Paying taxes with a credit card can be rewarding. It's important to earn credit card rewards that are more than offset. Paying taxes via credit card can be used if you sign up for a card that requires large spend to get a big welcome bonus.

Everything you need to know about using credit cards to pay taxes.

There is a warning against usingPayPal as the payment method with ACI. FAQ's have been added as well.

The tax year due dates are in 2022.

(Payable online from 03/01/22 – 05/15/22)

(Payable online from 05/15/22 – 07/15/22)

(Payable online from 07/15/22 – 10/15/22)

(Payable online from 10/15/22 – ?)

There are a number of credit cards that give cash rewards. 3% cash back is earned by some.

Your profit will be slightly more than 1% of your tax payment since you will earn 3% cash back on both the base tax payment and the processing fees with the above cards.

There is an example.

See: Best rewards for everyday spend for more examples.

If you recently signed up for a new credit card, it's likely that you have to spend a lot of money in order to get the associated bonuses. It is easy to pay taxes.

Some of the most valuable welcome bonuses for consumer cards can be found below.

Click on a card for more information.

Credit cards can give you up to 1.5 miles per dollar. A 2% tax payment fee means that you can purchase miles for 1.3 cents each. You can buy points/miles for 1 cent with these 2X everywhere cards.

The 2X example was used.

The 1.5X example was used.

There are cards that offer 2X points.

Some cards that offer 2x everywhere are not included because their points are less valuable than airline miles. Most Marriott cards give 2x everywhere rewards.

| Card Offer and Details |

|---|

| Citi Double Cash Card The card with 2X rewards for all spend is a winner. If you earn 2X everywhere, you can redeem for the equivalent of 2% cash back or 2X Thank You points. Points can be transferred to airlines with the help of the premier or prestige cards. There is a card type called Mastercard World Elite. 2% cash back everywhere, and 1% when you pay your credit card bill. You get 1X when you make a purchase and 1X when you pay for it. |

| Card Offer and Details |

|---|

| Capital One Venture Rewards Credit Card 50K after $3K in the first 3 months, 20K after 20K in the first 6 months, and 100K after 20k in the first 6 months. The card earns 2miles per dollar, which is worth 1 cent each to travel. The return on spend is similar to a 2% cash back card, but you have to redeem your miles to get 1 cent per mile. Capital One has an advantage over cash back. The card type is Visa signature. Capital One Travel's earning rate is 5X on hotels and rental cars. Receive up to $100 application fee credit for Global Entry, convert "miles" to airline miles, and 2 complimentary visits per year to Capital. |

| Capital One Venture X Rewards Credit Card 100k after 10k spend in 6 months + $200 credit for vacation rental spend in first year is a better offer. The cost/benefit ratio makes it worth it for the lounge access and travel protections for those who travel frequently. Privileges like Priority Pass, Capital One Lounges, and Plaza Premium are available to authorized users. The Capital One Venture rewards card is worth 1 cent for every dollar spent on travel. It's similar to a 2% cash back card in that you have to redeem your miles to get 1 cent per mile. Capital One has an advantage over cash back. There is a card type called Visa Infinite. The earning rate is 10X on hotels and rental cars booked via Capital One Travel. Up to $300 in statement credits annually for bookings made through Capital One Travel, and 10,000 bonus miles each year starting at the first anniversary, are noteworthy perks. |

| Capital One Spark Miles for Business This card is similar to the Spark Cash Plus card, but it has an advantage that can be used to transfer miles to many airline and hotel programs. There is a card type called Mastercard. Earning rate: 2X everywhere ⚬ Earn 5X miles on hotel and rental car bookings through Capital One Travel It's worth mentioning that you can redeem miles for travel at a value of 1 cent per mile. |

There are cards that offer 1.5X points or airline miles.

| Card Offer and Details |

|---|

| The Business Platinum Card® from American Express The card is loaded with perks. Those perks might be worth more than the annual fee. The Amex pay over time card has a card type. 1.5X points per dollar on eligible purchases of $5,000 or more, 1.5x on US construction/hardware stores, 1.5x on US electronic goods, and 1.5x on US shipping are included. Up to $400 a year in statement credits for Dell purchases, and up to $120 a year in wireless service credits. You have to enroll for certain benefits. Amex Platinum Guide is another one. |

Credit cards have bonuses for meeting high spending thresholds. The best big spend bonuses can be found here. There are a number of examples.

