Philip Wilson was a reluctant landlord during the financial crisis.

He decided to rent out a flat and a house rather than sell them because of the slow property market.

The upheaval in the mortgage market has forced him to push up the rent for his tenants, and he is wondering if he will have to sell his house.

I feel for my tenants, says the 64 year old. One of them is struggling, she pays her rent in part when she has the money. I'm going to have to tell her that she's going to have to pay more. It's looking like she's going to have to pay more because it's now looking like she'll have to pay more. It's an increase.

I have not increased my rents this year despite several interest rate increases. They have to be passed on.

I will be selling both properties once this crisis ends. I don't want to be a charity but I feel bad for my tenants.

More people are affected by the rising costs of mortgages than just the 100,000 or so homeowners a month whose existing fixed-rate deals are ending.

If landlords are on variable rates, like Mr Wilson is, they have to pass on higher costs to their tenants.

Fixed-rate deals have been the most obvious change in the last two weeks.

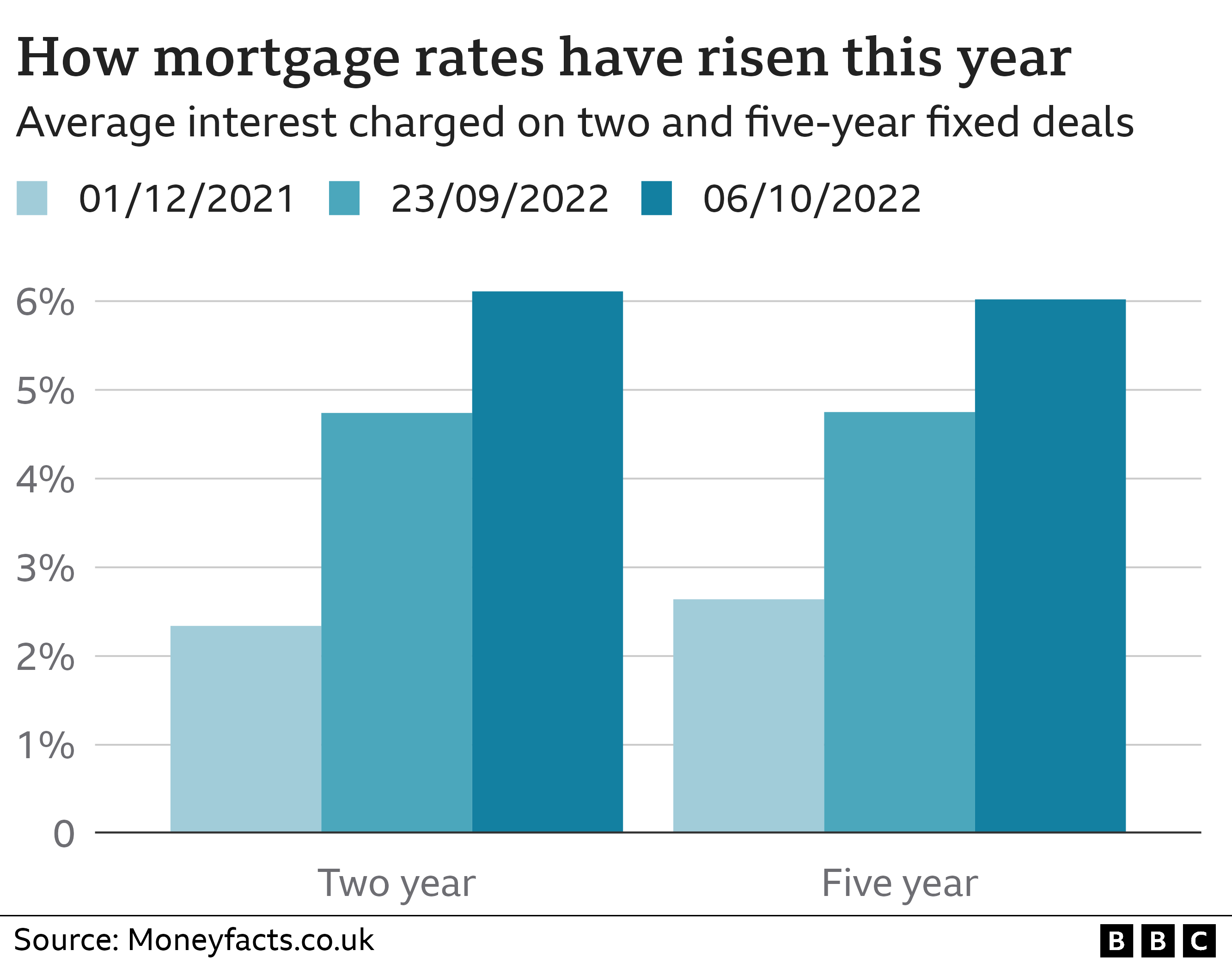

Moneyfacts said that the interest rate on the average two-year fixed rate mortgage hit 6 percent for the first time in 14 years.

A typical five-year fixed rate product had a rate over 6% for the first time in over a decade.

Many people don't know what to do next.

When Alice's current deal ends in June, she has been looking at what the increases mean for her.

I've been paying more on my mortgage because I want to reduce the term. I was doing well with my contract. I knew interest rates would go up but I didn't think it would be an overnight jump.

She is facing repayments that are more than she anticipated.

I had been doing the right things, trying to reduce my mortgage debt and get a permanent job. The rug has been pulled from under my feet.

Michael Bird says he and his girlfriend have been getting their hair cut.

First-time buyers down the chain have been unable to secure a mortgage at the higher rates and that is now at risk, because the 45-year-old fromSheffield was expecting to get close to a house purchase any day

It was taking a long time. He's waiting to hear if anything can be done.

It's very hard to understand. We were hoping to have our baby in her own room by now, but she is sleeping in our room.

We need to wait again.

The Chancellor met with officials from the major mortgage lender.

The Prime Minister said that the government will do what it can to support homeowners.

She stated that the benchmark interest rate was set by the Bank of England.