Sam Bankman-Fried, the founder of FTX, has agreed to sell his exchange to the world's largestcryptocurrencies firm.

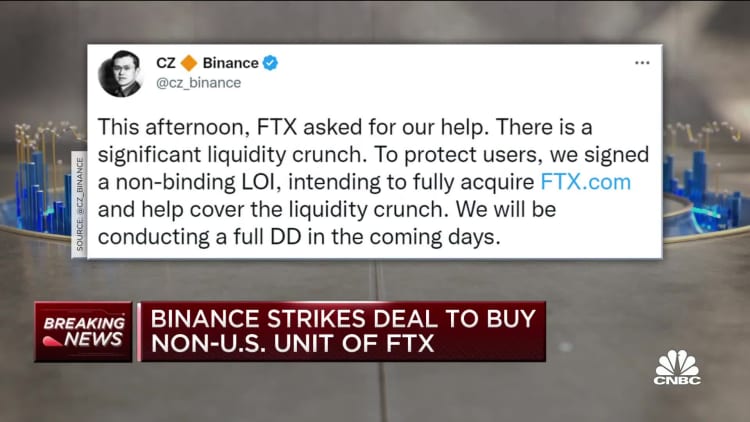

Changpeng Zhao said on Tuesday morning that there is a significant liquidity crunch at FTX and that he signed a non-binding LOI to help cover it.

The firm has the ability to withdraw from the deal at any time.

Sam Bankman- Fried confirmed the agreement on his verified account.

FTX was one of the first investors. FTX.com would be the first and last investor according to Bankman- Fried.

FTX.com is only impacted by the acquisition. FTX.us won't be part of Binance. The deal is dependent on a non-binding letter of intent, pending full due diligence.

The token native to FTX was up on the news. In the last 45 minutes, it has increased more than 26%. Concerns about the solvency of FTX and its sister trading firm, Alameda Research, led to a major sell-off on Monday. BNB is up 20% over the past year.

FTT is expected to be highly volatile in the coming days.

FTX halted withdrawals from its platform after spooked investors tried to pull their money. The company's holdings of FTT were going to be sold.

Due to recent revelations, we have decided to liquidate any remaining Ftt on our books.

Alameda Research is Sam Bankman- Fried's trading firm and sister company to FTX. According to a report last week on the state of Alameda's finances, a large portion of its balance sheet is concentrated in FTT. Alameda says that FTT is only a small part of its balance sheet.

There are two issues with the Alameda hedge fund being tied to FTX through a ton of FTT token. If the price of FTT goes way down then Alameda could face margin calls and all sorts of pressure, and if FTX is the lender to Alameda then everyone is going to be in trouble.

He said that the issue at Alameda became a bank run. Everyone pulled their assets out of FTX because of the fear that it would be bankrupt.

CNBC contributed to the report.