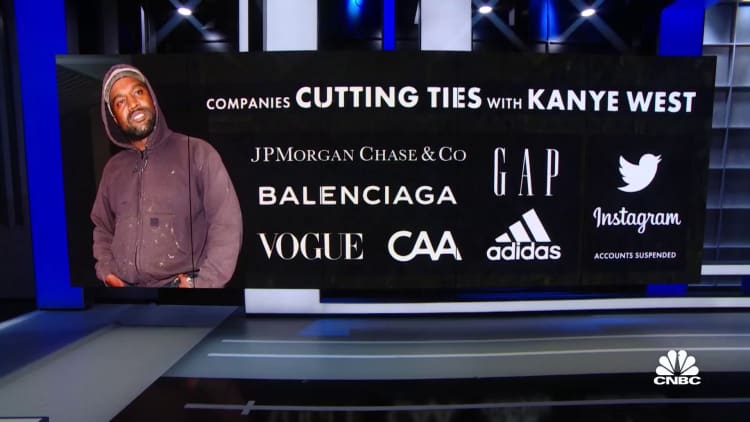

The German sportswear giant cut its full-year guidance on Wednesday due to the fact that it terminated its partnership with West.

On October 25th, the company ended its relationship with Ye after he launched a series of offensive and antisemitic rants on social media.

The company now expects a net income from continuing operations of around 250 million euros, down from a target of 500 million euros. The gross margin is expected to come in at around 47% for the year, with the company now expecting currency neutral revenues for low single digit growth.

In the third quarter, Adidas reported a 4% year-on-year increase in currency-neutral sales, with double-digit growth in e- commerce in Europe, the Middle East, and Africa. The company's gross margin fell due to higher supply chain costs, higher discounting, and an unfavorable market mix.

Net income from continuing operations was 66 million euros, down from 479 million euros a year ago, due to a number of one-off costs and tax effects.

Negative tax implications in the third quarter of the year resulted in the difference between the preliminary figure and the actual figure. A positive tax effect of similar size will compensate for the negative tax effect.

The company said that it had reduced its full-year guidance because of worsening traffic trends in Greater China, higher clearance activity to reduce elevated inventory levels as well as total one-off costs of 500 million euros.

The CFO of Adidas said in a statement that the market environment shifted at the beginning of September as consumer demand in Western markets slowed.

A significant inventory build up across the industry led to higher promotional activity during the remainder of the year which will weigh on our earnings.

Ohlmeyer said the company was encouraged by the enthusiasm in the build up to the world cup.