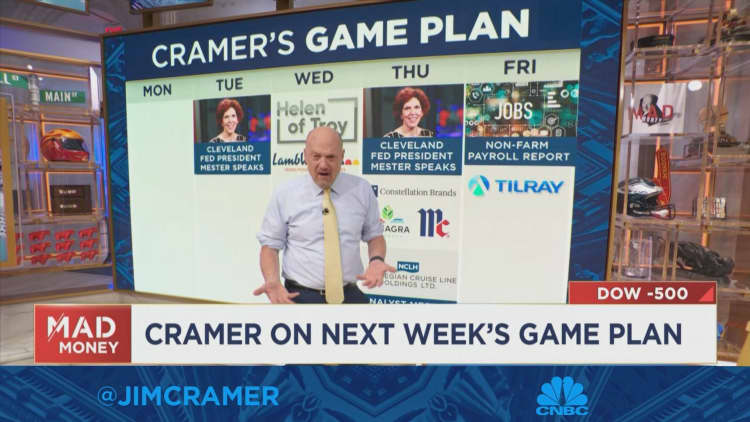

Three key events next week will determine if the stock market will continue into October.

The events are listed here.

The S&P 500 ended the month with its worst performance in over a year. The index fell for the month as well as for the year.

Cramer says that investors can protect themselves from the market turmoil if they stick to their game plan.

He believes that a decline in inflation will benefit companies with good balance sheets and high dividends.

Next week's earnings were previewed by him. Earnings and revenue estimates are provided by FactSet.

Helen of Troy.

Helen of Troy was a woman.

Lamb Weston is a holding company.

The upside just treads water or goes marginally higher as the downside gets worse. Cramer expects that will happen with both when they report.

Thursday: ConAgra Brands.

The brands that are part of the Constellations are:

The company's top line is expected to be good.

The brands of ConAgra.

Cramer said that the company needs to grow.

There is a person named McCormick.

Cramer said that the earnings call will reinforce the company's weaker-than- expected third-quarter earnings and full-year outlook cut.

The Norwegian Cruise Line is a cruise line.

Cramer said that he expects Norwegian to perform better than Carnival, which struggled with higher costs in its latest quarter, but it's not clear if that will help Norwegian's stock.

Tilray brands are on Friday.

He thinks that this could be a great speculative stock to own during the Biden administration, as he predicts that the company will make a "bold" statement about the legalization of cannabis.

Cramer's Charitable Trust is a shareholder in the company.

Jim Cramer has a guide to investing that you can download for free.