According to Paul Fabara, executive vice president and chief risk officer at Visa, the growing importance of digital payments is one of the main causes of post-pandemic behavioral shifts.

Fabara says that covid forced a market to grow quickly. The number of people with an account with a financial institution or mobile money provider has increased over the last few years. There are a lot of adults in developing countries. Almost all of the adults in high-income economies made or received digital payments in 2011. 100 million adults in China made their first digital payment during the Pandemic.

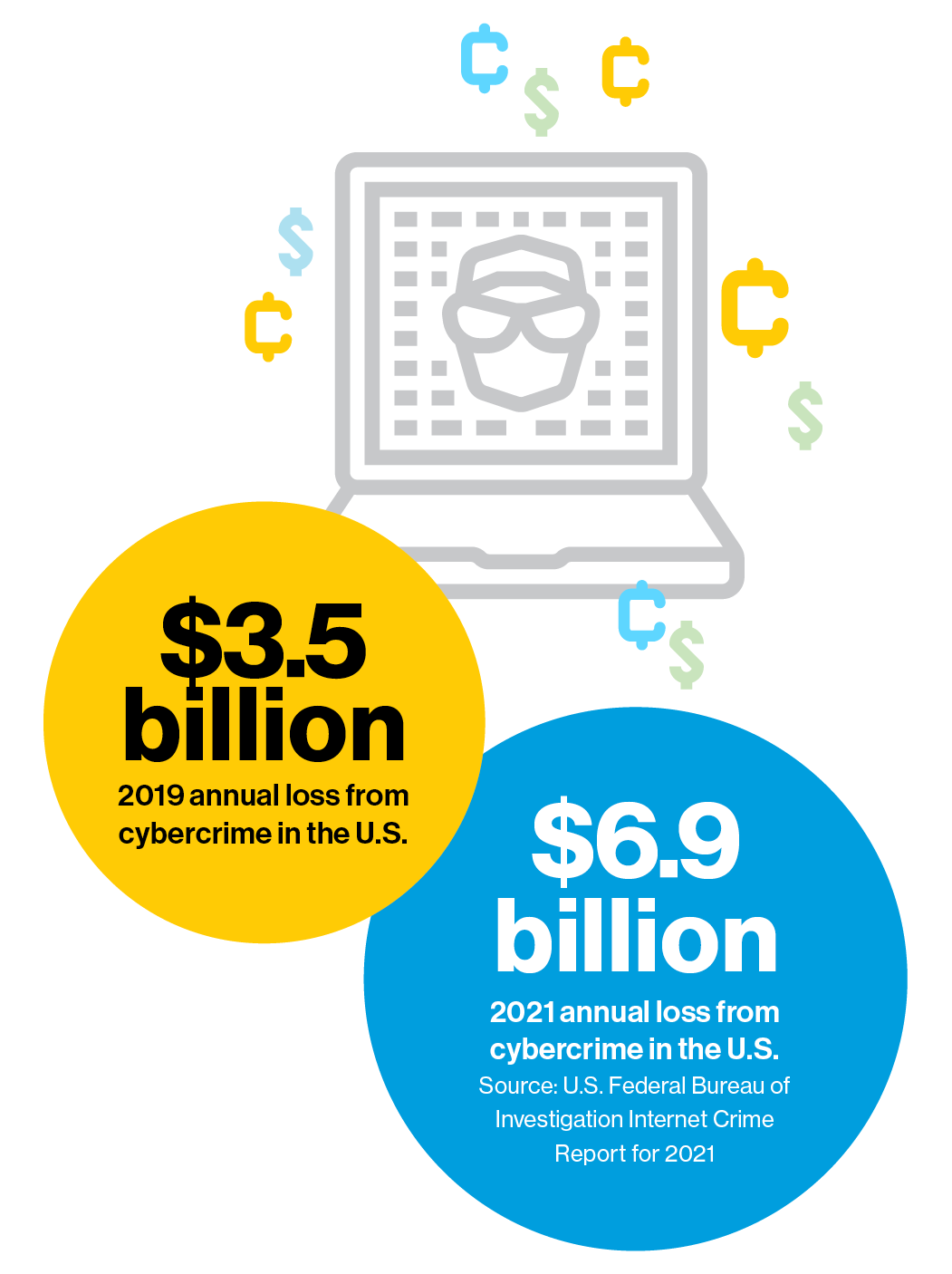

Fraudsters go where the money is and their online activities are growing along with the growth in digital transactions. According to the FBI's Internet Crime Report for 2021, the annual losses from cybercrime in the U.S. almost doubled between 2019 and 2021. The post-pandemic boom in transactions made fortifying cyberspace against theft and fraud even more important.

The same seamless real-time transactions that consumers expect are starting to be demanded by business-to-business customers. Expectations are finding their way into the business environment if you think about the way you shop online for personal things or pay your friends using a mobile-to- mobile app.

There are end-to-end digital transactions. A survey of global business leaders found high interest in digital payment technologies. 42% of respondents are just getting started with digital payments, and 42% expect to expand their offerings over the next 18 months.

Businesses are moving to all-digital payments. 70% of survey replies said businesses prioritized improving customer experience by offering multiple payment options and saving customers time. The benefits of operational improvements are what respondents want. More options for securing payments and personalized offers are what many want.

Press says that digital payments are more efficient and less error prone. There are checks and balances within the system, which means you are less likely to fill out the wrong form.

You can download the report.

This content was produced by Insights, the custom content arm of MIT Technology Review. It was not written by MIT Technology Review’s editorial staff.