The American Express Platinum Card is considered to be one of the top travel cards on the market due to its many benefits and perks. Right now is a good time to sign up for the card because of the targeted 125,000 point offers. There are over 40 unique perks of the American Express Platinum card that will be discussed in our benefits guide.

There were changes to the credit and status of the company.

We wanted to give you more information about the benefits of the Amex Platinum card, so we broke them down for you. In order to save you time, I highlighted and linked to relevant content from our website. The Platinum Card's annual fee is going to go up to $700 for the personal version. There are some ways to get huge value from the card. When the annual fee is due, you should call. This is an example of a successful call.

The guide covers the personal version of the card. There is too much overlap between the personal and business versions to justify a separate post.

Amex Platinum can get you free changes and cancellation on American Airlines without status.

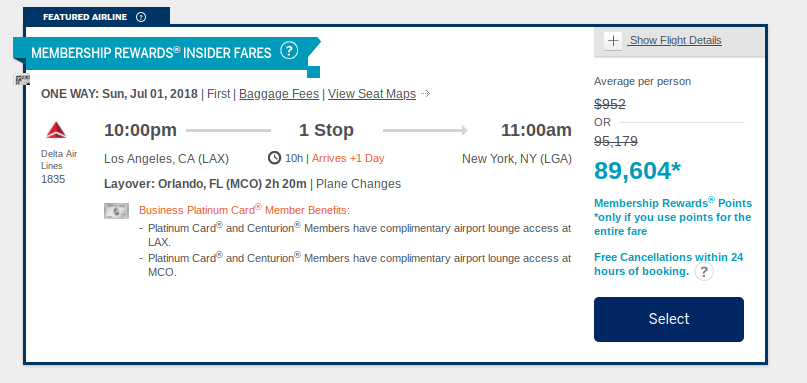

Membership rewards points are worth a lot. I devoted weeks of my life to teaching people how to earn and redeem them, because they are so valuable. The American Express Membership rewards points guide includes the best ways to earn and redeem points.

The Platinum Card gives the best return on spend for airfare as well as 5x points on certain hotel reservations.

Amex offers can save you a lot of money and are a great way to get extra points for shopping at a lot of retailers. Click here if you want to learn more about Amex offers.

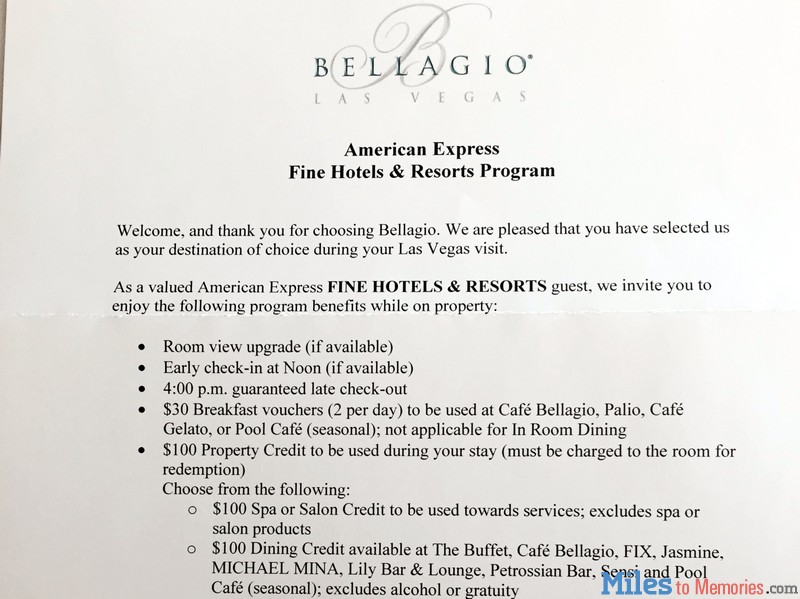

If you book through Amex Travel, you'll get perks at the Fine Hotels & Resorts.

There is a guide to the Amex fine hotels and resorts collection.

When you stay at least two nights in a row, you'll get the following benefits.

Click here for my complete guide to American Express Platinum's international airline program discount. Flight discounts on premium economy, business and first class fares for participating airlines are offered when tickets are booked through Amex Travel and the Platinum Cardholder is flying on the itinerary. Delta, American and Air France are among the airlines that participate in the program.