Debit cards are used for gift cards. Depending on the tax processor you use, they can get low flat fees for tax payments. The cost to liquidate $500 gift cards will be less than 1%. That is fairly inexpensive.

You can pay with Visa/Mastercard gift cards.

The IRS imposes 2 payments per processor limit, which is the biggest problem with this. You can't sell more than 6 gift cards per payment.

The best ways to buy Visa and Mastercard gift cards.

It is important that you know about paying taxes with credit or debit cards.

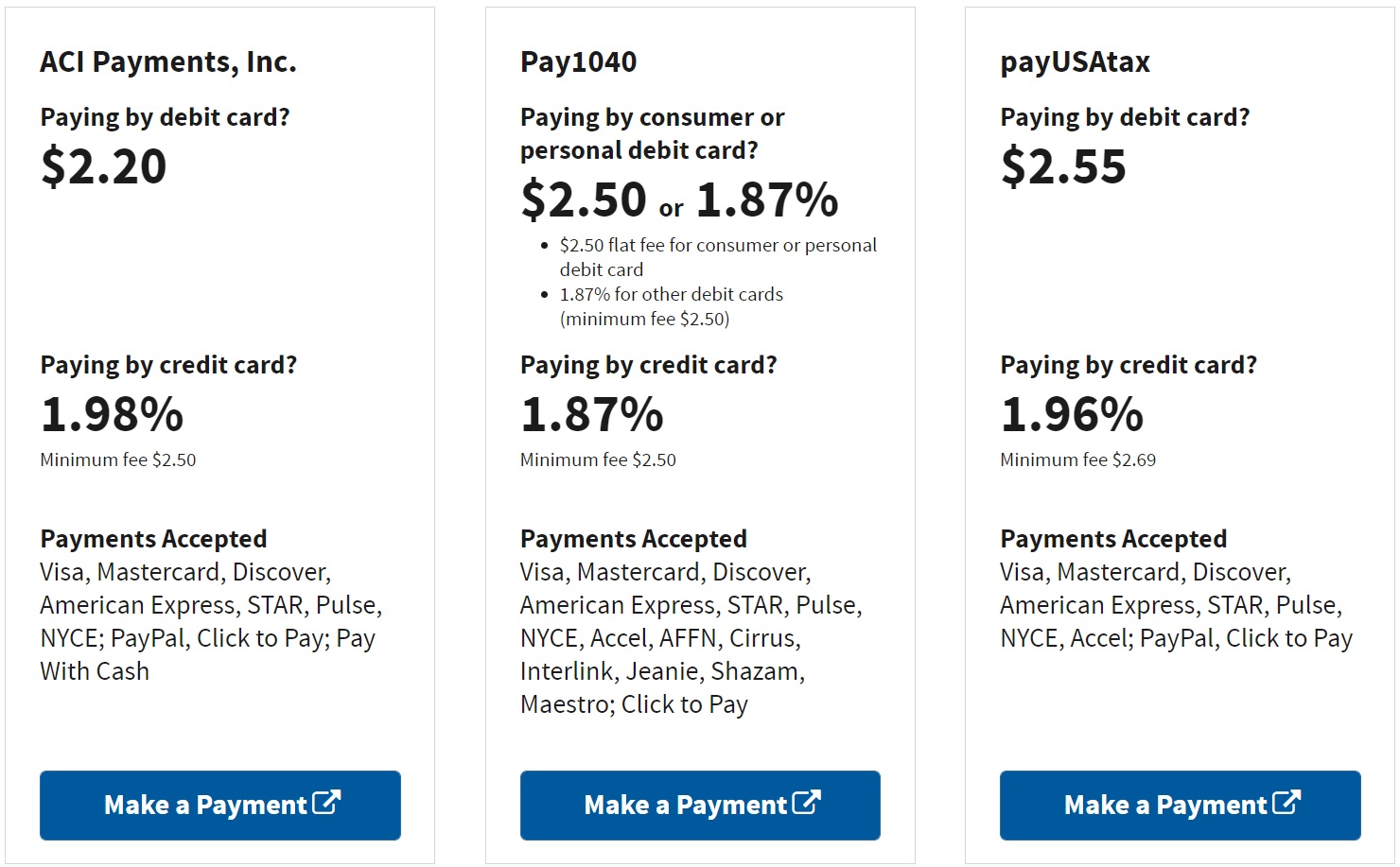

The IRS has a list of companies that accept credit cards. The current information can be found here. There are three companies on the list. Debit card fees range from $2.20 to $2.55 per transaction and credit card fees range from 1.81% to 1.98%. The Plastiq Bill Pay service will cost you 2.85% more.

