The token native to FTX lost most of its value after the company was acquired by another firm.

The coin fell below $5 in New York on Tuesday. In a single day, the selloff wiped out more than $2 billion in value.

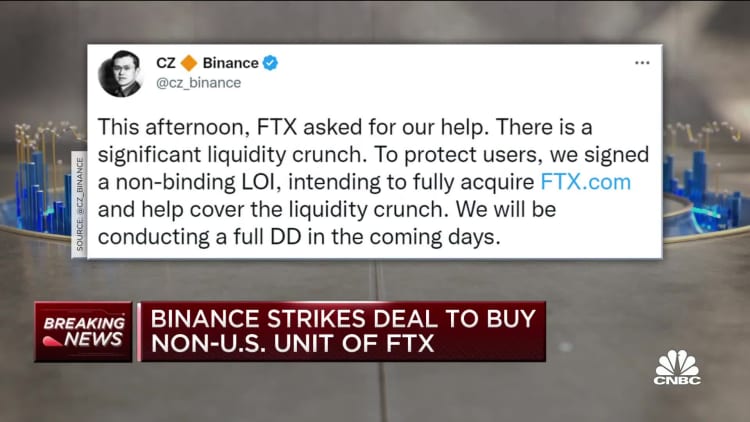

Changpeng Zhao, also known as CZ, wrote on his verified account that he expects FTT to be highly volatile in the next few days.

Tuesday was a bad day for Cryptocurrencies as a class. There was a double-digit percentage drop in the share price of the exchange.

Nic Carter, a partner at Castle Island Venture, said that it was the most dramatic deal in the history of the industry. It consolidates the two largest offshore exchanges into a single entity and is a disaster for FTX.

The agreement between the two companies is non-binding and follows what FTX CEO Sam Bankman- Fried called "liquidity crunches" at his firm which was valued at $32 billion in a financing round earlier this year.

Non-U.S. businesses are unaffected by the acquisition. The U.S. division won't be part of Binance. The U.S. part of FTX accounted for less than 5% of revenue. Bankman- Fried lives in the Bahamas.

Though it wasn't as widely available, FTX created its own token called FTT, which could be used to purchase goods and services. The ability to earn interest and rewards was promised to owners of FTT. FTT and other coins are vulnerable to market downturns because they are largely unregulated.

A long-term position in the FTX token was taken by Binance as part of the strategic investment it made in FTX.

The company had a lot of sway over FTX and the market's view of it. Over the weekend, investor confidence in FTX was thrown into turmoil by the announcement of the sale of the holdings of FTT.

He said that the company had about $2 billion worth of stable coins.

He said that they were going to liquidate any remaining FTT on their books due to recent revelations.

The price of FTT was close to $25 the day before the announcement. After the deal was announced Tuesday, it plummeted off a cliff. The circulating supply of FTT is about $735 million, down from the previous day.

According to Bankman-Fried, there had been $6 billion of net withdrawals from FTX in the last 72 hours. Net outflows are usually in the tens of millions of dollars.

Carter said that the fact that Sam was willing to do this deal suggested that FTX was deeply impaired in terms of the run on the bank that began in the last 48 hours. We don't know if they were lending out or gambling with user deposits.

FTX didn't reply to CNBC's requests for comment.

FTX halted withdrawals from its platform after spooked investors attempted to pull their funds, in a move similar to the collapse of other firms this year.

Alameda Research is Bankman- Fried's trading firm and sister company to FTX. According to a report last week on the state of Alameda's finances, a large portion of its balance sheet is concentrated in FTT. Alameda says that FTT is only a small part of its balance sheet.

If the price of FTT goes down, then Alameda could face margin calls and other pressures. Everyone will be in trouble if FTX is the lender.

CNBC contributed to the report.