It's obvious that periods of enormous growth won't continue forever, but it's still quite shocking when they end. The turn came at the end of a period that saw robust investment activity. It is easy to forget how far edtech has come.

There is still hope for the sector, according to a paper by Dealroom and Brighteye Venture. The momentum that has been building in recent years has slowed as investors tighten their belts to better understand the more robust parts of the sector

Tech and high growth companies are affected by the macro environment. There is variation in the extent to which market caps have evolved. Coursera and 2U have suffered significant declines, while companies that seem to have more robust caps are B2B software companies. The changes are linked to performance in many ways.

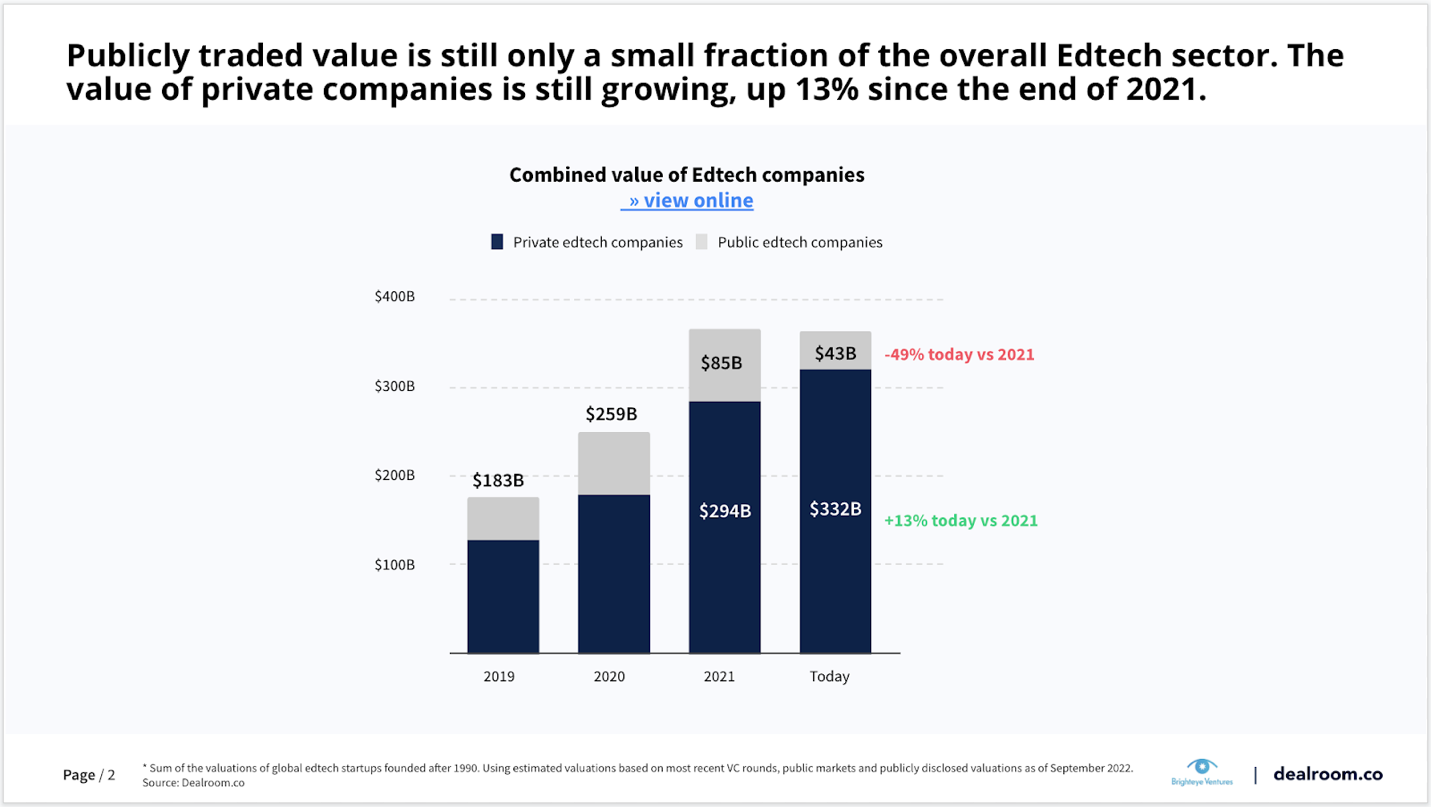

It is important to remember that publicly traded value is a small part of the overall ed tech sector. The value of private companies is growing at a slower rate than in the past.

There is a picture of BrighteyeVentures, Dealroom.

Public exits have been rare since last year. M&A activity has already surpassed 2020 levels despite the fact that big public exits aren't necessarily an appealing exit strategy.

Major M&A activity led by the sector's biggest names has begun to show signs of maturity as a result of the good times. Byju's, edtech's most valuable company, has bought 11 edtech startups in the last two years.