Vale SA, the world's No. 2 iron Ore producer, churned out more of the steelmaking ingredient than expected last quarter.

The Brazilian mining giant produced more than expected. The result was better than the last three months and a year ago. Vale produced more nickel and copper.

In a report Monday, the company said it was due to dry weather in northern Brazil and higher third party purchases in the south. Vale blamed transiting inventories along the supply chain for the lower sales.

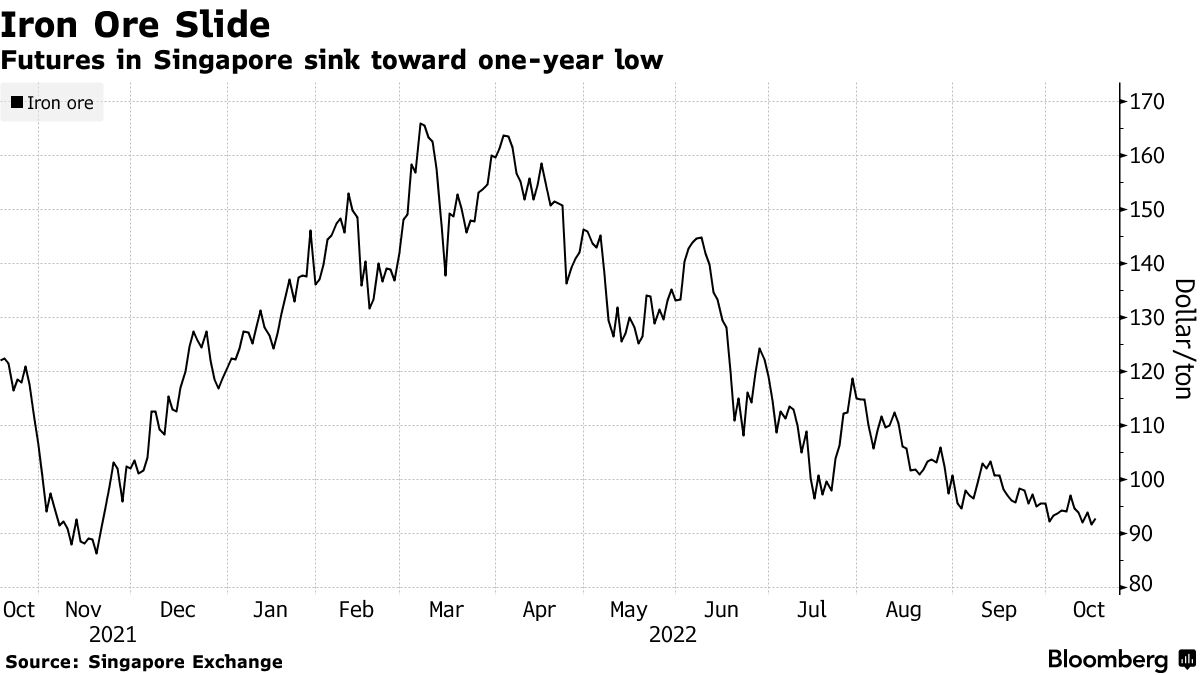

Concerns over the cooling impact of higher interest rates, as well as China's zero- Covid policy and a recent push for pollution curbs, have Iron Ore futures trading near their lowest this year. China's peak building season has failed to spark a recovery.

Vale is a major swing factor on the supply side. In July, the firm said it was looking for more flexibility due to market conditions. To get to the lower end of the guidance range, it needs to produce 83 million tons this quarter. The production is usually better in the second half of the year.

Vale produced more nickel in the third quarter of this year than in the same period last year. After the end of refinery maintenance in Canada, the division was helped. Low availability of containers for Brazilian production and shipping congestion at UK ports led to nickel lagging production.

The base metals division, which is recovering from several operational setbacks last year, is under the microscope as Vale takes advice on options to unlock value. It could be a spin-off that goes public. The decision will be made by the end of the year.

One of the things Rubens Ometto was interested in was a base-metals revival. Ometto plans to raise his voting stake to 6.5% after acquiring a 4.9% stake.

The earnings will be released after the close of regular trading.

Simar Khanna assisted with the project.