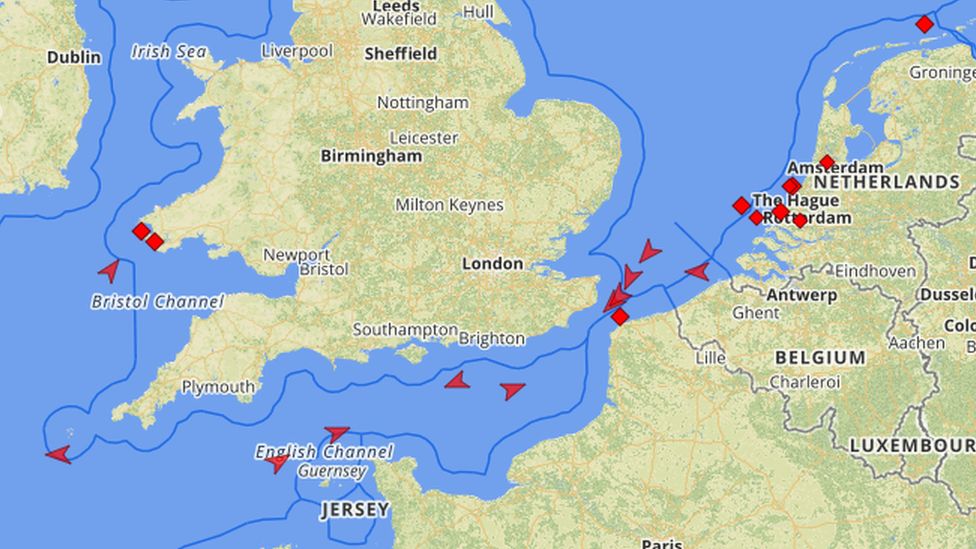

There are big tanker trucks waiting. The UK and other European nations are home to dozens of giant ships filled with gas.

The fossil fuel is in high demand due to its cool temperature. The ships are still at sea with their goods.

The price of gas went up after Russia reduced gas supplies to Europe. Consumers were worried about energy shortages and high bills.

Augustin Prate, vice president of energy and commodity markets at Kayrros, said it was built up for about five to six weeks.

He and his colleagues use signals from ships to satellites to track ships.

He says it's a large story.

Why are ships carrying gas in Europe? The answer is a bit complicated.

Fraser Carson is a research analyst at Wood Mackenzie and he has been watching the vessels accumulate. The one-year average for the number of ships on the water is 241. The majority of those at sea are in Europe.

European nations bought a lot of gas in the summer in order to fill their storage tanks. This was done to make sure there was enough fuel for the winter.

Storage facilities were supposed to be filled to 80% of their total capacity by November. The target has been achieved far ahead of schedule. According to the latest data, the total amount of storage is almost entirely gone.

Europe is at this point because of imported Liquefied Natural Gas.

Demand for facilities that heat the liquid and turn it into gas continues to be high asLNG continues to arrive. Europe has relied on gas from Russia for a long time, so there aren't a lot of such plants.

Some of the ships are waiting for access to regasification terminal. New regasification facilities have been built in Germany and the Netherlands. Converted LNG ships pinned to docks are expected to become operational in the months to come.

Less gas is being used in Europe than it would be otherwise because the weather has been very warm.

Industrial activities that rely on gas have relaxed. Satellite images of factories are used to track this thing.

He says there has been a decrease in cement and steel production.

It all means that a market situation has arisen for gas. The future price of a commodity is higher than the current price.

He says that the price for a delivery in January would be higher than the price in November.

By waiting to deliver in December, the difference in profit could be in the order of tens of millions of dollars per shipment.

It is possible that buyers elsewhere in the world could snap up some of the waiting ships, meaning they could leave and head to Asia, but it may still benefit Europe to have a large amount of floating gas.

It's a good thing that the ships are waiting, you want the gas to be available when you need it.

The sobering sums are the only roadblock in the way of the work. Demand for gas is so high that countries have already paid a lot of money to get it.

In the first eight months of the year, Germany spent over 43 billion euro on imports. In the same period in 2021, the total was 17.1 billion euros.

Market forces are at work. She says that European nations are in the best position they can be.

The market has responded appropriately in regards to what can be done at the moment.

What will happen next is the real question. The price of gas in Europe has begun to fall.

Since August, gas prices in Europe have fallen dramatically, but are still more than double what they were a year ago.

It is possible that disruptions to supply and very cold winter months will change the picture again.

The global situation is also considered. Competition for gas has increased due to increased demand in Europe. Pakistan and Bangladesh, which have less financial leverage in the market, have been negatively affected by the current situation.

This year has seen some of the gas go to Europe. Mr Halff says it has been a huge game.

China, Japan, and South Korea, which all use a lot of gas, will likely seek imports in the colder months, potentially sparking competition between continents.

What's happening in the market for liquified natural gas is a short-term phenomenon according to the COO of Cheniere.

Things are going to get easier in the coming years.

He says that the majority of his firm's output this year has already been sold, and that Cheniere's production should rise from 45 million to 55 million tonnes by the year's end.

The current bonanza over gas has concerned some who argue that it would be better for the planet to switch to renewable sources.

It's great to have renewable deployment. "I'm all for doing the right thing for the planet that we live on."

He says the need for gas to heat people's homes is immediate. He says we need it.

The war in Ukraine, the weather, the rise of renewable energy, and hundreds of ships full of gas are just some of the variables that will affect tomorrow's events.