There are additional information listed on the IRS page for paying by credit or debit card.

[Editor’s caution: In recent years the IRS has been very slow to do so]

The IRS has a table of limits for using credit or debit cards to pay taxes. They said you can make up to two payments per tax period. You can make two payments every quarter to your estimated taxes and two payments every year to your taxes. These limits are enforced by payment processing companies. If you make Plastiq bill payments, you can make up to 6 payments per tax period. I spoke with an IRS advisor several years ago and he didn't think there would be a problem with making more than two payments. I have made more than 2 payments per tax period many times and never had an issue. It's just my own experience. I can't say that your outcome will be the same.

You can make payments in each person's name if you file with a partner.

You can make your own payments if you file separately.

You can make an unlimited number of tax payments using the Plastiq bill pay service. Plastiq charges 2.85% to use a credit card to pay bills, but sometimes they offer lower fees. The Plastiq Bill Payment Service can be found here.

If you want to pay taxes via Plastiq, you need to use the tax payment screen.

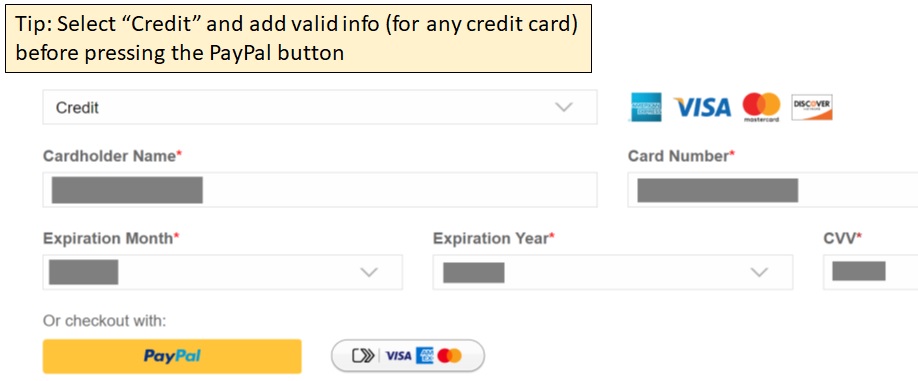

According to the Doctor of Credit, using AIC to pay federal tax payments with Paypal as the payment method are triggering a cash advance fee. Although the tax payment is not considered a cash advance, the fee charged by ACI is, in fact, a cash advance. It's best to steer clear of this method in the meantime.

Sometimes cards like the Discover It, Discover It Student, and Chase Freedom offer 5% rewards for purchases made with the payment method of choice.

There is a weird issue with choosing to pay with a credit card. If you put in valid credit card information first, you can press the button.

Tax payment websites can be used to pay for things with a mobile wallet. The US Bank Altitude Reserve card earns 3X for mobile wallet payments. Readers have reported that the Altitude's 3X rewards are not triggered if you use Visa Checkout to pay for goods and services.

Credit card companies charge cash advance fees when paying taxes with a credit card. The answer is that the payment is treated as a purchase and not a cash advance. FAQ information can be found here, here and here.

Tax preparation fees used to be deductible, but that is no longer the case.

Card processing fees can be deductible for business taxes.

You may need to show proof that the IRS received the money you sent. Signing up for irs.gov/payments/view-your-tax-account will allow you to see past payments.

When you file your taxes, you should report estimated payments. If you make a mistake and don't report some of the payments, the IRS will eventually catch the mistake and refunds the difference.

You can pay your taxes via check if you tell your tax preparer. You can pay your taxes on the appropriate tax payment sites. It's not necessary to mail in the payment voucher.

If you owe a debt on your account, the IRS will not be able to refunds overpayments.

You can schedule an appointment with the Taxpayer Assistance Center by calling.

It is not possible to say yes. There is no need for a voucher. If you pay with a card, you don't need to give a voucher.