The government report showing that inflation had cooled in October caused a decline in bond yields.

According to Mortgage News Daily, the 30-year fixed rate dropped 60 basis points. That is in line with the record drop at the beginning of the Covid 19 epidemic. At the beginning of the year, the rate was more than double what it is now.

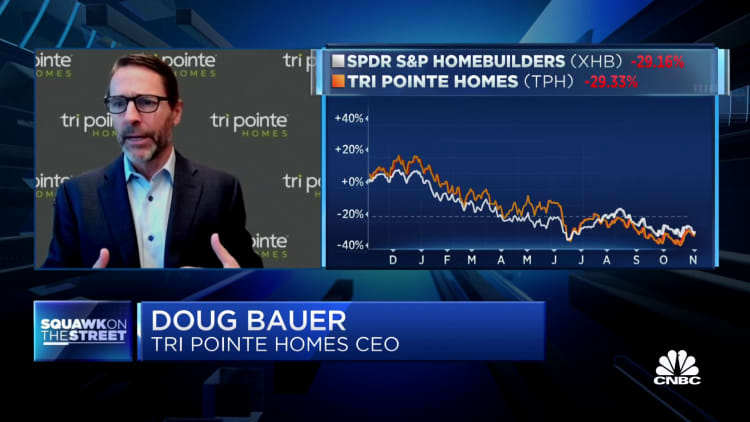

Homebuilders such as DR Horton and Pulte surged along with broader market gains. The stock prices of those companies have been hammered by the increase in rates.

The consumer price index rose in October at a slower pace than anticipated. Mortgage rates followed the yield on the 10-year Treasury as a result.

What do you think will happen next?

Matthew Graham, chief operating officer of Mortgage News Daily, said that this is the best argument to date that rates are done rising.

Rates are not out of the woods yet, according to Graham. There is still a lot of economic uncertainty in the U.S. and global financial markets.