Lucy Hooker is a news correspondent for the British Broadcasting Corporation.

The Chancellor presented his tax-cutting mini-budget a week ago. His goal was to make the economy grow. It seems to have caused a crisis of confidence, a jump in mortgage rates, and a complete U-turn.

What did just happen? The people who lived it tell us about a dramatic week for the UK economy.

The pound fell to its lowest level on record after Jordan Rochester woke up and checked his phone.

There were questions about how far it could fall. Is the Bank of England going to raise the interest rate? The pound is in danger of being saved by the government.

He says there was a rush to answer important questions.

He has been betting against the pound for the last few months.

It may be the best trade of my career, but it may also be the least enjoyable. Nobody wants a downturn.

The lower the currency, the less faith investors have in a country's economy.

The pound was knocked further by the mini-budget that outlined tax cuts and a huge package of help with energy bills but didn't spell out where the extra money would come from.

It didn't come with an analysis of how the numbers were added up.

The fall in sterling made it more difficult for Mike Walley to sell toys in his store. He had a large bill to pay for imports.

He said that if they had made that payment last week, it would have been around $35000. Because of the pound situation, we have to pay over 39,000 dollars.

Expectations were that the Bank of England would have to raise interest rates.

The phone rang off the hook for Andrew Montlake at Coreco Partners.

He says the beginning of the week was chaotic.

His staff worked around the clock to help clients tie down deals.

There were less products available by the end of the week.

If we spoke to a client at nine in the morning and quoted them a rate, we had to call back two hours later to say it was going in the next hour. He says you need to make a decision quickly.

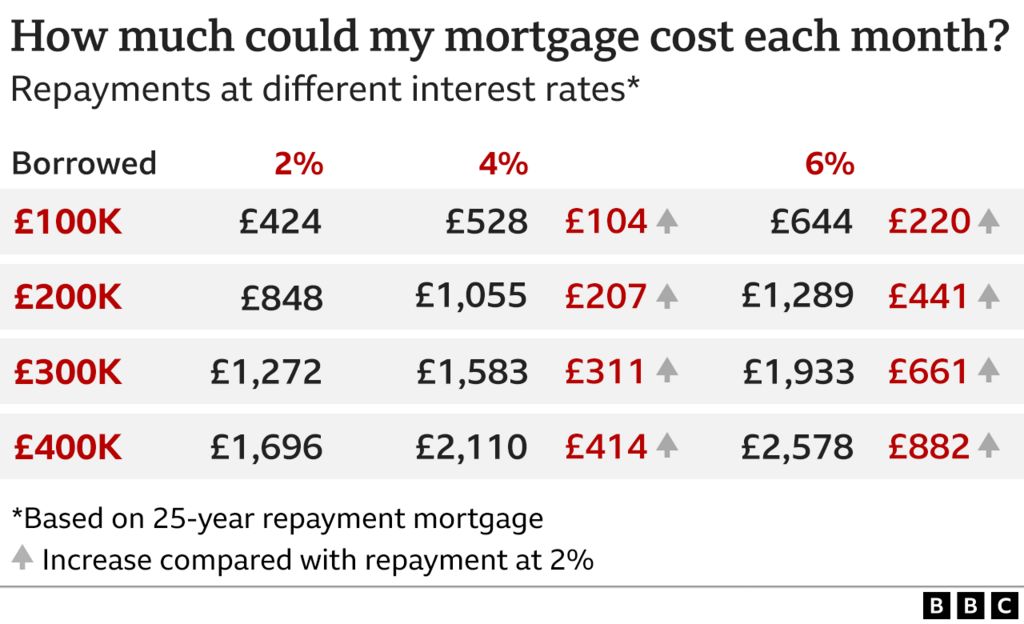

He says that people about to come off fixed rates are facing big jumps in their payments.

Steve is worried that he is about to go for disaster.

He says he will lose his home if interest rates go up. We have to go through this after everyone worked so hard. It is similar to being stabbed in the back.

The International Monetary Fund said that the government's strategy is likely to increase inequality and push up prices. The Fund frequently bails out countries who are struggling financially.

Many economists thought that the cost of government borrowing was worrying.

Lucy Coutts explained that it was a knee jerk lack of confidence.

She invests in government bonds that are low risk and don't move because lending to the UK is considered an ultra safe bet. Some bonds fell in price.

She says the moves are very sleepy.

She was on the phone to a client when she heard that the Bank of England would be buying up bonds.

She says she thought that was serious. The action had to be taken to avoid a panic in the pension market.

The Bank of England is in a state of emergency.

Things began to settle down thanks to the intervention.

The package of measures was defended by Liz and Kwarteng on the radio.

The prime minister said the strategy would get the economy growing and that she was not afraid to make unpopular decisions.

The PM was questioned on the mini-budget.

Chancellor Kwarteng said that his mini-budget measures were essential to deliver better growth outcomes.

He said in a message that the path we were on was unsustainable. I know the need to be credible with markets. We will show markets that our plan is credible.

Lucy Coutts was reassured by the fact that the prime minister had confirmed her commitment to the Bank of England. Some of the government bonds' losses were recovered.

The share prices on the UK stock market plummeted.

According to one poll, Labour has a 33 point lead over the Conservatives.

The market was in "very choppy waters still" despite the fact that the rates had shifted up a percentage point or two.

Some lost ground was made up by shares.

After meeting the Office for Budget Responsibility in the morning, the prime minister and chancellor said there would be no independent analysis of their plans until the next full budget.

The government's credibility remained in question until they could provide an explanation of how spending would be paid for and how debt would be managed over the long term. That's what we want.

It was good news for Mike Walley that he was able to save a few hundred pounds by holding off on one of his dollar payments until the end of the week.

He is concerned about "turbulent times" in the run up to Christmas.

We know this is all about growth. Businesses need stability.

Julie James said "you just live to pay the bills now".