The Bureau of Labor Statistics reported Tuesday that wholesale prices increased less than anticipated in October.

The produce price index, a measure of the prices that companies get for finished goods in the marketplace, rose against expectations.

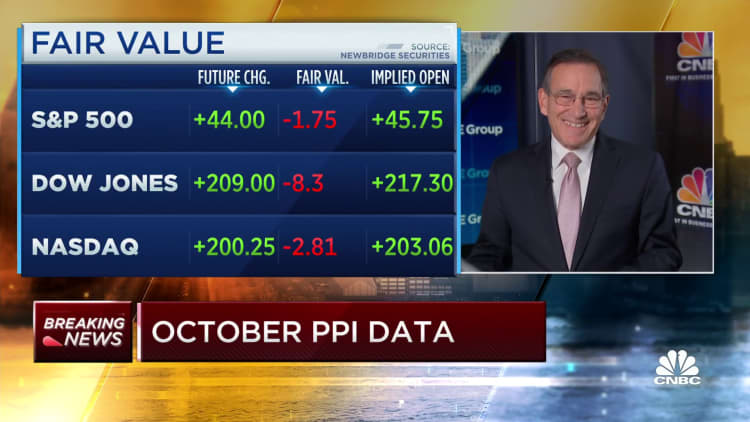

Shortly after the release, stock futures tied to the Dow Jones Industrial Average were up more than 400 points, reflecting market anticipation that cost of living increases not seen since the early 1980's were easing.

The year-over-year increase in the producer price index was 8%, off the all-time peak of 11.7% hit in March. October's gain was equal to September's gain.

Excluding food, energy and trade services, the index rose 4.9% on the year. The index was unchanged on the month and up 6.7% on the year.

The services component of the index declined in a significant way. It was the first decline in that measure in over a year. The biggest gain since June was attributed to the rebound in energy, which resulted in a 5.7% jump in gasoline.

Despite the increase in energy costs, the deceleration came.

The index is a good leading indicator for inflation, as it shows the prices that will make their way into the marketplace.

The consumer price index showed a monthly gain of 0.4% last week, which was less than the 0.6% estimate. In June, the annual gain was 9%, which was the highest in 41 years. The markets jumped after Thursday'sCPI release.

The Federal Reserve is trying to bring down inflation. The central bank's benchmark borrowing rate has gone up six times in a year for the first time in 14 years.

Vice Chair Lael Brainard said Monday that she expects the pace of hikes to slow in the near future. The Fed can move to a more deliberate stance as it watches the impact of its rate hikes on financial conditions.

The New York Fed's Empire State Manufacturing Survey for November registered a reading of 4.5%, an increase of 14 percentage points on a monthly basis and better than the estimate for a -6% reading. The difference between expansion and contraction is measured.

The prices paid and received components increased in value.