There are four different long-term growth scenarios.

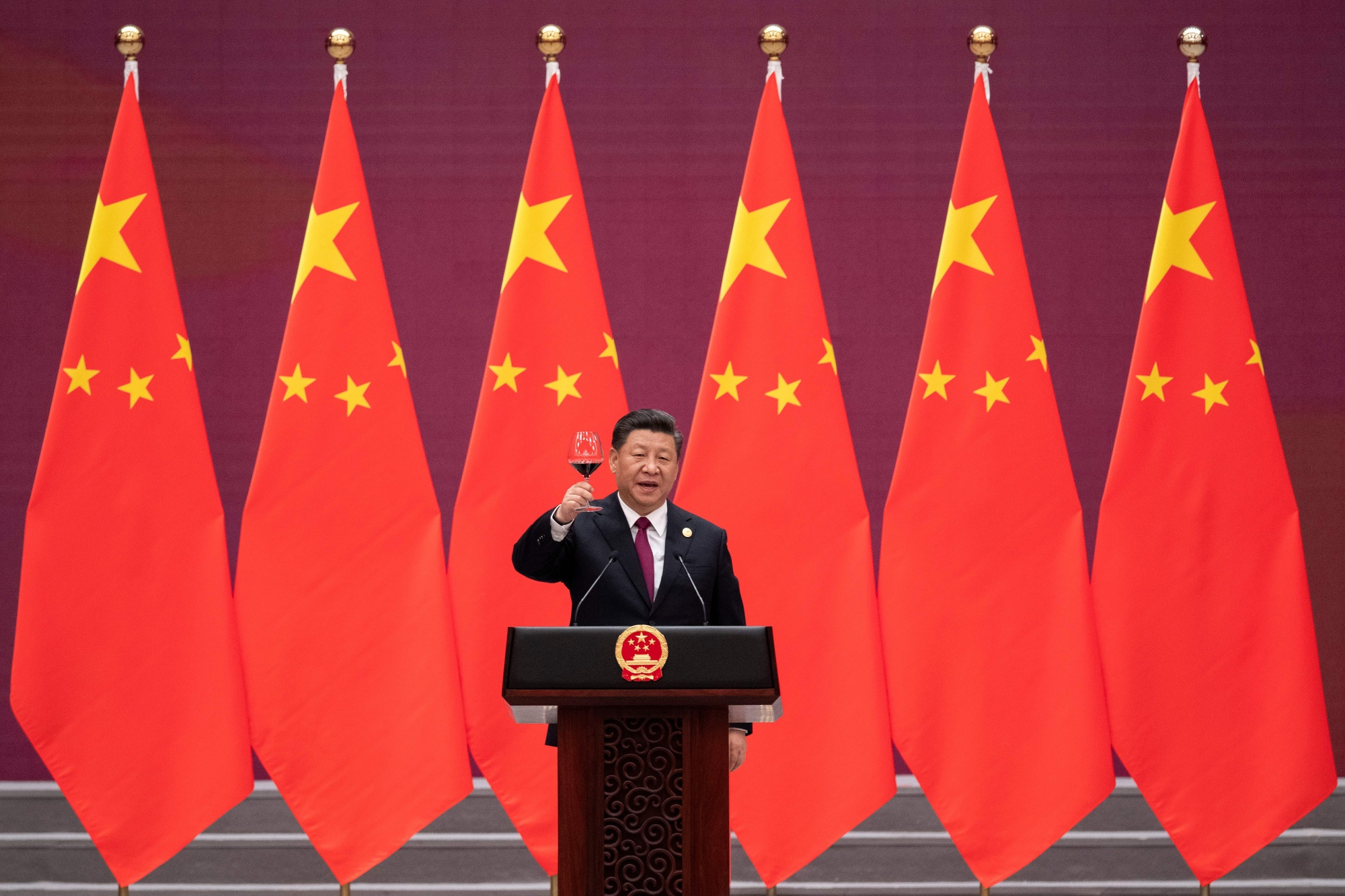

Policies on the table at this month's Communist Party congress will help determine if China surpasses the US economy or not.

