Federal student loan borrowers who don't have their loans held by the U.S. Department of Education will not be able to consolidate in order to qualify for President Joe Biden's student loan forgiveness program.

The guidance for the one-time student loan debt relief has been updated by the Education Department, which used to say that borrowers could consolidate their debts to Direct Loans in order to get the relief.

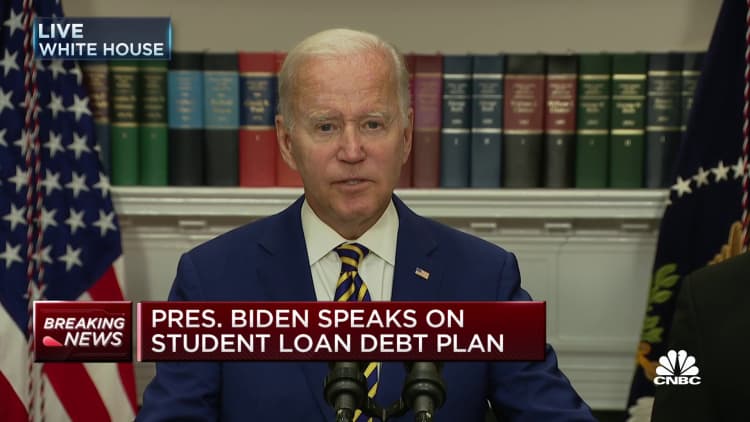

In August, Biden announced plans to forgive student loans. Up to $10,000 in forgiveness for federal student loan borrowers is included. To be eligible, borrowers had to have an income of at least $125,000 for individuals and $250,000 for households.

Personal finance asks if your student loans are eligible for federal forgiveness. What does Biden's student loan forgiveness mean for your tax situation?

The plan announcement raised questions as to whether borrowers with loans that aren't held by the government would be eligible.

The Education Department was looking at ways to allow overlooked borrowers to be included in forgiveness.

An administration official said that 770,000 borrowers were affected by the decision. Depending on income requirements, some may be excluded and others may be eligible for the relief.

Those with commercially-held FFEL loans are not included in the student loan payment pause.

In an update to its website, the Education Department now states that consolidation loans of any FFEL or Perkins loans not held by ED are also eligible.

As news of the policy change hit social media, student loan experts and borrowers expressed their shock.

Betsy Mayotte, president of The Institute of Student Loan Advisors, said that the site said they were working on a solution. It's a gut punch.

According to the website, the Education Department is assessing whether there are alternative pathways to provide relief to borrowers with federal student loans that aren't held by ED.