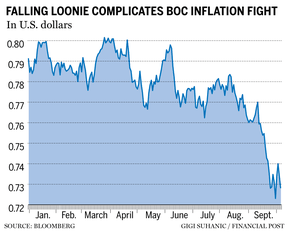

If battling decades-high inflation wasn't hard enough, the Bank of Canada is now faced with an added burden because of the weak Canadian dollar.

At the end of September, the Canadian dollar was below 73 U.S. cents for the first time in two years. Though it has clawed its way back above the 73-cent mark in recent days, the drop from the 77-cent range in which it was trading last month may add to the country's inflation troubles.

The Financial Post is part of Postmedia Network Inc. There was an issue with signing you up. Try again.

Benjamin Tal, deputy chief economist of CIBC Capital Markets, thinks that the inflationary impact of the Canadian dollar is complicating the Bank of Canada.

The central bank may need to keep interest rates higher for longer than they think in the face of inflationary pressures.

In a downturn, rising interest rates would slow down the consumer. The recent slowdown has been unique in that the labour market has remained robust, supporting wage growth for lower income brackets, while substantial savings amassed during the pandemic are giving the consumer the purchasing power to continue spending.

The governor of the Bank of Canada.

The photo was taken byJustin Tang.

Since cooling commodities prices are working in the opposite direction, Tal doesn't expect these factors to translate to a higher inflation reading in the next data print. The Bank of Canada has a two per cent target for inflation.

The weaker exchange rate is offsetting some of the disinflationary effects of lower commodity prices, according to the governor of the Bank of Canada.

Macklem said on the central bank's website that they can't count on easing pressure on global prices to lower inflation in Canada. It will take time to improve global factors. The recent depreciation of the Canadian dollar will make US goods and vacations more expensive for Canadians.

Normally, the Canadian dollar would go up when commodity prices go up. Macklem said in July that the central bank would have to do more of the heavy lifting through interest rates because the country wasn't seeing commodity linked appreciation.

The Canadian dollar did not take flight in tandem with the price of oil, barely glancing at the 80 U.S. cents level. Macklem pointed to the lack of investment in oil projects as one of the reasons the connection became unmoored.

The Bank of Canada is having a hard time with inflation.

The deputy chief economist is Benjamin Tal.

The falling price of oil puts more pressure on interest rate policy here.

Canada isn't the only country with currency troubles. The Fed has caused the dollar to surge against the currencies of other countries. Canada's dependence on the U.S. as a trade partner magnifies the impact on our economy.

Currency impacts have been a topic of debate.

A 10 per cent drop in the Canadian dollar has resulted in a half per cent upward shock in the headline inflation reading.

Currency effects can take up to a year to show up.

The impacts are small and could surprise observers.

Some factors are at play that could affect the economy. The cost burden in supply chains leans on domestic services, which are less sensitive to exchange rate changes.

The Canadian dollar is not expected to improve until later in the decade.

The person is Benjamin Tal.

Falling commodity prices, dollar hedges already in place by importers and the nature of exchange rate depreciation are all helping to lower sensitivity to exchange rates.

Exchange rate-driven inflation pressures are usually short-lived and central banks wouldn't overreact.

The Fed has made the U.S. dollar more attractive to foreign investors.

The photo was taken by Dado Ruvic.

No one has ever been able to identify a fundamental equilibrium exchange rate that the central bank can target. The best way to reflect domestic supply and demand is to adjust interest rates.

The Bank of Canada isn't likely to change policy settings or try to talk up the currency markets unless there is clear evidence of significant inflation.

The lower Canadian dollar is expected to stay there for a while. The Bank of Montreal's senior economist said in a note that the Canadian dollar will depreciate further this year.

Tal said the market will keep the Canadian dollar lower.

When interest rates stop rising and the market gets into some sort of equilibrium, we don't think the Canadian dollar will improve. The Canadian dollar will be under pressure in between.

The email address is shughes@postmedia.