Between $1 billion to $2 billion of customer funds have vanished from the failed FTX.

Bankman-Fried, the former CEO of FTX, transferred $10 billion of customer funds from his exchange to a digital asset trading house.

FTX was thought to be a sister company to Alameda. The Department of Justice, as well as the Securities and Exchange Commission, are looking into how FTX handled customer funds.

Some of the $10 billion sent to Alameda has vanished according to two people.

Both sources were briefed on the company's finances by top staff.

The gap was estimated to be more than $1 billion. The other said it could be between $1 billion and $2 billion.

It seems that the news agency reached Bankman-Fried by text. The former FTX chief wrote that he didn't agree with the characterization of the transfer.

When asked about the funds that are allegedly missing, Bankman- Fried wrote, "???"

Bankman-Fried met with executives in Nassau to figure out how much cash the company needed to cover the hole in its balance sheet. The meeting happened, according to Bankman- Fried.

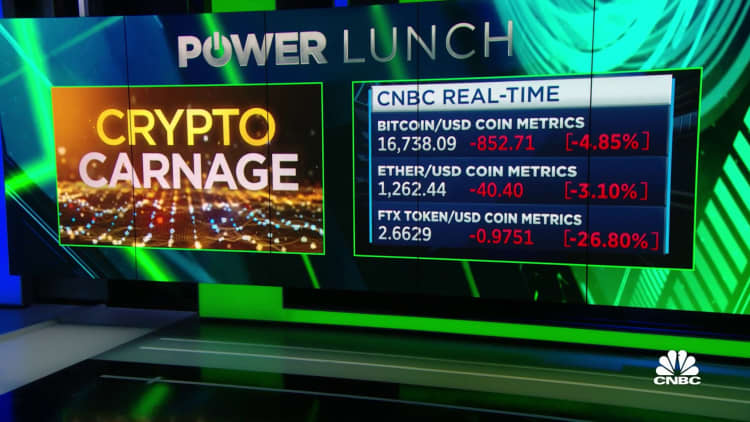

It had been a rough few days for FTX after Changpeng Zhao, the CEO of the world's largest exchange, said that his company was selling the last of its FTT token, the native currency of FTX. The article pointed out that Bankman-Fried's hedge fund, Alameda Research, held an outsized amount of FTT.

The plunge in the price of FTT was caused by Zhao's public declaration. The largest by a huge margin was demanded by FTX clients on Sunday, according to Bankman- Fried. The emergency meeting was held in the capital of the Bahamas.

The heads of FTX's regulatory and legal teams were in the room as Bankman-Fried showed multiple spreadsheets detailing how much cash FTX had lent to Alameda.

The documents show a $10 billion transfer of customer deposits from FTX to Alameda. Some of the funds could not be accounted for among the assets of the city.

There was a back door in FTX's books that was created with "bespoke software."

According to two sources, it was a way that ex-CEO Bankman-Fried could make changes to the company's financial record without being flagged. It could have prevented the $10 billion transfer from being flagged to either his internal compliance team or external auditors.

The back door was denied by Bankman- Fried.

CNBC requested comment from FTX and Alameda Research, but neither responded.