You can apply for the executive world elite Mastercard.

One of the most lucrative airline credit cards for airport lounge access is the Citi / AAdvantage Executive World Elite Mastercard. I wanted to explain everything you need to know about the lounge access perks, as the card is currently giving a limited time welcome bonus.

The $450 annual fee for the Citi AAdvantage Executive Card is a no-brainer for American Airlines frequent flyers. Whether you want to grab a drink or snack, or just want a quiet place to get some work done, airport lounge access is a great perk for frequent flyers.

The Citi AAdvantage Executive Card offers an Admirals Club membership for the primary cardmember, as well as complimentary Admirals Club access for up to 10 authorized users, all at no additional cost. This represents significant savings, not even taking into account the authorized user perks, because American normally charges $500- 650 per year for an admirals club membership.

The perks begin with the Admirals Club membership for the primary cardmember and then we will discuss the Admirals Club access for authorized users.

A full admirals club membership is given to the primary cardmember on the Citi AAdvantage Executive Card.

If you pay the card's annual fee, you can save anywhere from $50 to 200 per year, and that doesn't include the other perks.

The Citi AAdvantage Executive Card allows the primary cardmember to add up to 10 authorized users to the card at no extra cost.

You can get a $450 annual fee on the Citi AAdvantage Executive Card, which is less than you would pay for an admirals club membership. I don't know how to account for the cost of the card and the other perks. There are at least two ways to look at it.

I wanted to answer some of the questions that may arise, and if there are any I missed, please let me know, and I will answer them as well.

The Citi AAdvantage Executive Card may be of interest to many people. How soon after being approved for the card does your membership begin?

The primary cardmember gets a full membership in the admirals club. If you receive your credit card in the mail, you don't have to use it to enter a lounge.

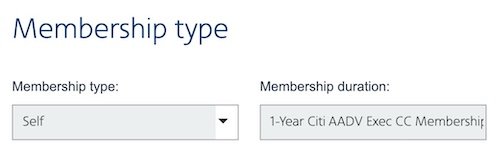

You can tell if your membership has been activated by looking at it. Pretend that you are about to sign up for an admirals club membership. Go to this page and enter your AAdvantage number and password.

The next page shows the 1-year Citi AADV Exec CC Membership if your account has already been updated.

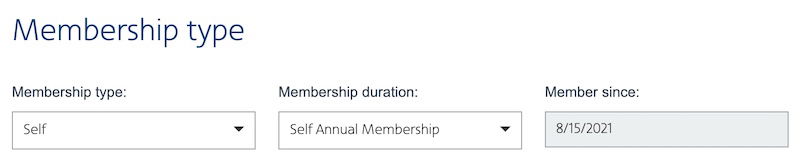

You will be able to choose what kind of membership you want if it hasn't been updated.

This only works for the primary card member. The authorized users wouldn't show up as being eligible online if they didn't have a full admirals club membership. Since there is no membership associated with their AAdvantage account, authorized users need to present a physical Citi AAdvantage Executive Card.

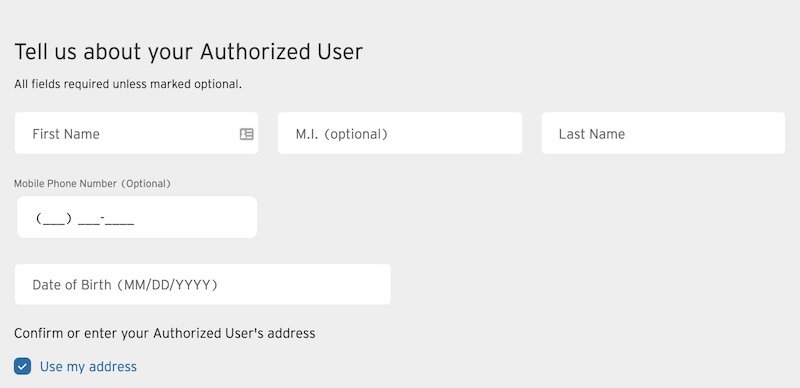

The easiest way to add authorized users to the Citi AAdvantage Executive Card is on the website. You can access the part of the website where authorized users are added by following this link.

You can add and remove authorized users on the next page.

You have the option of giving them permission to access your online account or not.

If you use the Citi AAdvantage Executive Card, you'll have full access to your credit line. It is not possible to set a lower limit on an authorized user's account, and you will be responsible for any charges they incur.

There is no age limit on how old you need to be to use the Citi AAdvantage Executive Card. The agent at the entrance may or may not ask for your identification.

Should you get approved for the Citi AAdvantage Executive Card if you have an existing Admirals Club membership? If you have at least 60 days left in your membership, you will get a pro-rated refund.

It can take up to a year for this to happen, but it will happen automatically.

All Admirals Club benefits will be terminated if you cancel the Citi AAdvantage Executive card. The primary cardmember will lose their membership in the admirals club.

The best card for American frequent flyers to use is the Citi AAdvantage Executive Card. It is possible to get access to a larger selection of airport lounges with other cards.

There are a few other options presented.

The best credit card for accessing American Airlines admirals clubs is the Citi AAdvantage executive card. The card also offers complimentary access to the admirals club for up to 10 authorized users. This is very close to being too good to be true. This is a great time to get the card.

People may have had questions about how this benefit works. Let me know if I didn't cover something.

What has your experience with the AAdvantage Executive Card been like?