Receive discounts on Wheels Up Connect and Wheels Up Core memberships. You can get a $500 or $2,000 credit added to your Wheels Up account, depending on your membership type. Visit here to learn more.

If you pay the full cost in points, you can get a discount on flights if you use the Amex travel portal for airfare. I've seen these deals on flights from Alaska, Delta and American to other destinations.

The benefits of the cruise privileges program were decent. I received an additional membership rewards point for every dollar of spend, a $200 on board credit, and a bottle of champagne.

When you pay with an American Express card, you can earn more Membership Reward Point.

The new Amex Platinum Benefit is promising flight discounts. Is it a bait and switch?

There is room upgrade, free breakfast, bonus earnings and more. You can see all benefits here.

Premium car rental programs have complimentary memberships for you.

The president's circle status comes with perks that may be used. Adding a free additional driver, expedited returns, and a 4 hour grace period on returns are some of the things that can be done. Grant is a travel agent.

How much value you get out of concierge assistance is up to you. The concierge service can help you get things done for you. There is a thread on Flyertalk for all sorts of crazy requests.

I love the benefit of the global dining collection. Reservations were made for Amex Platinum and Centurion card holders only at the restaurants included in the collection. In the past, I have called for reservations and was told the restaurant was full, only to find out a few hours later that the concierge agent was able to get me in. There are member restaurants.

ShopRunner gives you 2 days of free shipping. I get a lot of use out of this benefit with some of my favorite retailers.

You can earn points on purchases without a store card with InCircle.

The complete guide to credit card shopping benefits is a good place to start.

The manufacturer's warranty will be extended for an additional year or two.

Purchases that are accidentally damaged, stolen, or lost can be protected for up to 90 days.

If you try to return an eligible item within 90 days from the date of purchase and the merchant won't take it back, American Express will reimburse the full purchase price, up to $300 per item, up to a maximum of $1,000 per calendar year per card account.

The trip delay insurance was added by American Express in January of 2020. If you book a flight you will be able to earn 5X membership rewards. If your flight is delayed more than 6 hours, you will have some protection.

I have never used this benefit on the Platinum card, but it is one of my favorites.

If you purchase the entire fare for a Common Carrier ticket on your eligible card, you can be covered for eligible lost baggage.

If the car you rent is damaged or stolen, you can be covered if you use your eligible card to reserve and pay for it.

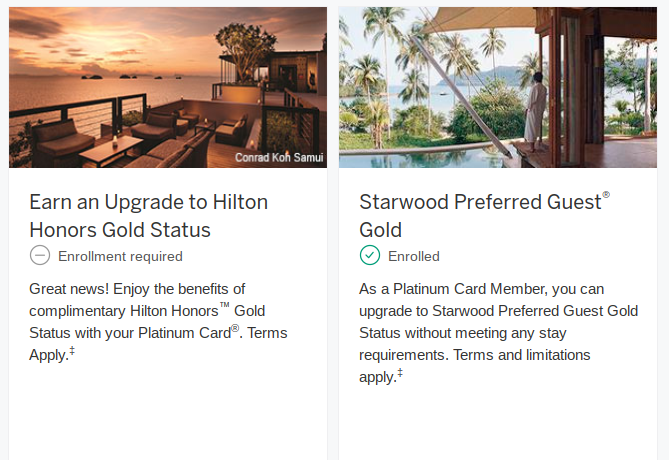

As you can see, the American Express Platinum Card has a ton of benefits and depending on your needs it may very well be worth the $550 annual fee. Before applying make sure you check to see if you’re eligible for 100k Welcome offer. Platinum also happens to be my favorite premium card because of the elite status at Hilton, SPG and Marriott and the Membership Rewards program. Here’s our American Express Membership Rewards Points Guide: Including Best Ways to Earn and Redeem Rewards Points.

Disclosure: Miles to Memories has partnered with CardRatings for our coverage of credit card products. Miles to Memories and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.Capital One Venture increased their welcome offer by 75k.

Capital One Venture is increasing their offer. You can earn 75,000 miles after spending $4000 in the first 3 months of your card's existence. Venture will give you 2X miles on all purchases and Capital One travel. Cash back and transfer to travel partners can be done with points.