You can apply for the executive world elite Mastercard.

Most of the profits from co- branded credit cards come from frequent flyer programs and the lucrative deals they have with banks.

The Platinum Card from American Express is probably the first card that comes to mind when you think of a premium credit card.

There is a premium airline credit card that gives me the same amount of value as other premium cards. When it comes to airline credit cards that offer lounge access, this one is in a league of it's own.

The most premium card in the portfolio is the Citi® / AAdvantage® Executive World Elite Mastercard® from Citigroup. The strongest lounge perk of any airline credit card is offered by this card.

The sign-up bonus is one of the major aspects of this card. Credit card spending can now count towards elite status in the AAdvantage program, so some might want to look at this card again.

The Citi AAdvantage Executive Card has a sign-up bonus of 80,000 American AAdvantage miles after spending less than $6,000 in the first three months. We don't know the end date for the bonus, but it's a limited time one.

The American AAdvantage miles are worth about $1,200 to me. That is a great bonus for a card. Think of the bonus as an additional incentive. The Citi AAdvantage Executive Card has a bigger reason than you might think.

Those who have received a new cardmember bonus for this card in the past 48 months are not eligible for the bonus miles.

The rules for applying for a Citi credit card include that you can only apply for one card at a time, and that you can only apply for two cards in a 65 day period.

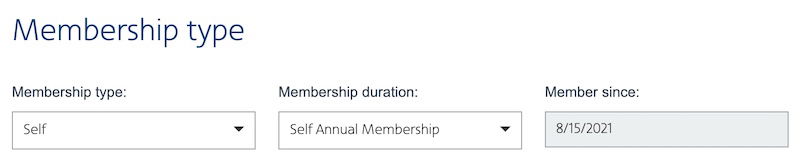

A $450 annual fee is charged for the Citi AAdvantage Executive Card. One of the perks of this card is that you can add up to 10 authorized users to your card at no extra cost.

Spending money on a card is not always easy.

There are better cards for buying airline tickets and for everyday spending. Changes have been made to the American AAdvantage program with the introduction of loyalty points.

You can earn one loyalty point for every dollar spent on an American Airlines credit card.

It's possible to earn elite status with spending on the Citi AAdvantage Executive Card. That is the main reason to use this card.

You can earn 10,000 Loyalty Points if you spend $40,000 on the card in a single year. The equivalent of 1.25x Loyalty Points would be earned for $40,000 of spending.

The AAdvantage elite qualification year is usually from March 1 to February 28 of the following year. The $40,000 spent on this card will help many maximize their loyalty points.

There are no foreign transaction fees on the Citi AAdvantage Executive Card.

The lounge access perk of the Citi AAdvantage Executive Card is one of the reasons you should get it. It's the best way to get to the clubs. How does that work?

A full admirals club membership is given to the primary cardmember on the Citi AAdvantage Executive Card. That is one of the reasons this card is right.

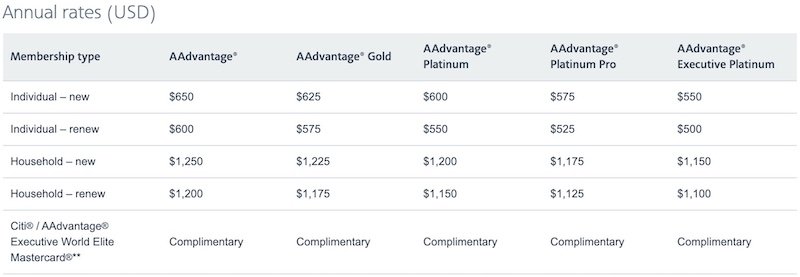

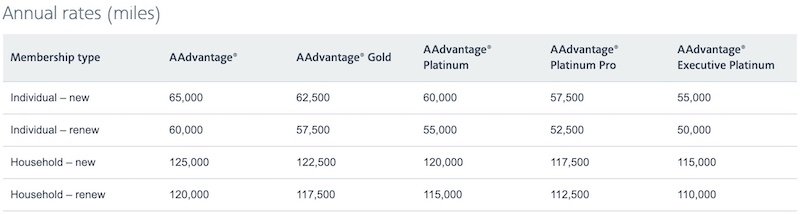

If you buy an Admirals Club membership, you will be paying anywhere from $500 to $650 per year, depending on whether you are a new member or renewing your membership.

You can save up to 200 dollars if you get an Admirals Club membership with the Citi AAdvantage Executive card.

If you redeem miles for an admirals club membership, you will get just a cent of value per mile, which is a bad value.

You don't have to bring your credit card as your membership will be linked to your AAdvantage number.

The access to Flagship Lounges is determined by the ticket you purchased rather than the membership you have.

A lot of people are considering applying for the Citi AAdvantage Executive Card before they go on a trip. How soon after being approved for the card does your membership begin?

The primary cardmember gets a full membership in the admirals club. If you receive your credit card in the mail, you don't have to use it to enter a lounge.