A base case of 4.6% growth for China's economy over the next decade is sketched out in a report. The model suggests that a growth rate above 5% is out of reach due to the effects of Covid Zero policies, a faster decline in fertility than previously expected, and a gradual Shrinking Real Estate Sector.

There are many ways in which China's economic growth will play out.

Official data can be found in the data sources listed above.

If the property downturn is deeper than expected, GDP growth may average below 4% over the next decade, meaning China wouldn't overtake the US until the mid-2030s, and any lead may be reversed as demographic trends become a drag a decade later.

If China can shake off those twin constraints, continue to invest in manufacturing, and increase productivity, an expansion rate above 5% becomes possible once more, leading to a swifter ascent to the top.

It would be risky to bet that he can't do it. Since 2010, the size of China's economy has increased. China has overtaken Argentina and Russia to become a high income country according to the World Bank.

The Atlas method is used to calculate GNI per capita.

The World Bank is owned by the World Bank.

It won't be easy. Increasing taxes on the wealthy, pushing up the retirement age, and overcoming resistance from local governments who don't want to provide public services to migrants from other parts of China are some of the things that will need to be done by the new president. Private companies, which employ most of the country's workers, need to be allowed to compete more evenly with state-owned competitors in order to ensure funds go to the most productive firms.

There are four scenarios for China's economic growth over the next ten years.

The decade of growth could be between 4% and 5%.

Some economists have lowered their GDP forecasts for this year due to the Covid Zero policy. There isn't much chance of improvement if the policy continues.

The policy can be relaxed if there are enough medical tools available, according to government experts. From the second quarter of 2023, the base case assumes gradual easing.

China has a demographic challenge with the population decline happening earlier than expected. The population is living longer so they can work longer, which is good for the economy.

China's labor force would be stable if the retirement age was raised gradually.

This is a source of economics.

If the retirement age is raised gradually to 65 over the next 10 years, the workforce will be stable at around 760 million.

As countries get richer, workers skills become key to their productivity, giving China an economic offset. China will produce more than 10 million college graduates this year, nearly double the number a decade ago.

The head of the East Asian Institute in Singapore is a former China country director at the World Bank.

There is more to it than universities. The share of 25 to 60-year-olds with a high-school education has risen to 37% and is on track to reach at least 50% by the end of this decade, if Beijing can continue to increase education spending.

There is still a lot of growth to be had from investing. China invests a higher proportion of GDP than any major country in recent history, and while much of that doesn't produce high returns, the overall return on investment is positive. China has become a world leader in electric vehicle plants built by companies such as BYD and Nio.

Hofman said that even if you waste some of it, you still get growth from capital. Even with a bare minimum of economic reforms, China could grow 3% a year for the next 20 years.

China will need to maintain its current high household savings rate, but give more money to manufacturing and service companies.

Growth has been held back by the property market. An ongoing decline in real estate investment is needed to align supply with demand, but there is no collapse. Resources are freed up due to the real estate downturn.

Even though the home building boom in China has ended, there is still a need for housing. China has room to grow with 10 million people expected to move to cities each year for the next decade. It's easier for workers in cities to match their skills with other workers.

China's economy is too big for foreign demand to drive growth. Beijing needs to reform to make it easier for Chinese companies to take advantage of the huge domestic market. There are two policies that come in: dual circulation and common prosperity. Economic barriers between China's provinces are the first thing that comes to mind. Higher taxes on the wealthy are likely to be required in order to make healthcare more equal.

Changes which allow labor and physical investment to be used more effectively are referred to as total factor productivity. Adoption of new technology is one thing.

Spending on research and development, scientific publications, and patents have all shown strong growth. China spends more of its GDP on research and development than it does in Europe.

China's growth is driven by increasing output per worker.

The Conference Board is the source of this information.

Workers will shift from jobs with lower value to jobs with higher value in the future. In advanced economies, the share of workers in agriculture has room to fall from 25% to 3%. Farmers have been helped by companies like ByteDance.

