Meta, the parent company of Facebook, is worth less than Home Depot and less than Pfizer and Coca-Cola.

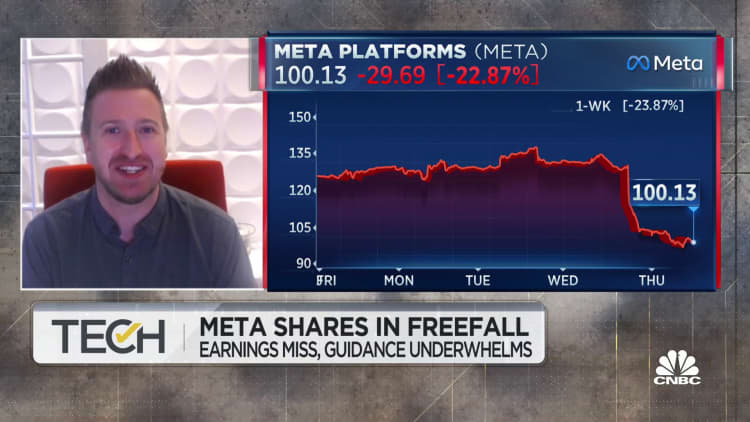

Meta is no longer among the 20 most valuable U.S. companies after the stock plummeted on Thursday. Since the stock peaked in September 2021, the company's market cap has lost $730 billion. When Barack Obama was still in office, it was at its lowest.

The collapse of Meta's share price is similar to the dot-com bust days in terms of value lost. The slide began late last year as signs of a sputtering economy began to emerge, and accelerated in early 2022.

The founder and CEO of Facebook has been unable to stop the bleeding. Since changing the company name to Meta a year ago, Facebook's founder has said that the future is a virtual universe of work, play and education. Facebook is forecasting a third consecutive drop in revenue for the fourth quarter as investors see it as a multi-billion dollar money pit.

There are a lot of things going on right now in the business and in the world according to the CEO of Facebook.

There are macroeconomic issues, there is a lot of competition, and we are taking on expenses because we believe that they will provide greater returns over time. Those who are patient and invest with us will be rewarded.

The five-year average for Meta's revenue is less than one-third. Its market cap is less than that of companies like Bank of America and Eli Lilly, but it is still worth half as much.

The other four tech companies that propelled past the trillion-dollar mark are all still there and remain the four most valuable U.S. businesses.

The other two companies that have fallen behind areTesla and Nvidia. The next company on the list would be Oracle, which is currently valued at just over $200 billion.

This is a bet-the-company moment for Facebook's CEO.