During the bull market, investors were thrilled by the higher than expected sales and earnings of the company. They are over.

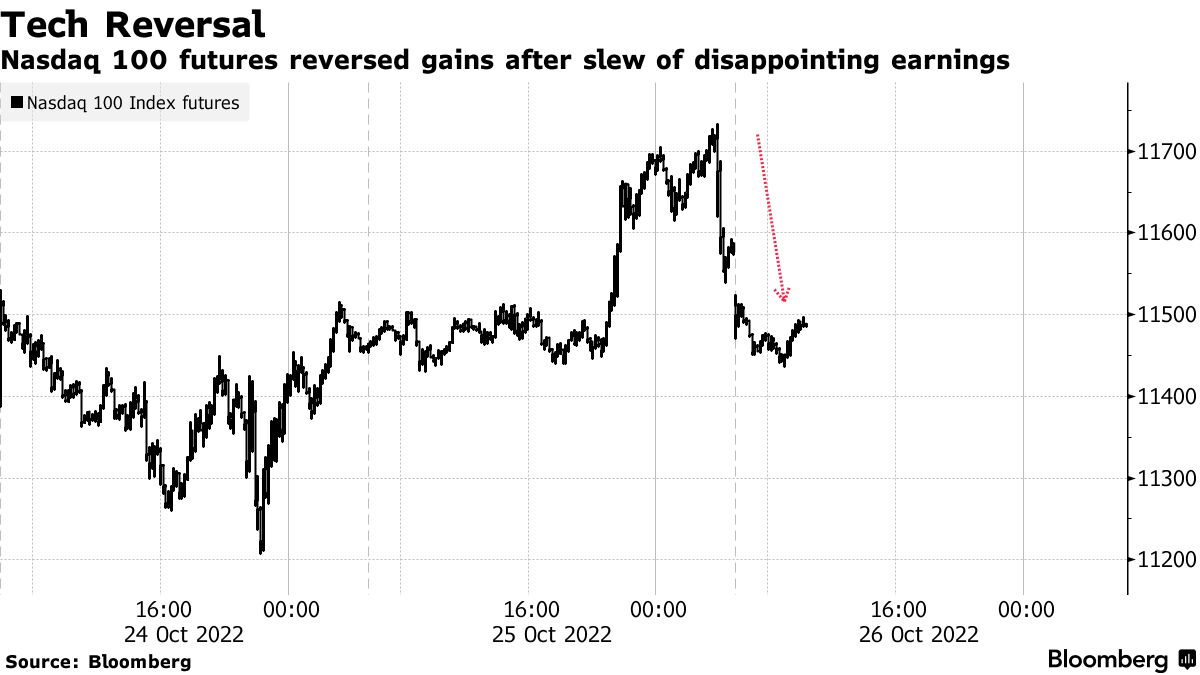

The company, along with Microsoft and Texas Instruments, announced disappointing results after the market closed on Tuesday.

