Macklem is willing to push rates higher in order to keep inflation under control.

A man named Kevin Carmichael.

5 minutes read and 7 comments

The Bank of Canada governor is struggling to convince the public that inflation will return to two per cent, but he has been able to change their perception of what constitutes a big interest rate increase.

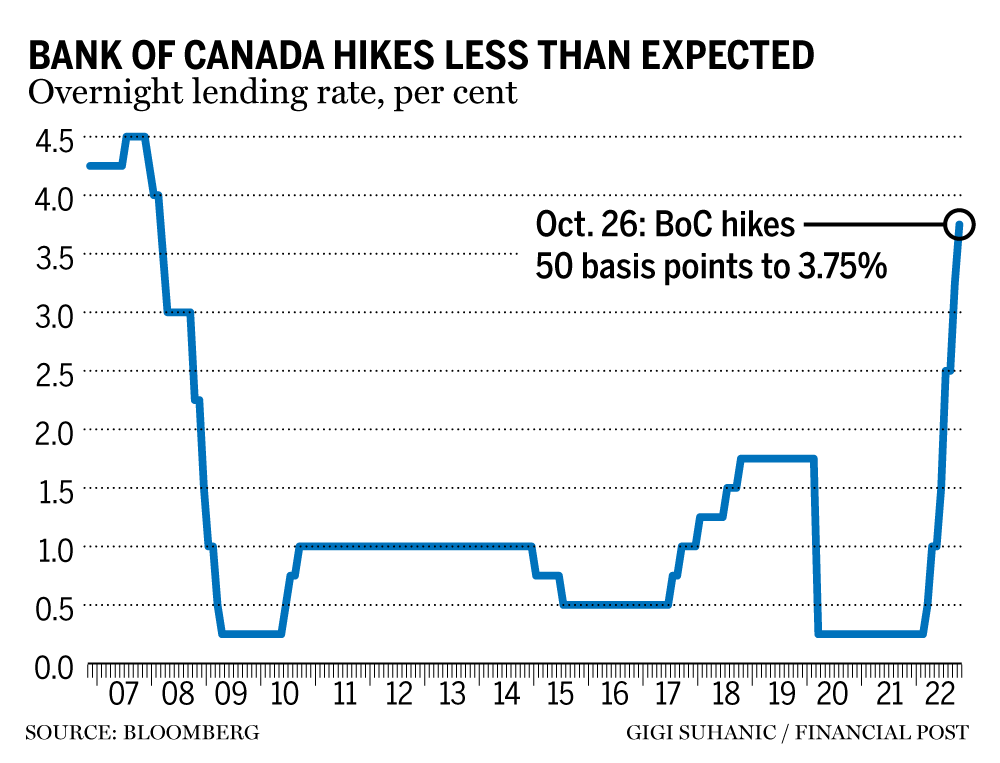

Macklem raised the benchmark interest rate by half a point on October 26th. It was thought to be a change of heart by the central bank.

The Financial Post is part of Postmedia Network Inc. There was an issue with signing you up. Try again.

A half-point increase in borrowing costs used to be considered extraordinary.

After more than a decade of a low- for-longer approach to monetary policy, central bankers became supersensitive about the damage they could cause by raising interest rates too quickly. It was thought that anything greater than quarter-point changes could cause consumers to turtle and companies to bail on investment plans.

It was then. In September, the Bank of Canada raised its interest rate by three quarters of a percentage point. Macklem had to convince people that a half-point lift was important. Most currency traders and bond investors were expecting the governor to raise borrowing costs by three quarters of a percentage point, but he didn't.

The yield on two-year Canadian government debt fell below 4% for the first time in two weeks after the Bank of Canada pulled up short of expectations. The dollar was little changed, trading at about 74 U.S. cents, which may reflect an assessment by traders that the Bank of Canada has joined the Reserve Bank of Australia in releasing the safety brake it had applied earlier this year to keep inflation from racing out of control

The Bank of Canada's policy decision is reinforcing the notion of a more generalized central bank pivot.

Macklem was clear that a cut isn't on the agenda, even though the Bank of Canada's new economic outlook has growth stalling soon In the current quarter, the central bank predicts that the economy will grow by only half a per cent.

The policy rate will need to rise further because inflation is way off the two-per-cent target. Bay Street and Wall Street economists think the benchmark rate is going to be at least four per cent by the end of the year. The Bank of Canada has paused on its way to a new interest-rate setting to gather more information about how monetary policy is affecting the economy.

A person is walking in Toronto.

The photo is from the National Post.

Macklem doesn't want to give inflation any oxygen. At the press conference, he was asked if the trajectory for interest rates from here would be data dependent, which would mean taking time to assess changing conditions, or if the only question on the table was when policymakers next gather to set interest.

Macklem said that he would be closer to your second description. We have been clear. Rates need to go up more. The phase will end. We are not there yet.

Those aren't the words of a central banker who is interested in testing the lessons of the 1970s. Even though the Bank of Canada hedged by opting against another big step, they still want to crush inflation.

Jean-Franois Perrault, chief economist at Bank of Nova Scotia, told Larysa Harapyn after the central bank's policy announcement that people don't think inflation is coming down very quickly. How is it possible for the central bank to not raise rates when inflation is high? The bigger challenge they have is that. How do they stop raising rates when inflation isn't close to their target?

Macklem was asked about the 70's. The Nixon administration ended the policy of linking the U.S. dollar to gold, which caused inflation to break its tether. It took the economics profession a long time to come to a decision on inflation targeting. Macklem was an up-and-comer at the Canadian central bank at the time.

The idea that the best way to execute monetary policy is targeting the year over year change in prices now faces its greatest test. Macklem has complete faith in the Bank of Canada. He is prepared to push interest rates higher until inflation goes down.

It will be difficult for Macklem to stay on the path he has chosen. Journalists who cover the Bank of Canada on a regular basis know monetary policy is popular with the public when they find themselves competing with TV reporters to ask questions at press conferences. Representatives from all the networks attended the press conference. They all asked the same question: Why are you killing the economy?

Macklem said that they needed to do what they had to do. He said that inflation is not going to fade away by itself and that they are trying to balance the risks.

The email address is kcarmichael@postmedia.