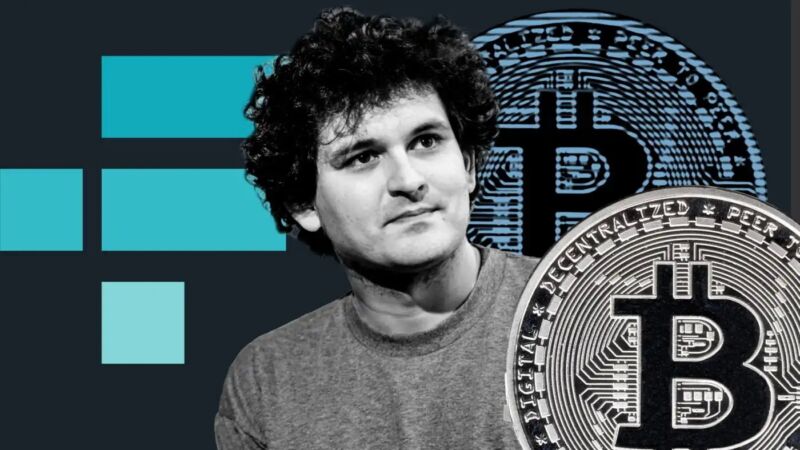

FTX has filed for Chapter 11 protection in the US, marking a stunning collapse for Sam Bankman-Fried's empire that was valued at $32 billion just months ago.

FTX's US entity, Bankman-Fried's proprietary trading group Alameda Research, and about 130 affiliated companies were included in the filing.

After customers rushed to pull their assets out of the business following concerns about its financial health, Bankman- Fried desperately sought billions of dollars to save his company.

John J Ray III, a restructuring specialist, will replace Bankman-Fried as CEO.

The relief of Chapter 11 will give the FTX Group the chance to assess its situation and develop a process to maximize recoveries for stakeholders.

AdvertisementBankman-Fried will continue to assist in an orderly transition.

In just over three years, FTX had secured a $32 billion valuation and had wooed a roster of blue chip investors. In the last few days, venture capital firms have marked their investments down to zero.

Bankman- Fried, one of the most well-known faces in the industry, had recently sought $6 billion to $8 billion in order to stem a liquidity crunch. He apologized on Thursday for the crisis that engulfed his company. That is the most important thing. I shouldn't have done worse.

FTX Digital Markets is not included in the Chapter 11 proceedings. The commission took action against the entity. Assets belonging to the subsidiary can't be moved without the approval of a provisional Liquidator.

There are other units that are not included in the filing. Japanese watchdogs suspended local operations of FTX's international platform while the group's Australian business was put into administration.

The Financial Times is a division of The Financial Times. All rights belong to the person. Not to be copied or altered in any way.