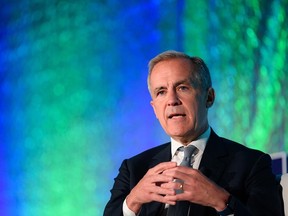

Mark Carney is a former Bank of Canada governor. It was the right time to reduce support-driven deficits according to the former central bankers argument.

In an environment where we have left the world of low-for-long interest rates and low volatility, in an environment where borrowing costs are going to be higher in the medium term, fiscal discipline is needed.

The Financial Post is part of Postmedia Network Inc. There was an issue with signing you up. Try again.

The drama unfolding in the United Kingdom is a cautionary tale for governments who don't take fiscal policy seriously.

The leader of the governing Conservative party resigned a few hours earlier. She didn't explain how her government would pay for the tax cuts she pitched. The Bank of England was forced to buy debt in order to calm the financial markets, even though it had been trying to reduce monetary stimuli in order to counter inflation.

The former head of the British central bank said that sound money credible fiscal policies will be rewarded but mistakes will be punished The U.K. experience shows that fiscal and monetary policies are counter productive. It's foolish to put the other foot on the gas with monetary policy.

The Canadian governments should pay attention. It is time to reduce deficits if targeted aid to households most affected by inflation is justified. The point was made that federal fiscal supports that were necessary through much of the epidemic went on longer than they should have.

There was a time when fiscal policy reinforced some of the challenges that the Bank of Canada began to see.

The Bank of Canada is raising interest rates so fast that it could cause a downturn. Since March, Governor Macklem has increased the benchmark rate by 3 percentage points. The central bank is expected to raise its rate by at least 50 or 75 basis points.

During a speech in Windsor, Ont., the finance minister warned that the country and global economy would see challenging days ahead.

According to the Bank of Canada, more rate hikes would be necessary as factors that would contribute to a slowing of the economy.

The combination of all of that is likely to cause a recession in Canada. We need to draw on our strengths but not weaken our position further. We have to make sure our fiscal resources are used appropriately.

The email address is shughes@postmedia.