Some Wall Street strategists see the potential for a short-term rally due to corporate earnings, as the stock market rebounded Monday after last week's dismal finish.

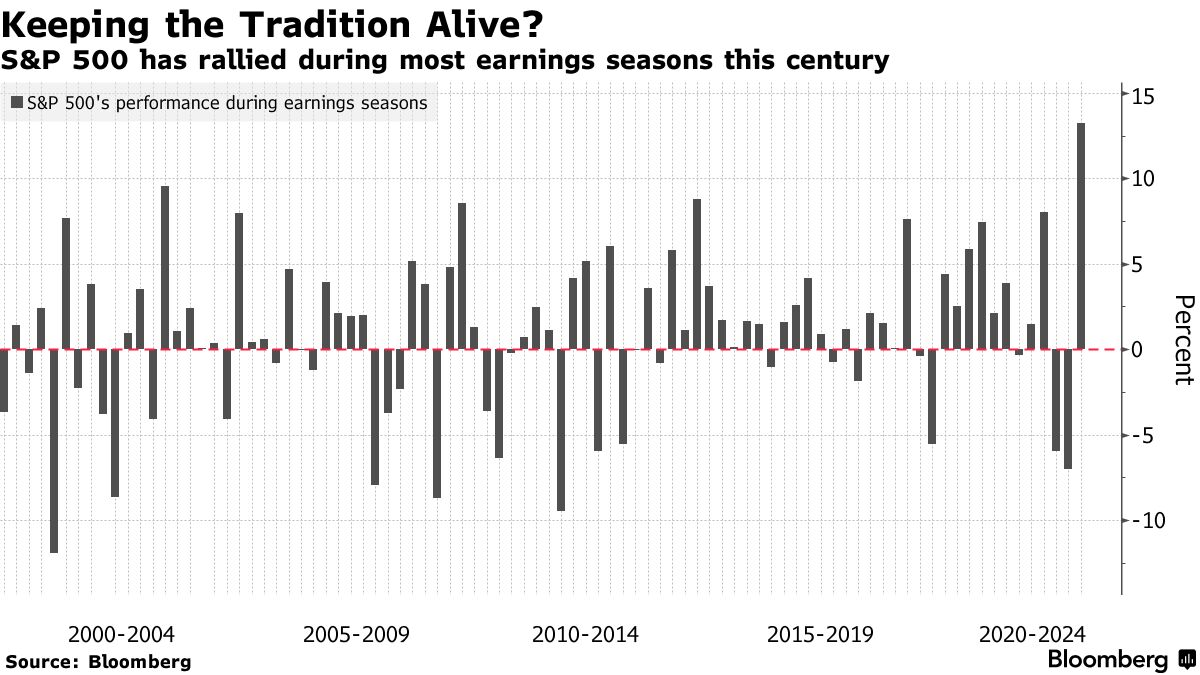

In the last four years, the arrival of earnings season has lifted the S&P 500 by more than 70%. In the current cycle, cut-to-bone profit estimates have been slashed down by more than two-thirds in four months, the most since the first quarter of 2020.

Bank of America's better than expected results helped to give the market a boost on Monday. The S&P 500 is up 2.5% in midday trading.

Gina Martin Adams wrote in a note that earnings could calm the market in the coming weeks. The announcement cycle could offer some relief.

It happened last quarter, when the equity plunge in June led to a 13% gain during earnings season, which is tied to the results of Walmart and JP Morgan. It's possible that could happen again.

Dennis Debusschere wrote in a note to clients that the case for a short-term bounce on less bad earnings and a stableUSD is interesting if investors shift their focus away from the expected Fed funds rate moving higher. His data shows that the number of companies issuing sour sales and earnings outlooks has gone up.

The absence of an earnings capitulation or an official recession could lead to a bounce in the S&P 500 from Friday's close. Wilson's team wrote in a note to clients that the S&P 500's 23% slump this year has pushed it to a "serious floor of support" that could lead to a technical recovery.

In the third quarter, corporate profits in the S&P 500 are predicted to grow. The figure was 10% in the month of June. The reduced assumption seems to be an easy target for TPW Advisory to beat.

Pelofsky said that the 2% consensus earnings growth would be met and cleared easily. The Fed is fairly priced in. The earnings will be okay. The economy is getting better.

Conditions don't look so good for Bank of America's Savita Subramanian The head of US equity and quant strategy at the firm believes there was a spike in mentions of weak demand during the earnings announcements. There is a correlation between mentions of weak demand and ISM manufacturing readings, with the current number of mentions pointing to ISM at 49, below the 50 level that separates contraction from expansion.

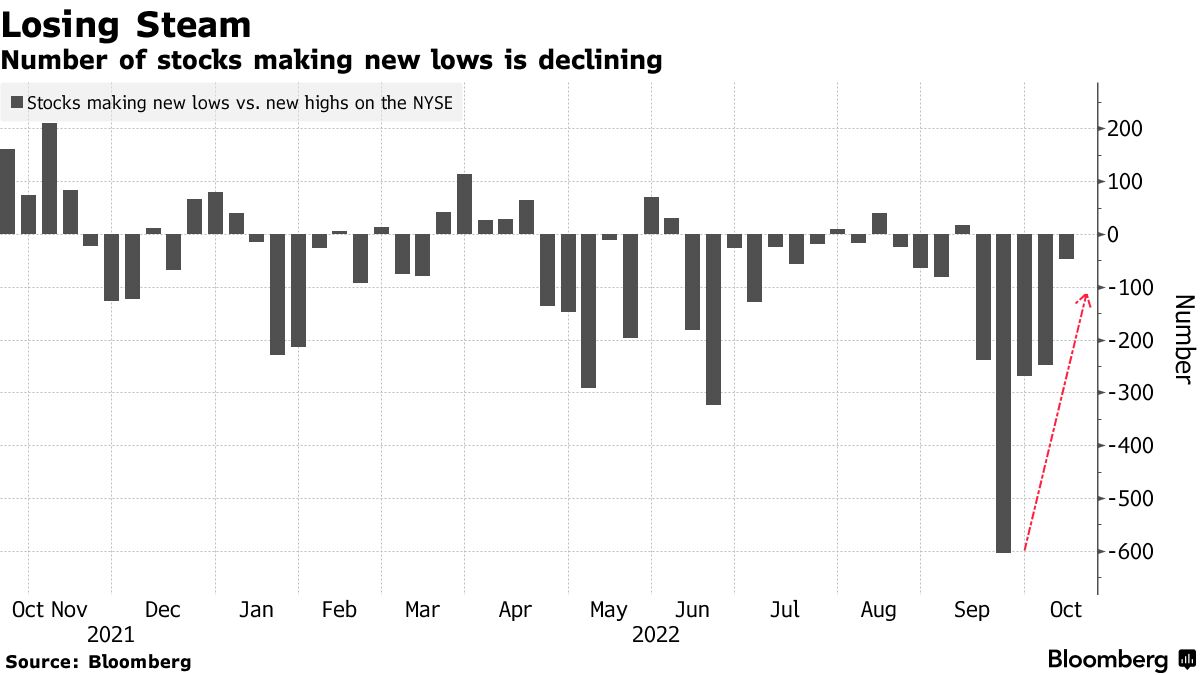

There are technical factors that point to a short-term improvement in sentiment. The number of stocks on the New York Stock Exchange making new lows relative to new highs has declined for three weeks in a row.

Since the dot-com bust in the early 2000s, the S&P 500 has not closed below its 200 week moving average in more than a year.

With the help of John, Michael, and Sagarika Jaisinghani.