Despite pleas to extend the bond-buying scheme, the boss of the Bank of England said it would end on Friday.

Andrew Bailey said that the scheme needs to end for the sake of the UK's financial stability.

He said that managers need to make sure their funds are able to survive.

The Bank of England bought bonds to try to calm the markets.

"We are doing everything to preserve financial stability, you have my assurance on that," Mr. Bailey said.

He said that pension funds have an important job to do.

He said he was afraid this had to be done for financial stability.

"You have three days left now," he had said earlier. You have to finish this.

The pound plummeted against the dollar after Mr. Bailey's statement.

After the tax cuts were announced in September, sterling fell to a record low of $1.03. The price was above $1.11 before the speech.

Pressure is mounting on the Chancellor and the Prime Minister over their fiscal plans.

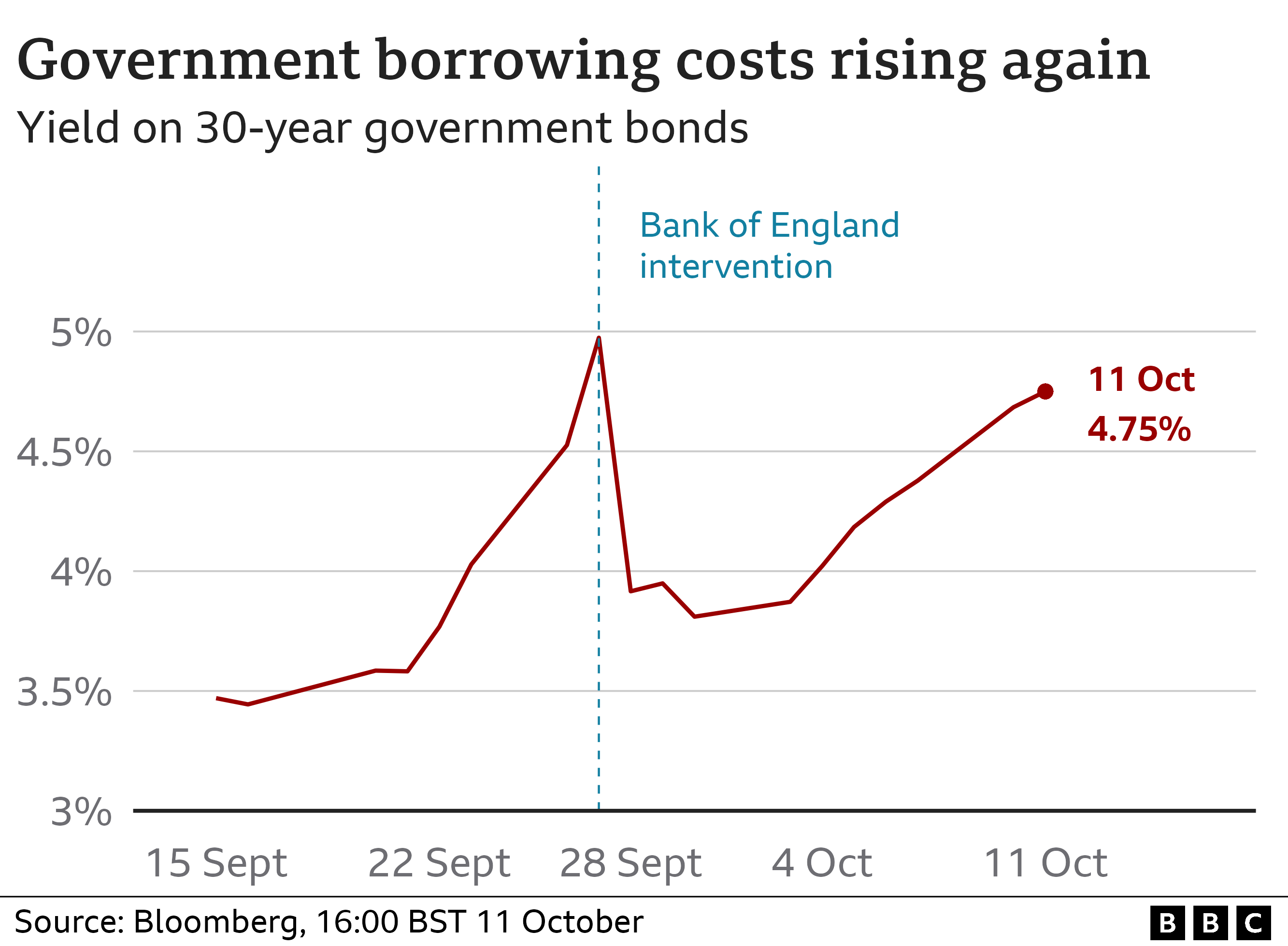

The mini-budget was announced by the government on September 23rd. The amount of government borrowing made investors question the plan's viability.

The pound hit a record low after the statement and investors wanted a higher return for buying bonds.

It was necessary for certain types of funds in the pension industry to start selling bonds in a way which could have led to their collapse.

The Bank stepped in to buy bonds because it was concerned about a material risk to the financial stability of the country.

The Bank is due to end its emergency bond-buying programme on Friday but a pensions industry body urged the Bank on Tuesday to extend the support due to fears of further market turmoil

The Bank always said its support of the UK government debt market would be temporary.

The giant market funds that had applied financial wizardry to the normal boring world of pension funds have three days more of support.

It was the first time this month that the comments against the dollar had fallen below $1.10 for sterling.

There was no slip of the tongue.

The governor went out of his way to say that the City giants now had to arrange their affairs after the governor was contacted about them.

It will have an impact on the government.

During times of high borrowing and fiscal stress, the Bank has bought up bonds.

This will not happen on this occasion.

The Bank will allow the market to push up the effective cost of government borrowing as a response to uncertainty over its economic policy.

The government and the chancellor need to come up with an economically credible and politically viable debt plan quickly.

Mr Bailey said that the Bank's help would end at the end of the week and urged pension funds to invest in less risky investments.

Mr Bailey may need to extend the help, according to a former pensions minister.

It's not a good thing for pension funds to be selling assets over a two week period, so it's perfectly possible, although a lot has been done, that more help will be needed from the Bank on Friday.

Mr Kwarteng told MPs that he was focused on growing the economy and raising living standards and that the government remained confident in its tax cuts plan.

The shadow chancellor said that the crisis was being paid for by working people.

El-Erian was a deputy director of the International Monetary Fund.

Financial systems can cause a lot of damage.

A form of debt that is paid back plus interest is called bonds and is used by the government to raise funds.

The rise in the cost of new government borrowing reflects an anxiety among investors that the UK's tax-cutting plans make it a riskier investment bet.

The Bank wants to keep their price stable and prevent investors from selling them in a fire sale.

The Pensions and Lifetime Savings Association said that many funds wanted the bond-buying programme to last until the chancellor delivered his economic plan.

The Treasury said it was keeping an eye on the markets.