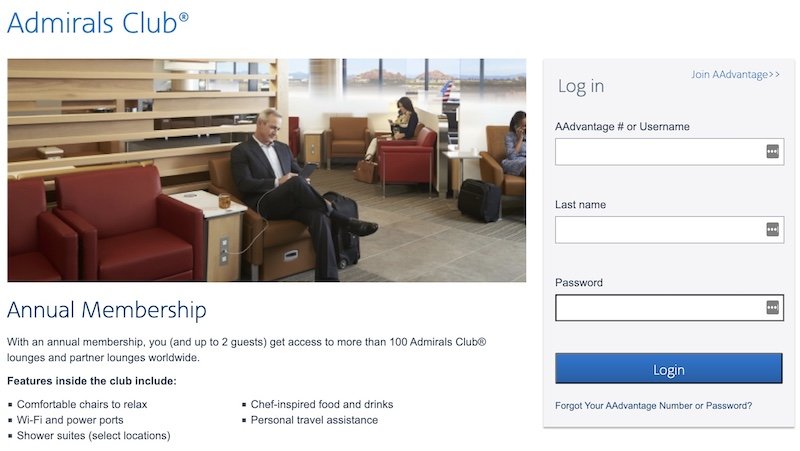

You can tell if your membership has been activated by looking at it. Pretend that you are about to sign up for an admirals club membership. Go to this page and enter your AAdvantage number and password.

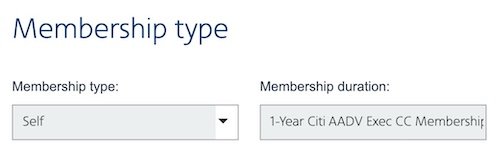

The next page shows the 1-year Citi AADV Exec CC Membership if your account has already been updated.

You will be able to choose what kind of membership you want if it hasn't been updated.

This only works for the primary card member. The authorized users wouldn't show up as being eligible online if they didn't have a full admirals club membership. Since there is no membership associated with their AAdvantage account, authorized users need to present a physical Citi AAdvantage Executive Card.

This is where the Citi AAdvantage Executive Card gets better. You can add up to 10 authorized users to the Citi AAdvantage Executive Card at no extra cost, and each of them will get access to the admirals club.

There are restrictions if you are an authorized user of the admirals club.

This is the same thing as a membership in the club.

It means that most of my family and some of my friends get access to the admirals club when they fly. I pay $450 a year for access to the Admirals Club, but I pay just over 40 a year for it. A single day pass costs more than that.

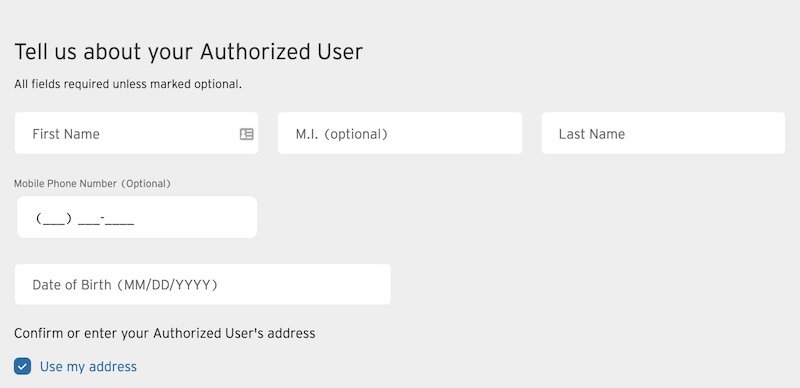

The easiest way to add authorized users to the Citi AAdvantage Executive Card is on the website. You can access the part of the website where authorized users are added by following this link.

You can add and remove authorized users on the next page.

You have the option of giving them permission to access your online account or not.

All your authorized users will be responsible for any charges they incur.

The main reason to get the Citi AAdvantage Executive Card is the great sign-up bonus, the ability to earn status with spending, and the Admirals Club benefit, which could add a lot of value for card members. Priority check-in is one of the perks.

You need to know about the other perks of the card.

The first checked bag free on domestic American Airlines itineraries is available to those with the Citi AAdvantage Executive Card. You don't need to pay for the ticket with your AAdvantage Executive Card, just make sure it's linked to your account and you'll be good to go.

$30 for the first checked bag is a $60 value per person, and if you had eight companions all checking a bag, that would be a value of $560

Priority check-in, priority airport screening, and early boarding are some of the benefits of being the primary cardmember. Features that can save you time and money are listed here.

When you have your credit card linked to your AAdvantage account, these perks will be reflected with your ticket, so you don't need to show your card.

Every five years, the Citi AAdvantage Executive Card gives a Global Entry credit. If you charge the purchase to your card, it will reimburse you. It is possible to pay for a friend or family member to sign up instead of you.

The inverse isn't true, so I always recommend applying for global entry.

The Citi AAdvantage Executive Card has a number of benefits that you may not be aware of. The concierge service is one of the perks with a variety of businesses.

Only if you are a frequent flyer with American you should use the Citi AAdvantage Executive Card. The best way to get an Admirals Club membership is if you fly a lot of times.

The card has an annual fee that is lower than the cheapest Admirals Club membership fee, as well as lounge access for 10 other people. This is a good time to apply.

If you are a frequent flyer on American Airlines, you should use the Citi AAdvantage Executive Card. Going with another premium card is a better option if you fly a lot of airlines.

You don't get access to any American Airlines admirals clubs with those cards.

It isn't for everyone. If you aren't a frequent flyer on American, you shouldn't use this card. This card is for frequent flyers on American.

There is still a lot of value in the complimentary snacks and drinks, free wi-fi and quiet places, and access to an agent in the event your flight has irregular operations.

The Citi AAdvantage Executive Card is something I have used for a long time. The Admirals Club access for up to 10 authorized users is one of the highlights of the membership. When it comes to lounge access, this card is the best.

Spending on American Airlines credit cards can help you earn elite status and this card may interest more people than before. The current welcome bonus is an excellent time to get the card.

You can learn more about the Citi Executive AAdvantage Card by following this link.