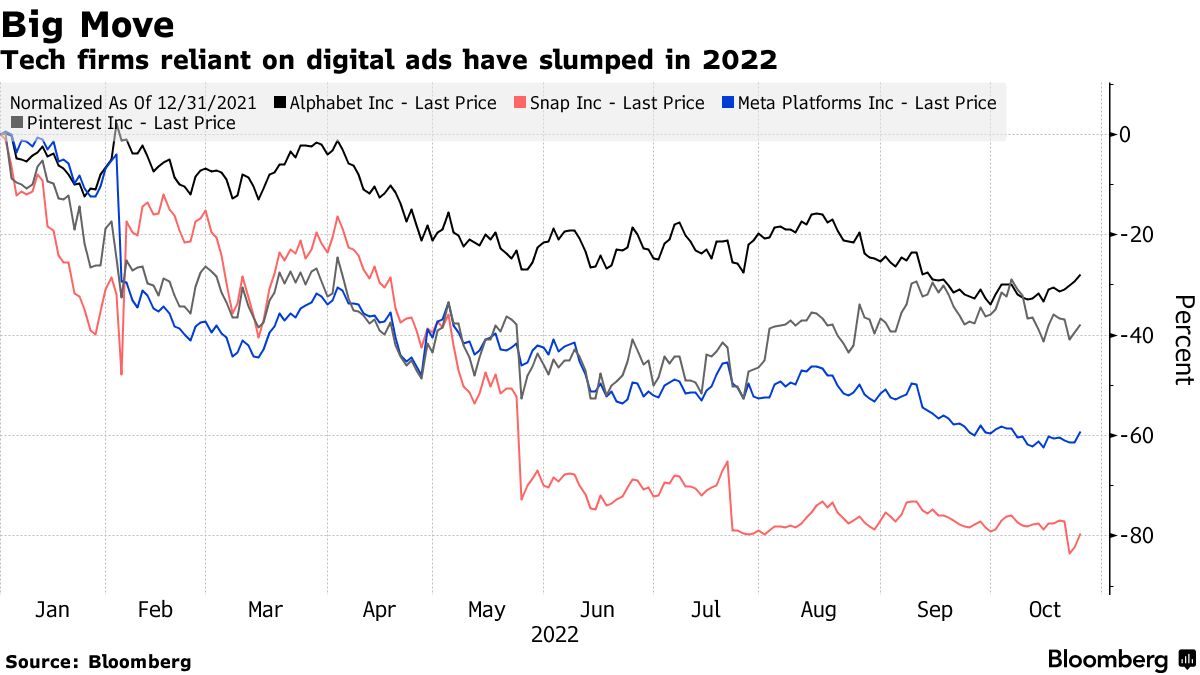

Corporate IT budgets, as well as digital ad spending and chips for industrial machinery, are under increasing pressure. The results refocused investor attention on the damage to earnings and the economy from the Fed's rapid interest-rate hikes.

Jessica said that the global economy was at a tipping point. At a time when consumer demand is likely to fall with the reverse wealth effect expected to grip markets, businesses will be hurt by the stronger dollar. Tech remains under pressure.

Three quarters of disappointing earnings per share is the longest such streak in seven years. The company had beaten estimates nine quarters in a row prior to this year.

The data shows that Meta Platforms and Amazon.com have missed revenue in three of the past four quarters. Meta will publish earnings after the market closes on Wednesday.

There were many signs of weakness in the results. Microsoft posted its weakest sales growth in five years due to the surging dollar.

Rana said that Microsoft's forecast pointed to a serious downturn.

Rana said that enterprise IT spending is decelerating at a faster pace because of the economic troubles.

Sales at the search and related businesses of the company rose less than analysts had expected. Microsoft and Alphabet were both down in pre market trading.

Amazon dropped 3.5% as the selloff extended to other giants. It was those that derive sales from online advertising that fell the most. Datadog Inc., which is moving in the wake of Microsoft, plummeted.

It is on course for its worst annual performance since 2008.

One of the hottest sectors during the Pandemic was the Semiconductor industry. Texas Instruments, whose chips go into everything from home appliances to missiles, saw its shares plummet after its weak forecast signaled that the chip slump is spreading into other businesses. The stock lost 4.6% and other companies also fell.

Semiconductor used in the industrial and automotive sectors were still in short supply despite falling demand in consumer electronics.

Morgan Stanley analyst Joseph Moore wrote in a note that they don't think that any of this is demand related at the moment. Customer sentiment has been driven by the supply chain challenges and as those concerns start to ease some head winds were inevitable.

The company said it would cut capital expenditures by more than half. It said that the market conditions were going to get worse. The memory makers are cutting production plans as the price of chips plummets.

The silver lining for investors is that once the supply comes down, it may be beneficial for stock prices. The company's shares rose 0.4%. Taiwan Semiconductor Manufacturing Co. added 0.4%.

The head of technology research at HMC Investment & Securities said that inventory would decrease and demand would increase again.

Ishika Mookerjee and James Cone assisted.