There have been changes in the market institutions that have made it easier for people to sell their goods and services. Since 2020, Chinese people have been entitled to buy housing and claim government benefits in any city with a population less than 3 million, with the policy now gradually extending to larger cities. Private firms raised a lot of money on Chinese stock markets. Such reforms are expected to continue according to the base case.

Over the last few years, Beijing has cracked down on private firms which grow too large. The government is rolling out policies to make it easier for small and medium-sized businesses to get loans, cut business taxes and reduce red-tape. Beijing is giving funds and tax breaks to companies that file patents outside of China.

China's workforce is getting well educated.

The UNESCO Institute for Statistics is one of the sources.

According to Chang-Tai Hsieh, an economist at the University of Chicago, the key unknown is whether the party's efforts to support its favored parts of the private sector can spur enough growth to outweigh the negative effects of its Crackdown on other, less favored areas.

Margit says that China's private-sector companies are more productive than their state-owned rivals due to the large number of poorly performing local government-owned enterprises. While he supports SOEs in sectors he sees as strategic for the economy, he has allowed local firms to go bankrupt at unprecedented rates.

Eliminating majority state-ownership in non-strategic sectors would boost long-term GDP by 1.3%. There are a lot of areas where reforms could help productivity.

Links never return to their pre-pandemic levels when the base case is included. While politicians in Europe and East Asia do not want to separate from China, ongoing exchanges with advanced economies will continue to be a growth driver.

The race to be number one in China will be influenced by exchange rates as GDP levels are compared in US dollar terms. A stronger currency will help propel China's rise if it continues to open up its financial markets.

There is room for China to catch up in productivity.

The International Federation of Robotics is a non profit organization.

The bear case was slower than 4%.

When the Covid Zero policy will end has been a mystery. It isn't relaxed until 2024, meaning at least another year of very low growth, with a long-term impact on productivity as unemployed workers miss out on opportunities to accumulate skills.

Pushback to pension reforms could mean that the process isn't finished until 2040 and the working age population will decline over the decade.

If the property market is mishandled, it could lead to a sharper downturn in investment. In a worst-case scenario, Beijing's investment could fall by 20% over the course of the next two decades. There is a possibility that the government overstimulates and as policy support is withdrawn, there will be a worse downturn.

If the US imposes sanctions on China that are close to Russia, it would be disastrous for China's growth. The blowback for the world would probably be too great for Washington to go that far, but more aggressive decelerating would hit growth further.

The nightmare scenario is 2% growth.

The goal of the past five years has been to reduce the chance of a financial crisis by choking off shadow banking. If housing prices crash and too many banks need to be rescued, growth could slow even more.

If US allies join in, things could get worse. China's output could be up to 8% smaller by the year 2030.

Extreme weather that is related to climate change could be very damaging to the economy. A clash over Taiwan would be terrible.

Taiwan declaring independence and triggering an invasion by mainland forces is the biggest external risk in the next decade according to an article that was viewed more than 100,000 times on Chinese social media. The article was written in the aftermath of Russia's invasion of Ukraine.

The growth case is above 5%.

The goal is to double GDP from 2020 levels, implying growth above 5% for most of the decade. It would take a faster reopening from Covid to resume reforms, such as raising the pension age by 2025, according to the model.

Longer term, efforts to boost fertility by providing cheaper childcare and more benefits to parents could pay off, though the impact won't be clear until those kids enter the workforce in the 25th century.

The boost as workers shift from producing less complex goods and services to more valued ones is easier for China because it has the world's largest manufacturing base. Ten years ago, China was 24th place.

The economic complexity of China and the US are related.

The growth lab is from Harvard.

It's thought that making a range of products will make it easier to move up the ladder to more complex products. China is predicted to be one of the fastest growing economies in the world over the next 10 years.

Chinese companies lead the world in solar power, while video game companies and TikTok have had success on the global stage for the first time.

In the short term, there are two key challenges that need to be overcome in order to fuel China's long-term prospects.

The policy of moving away from the Covid Zero orientation and stabilizing the property market can help boost short-term growth. The best hope of getting long-term growth back on pre-pandemic paths can be found in the combination of structural reforms and a renewed focus on productivity and labor.

Watch Live TVListen to Live Radio