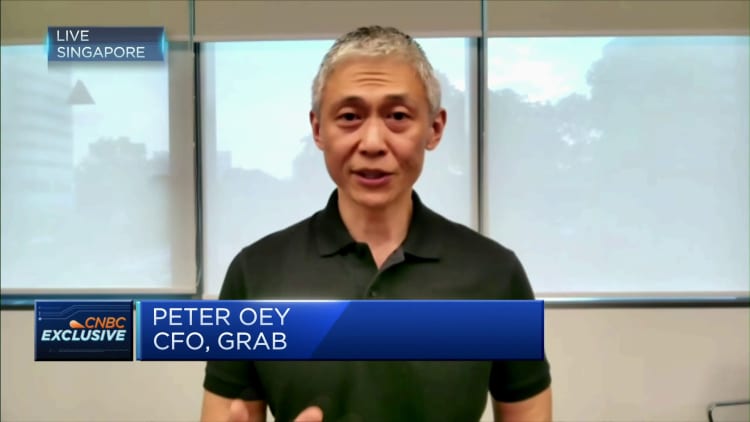

Peter Oey, CFO of Grab, said during the media conference that they will aim to improve their cost structure.

We paused or slowed hiring in corporate departments. He said that they have been disciplined to maximize costs in non-headcount overheads.