It is surprising to see how resistant some venture funds are to changing.

I attend a lot of annual meetings, talk with a lot of general partners, and review a lot of investor decks as a partner in a fund of funds.

I was surprised by the number of funds that invest in the same areas as well as the same stories.

Venture is about elephant hunting. At least one, and ideally a few, enormously successful, fund-returning investments can be found in great funds. It's important to let the companies ride and not sell them early.

The large returns come from companies that are market leaders. Sometimes the second-place company can win, but it won't be as large. The companies that end up at the bottom of the market do not end up being good investments.

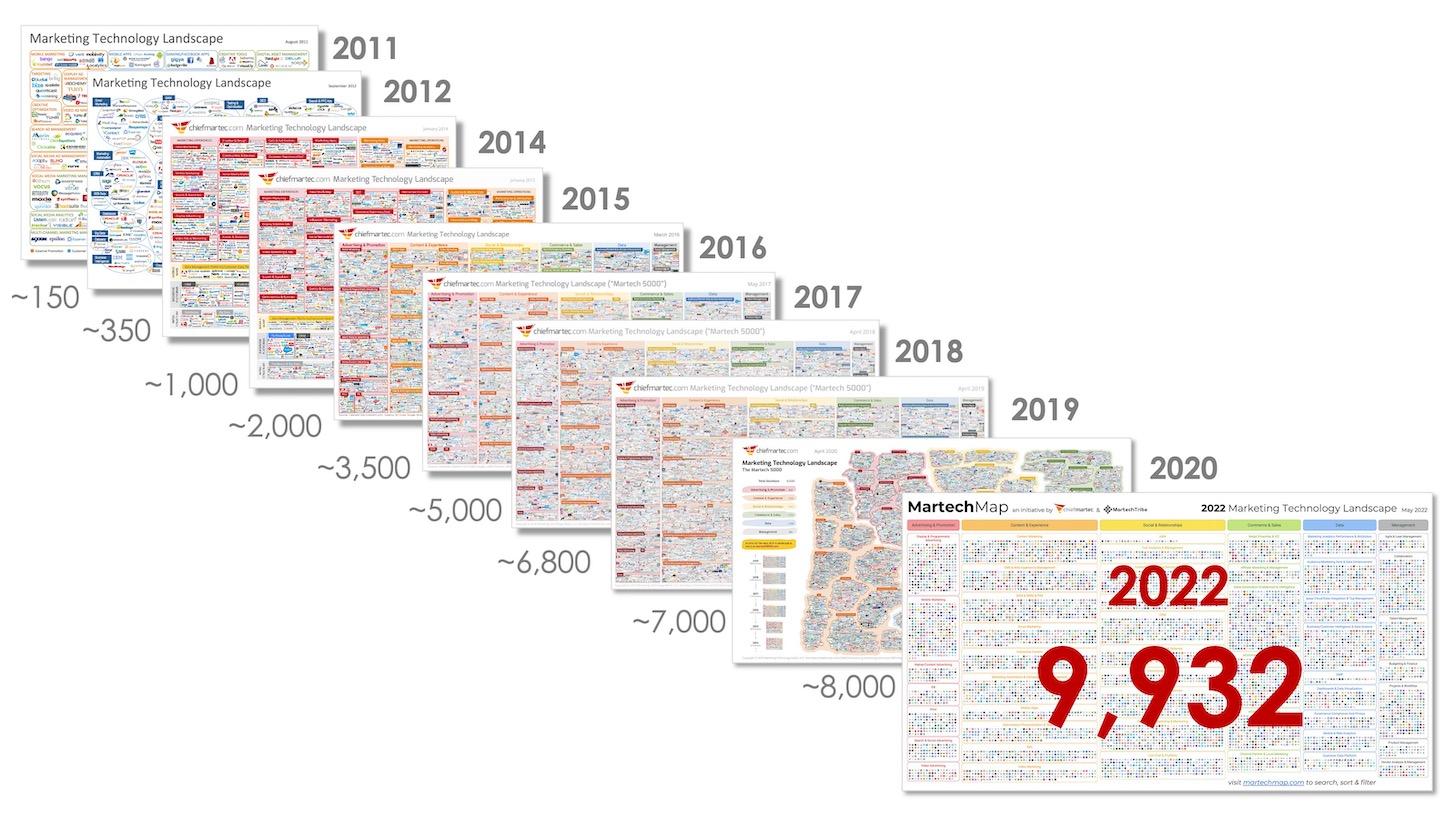

I looked at a map of martech companies recently and thought about this. There are a lot of marketing companies that still get funded.

Scott Brinker is the CEO of MartechTribe.

While not as bad as marketing tech, we are seeing a huge increase in the number of companies in the field of cybersecurity.

In my conversations with CISOs, I hear that they don't look as much for new point solutions as they do for a broader platform that will replace a lot of their applications. Many of the thousands of "me too" cybersecurity companies will find themselves becoming "insecure" in a market where capital is hard to come by.

It's the same for some areas. There are more payment companies that can be created. How many e- commerce finance companies can survive?

Software is eating the world, that's what it was once said by one of its authors. I too am eating returns when I invest.

It is important to invest in companies that will be hot in five to ten years. Outsized returns are what the VCs that invest in the leaders of tomorrow's markets will produce.

One doesn't need to stop investing in any of the above. There will always be disruptive companies in those segments, but the balance needs to shift to the large markets that are ripe for disruption by technologies that are not funded.

I think there are four areas that could produce huge winners over the next decade.