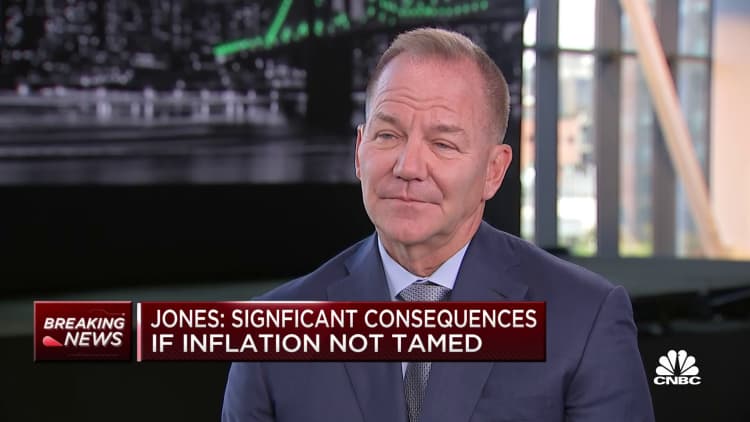

Paul Tudor Jones thinks the U.S. economy is in the middle of a recession.

Jones did not know if the recession started now or two months ago. We are always surprised when the recession starts, but I think we will go into one.

Multiple factors are used by the National Bureau of Economic Research to make its determination of a recession. A recession is a decline in economic activity that lasts more than a few months. Gross domestic product is not a primary barometer according to the bureau's economists.

The GDP fell in both the first and second quarters.

The founder and chief investment officer of Tudor Investment said that risk assets have more room to fall before hitting a bottom in a recession.

It takes most recessions about 300 days to start. The stock market is not doing as well as it could. Short rates will stop going up before the stock market bottoms.

Due to wage increases, it is difficult for the Fed to bring inflation back to its 2% target.

It's like toothpaste when it comes to inflation. It is difficult to get it back in once you get out of the tube. The Fed is trying to get rid of that taste in their mouths. If we go into a recession, it will have a negative effect on a lot of assets.

The Fed raised rates by three-quarters of a percentage point last month in order to fight inflation. Jones said that the central bank should tighten up.

Jones thinks that if they don't keep going, we'll have high and permanent inflation. If we want to have long-term prosperity, we need a stable currency and a stable way to value it. If you want to have a stable society, you have to have a 2% inflation rate. There is short-term pain associated with long term gain.

He made a lot of money from the 1987 stock market crash. Just Capital ranks public U.S. companies on social and environmental metrics.