There are opportunities in this turbulent market.

The stock market has been in a bear market this year as investors worry about inflation, Federal Reserve interest rate hikes and a potential recession. The S&P 500 rebounded after hitting a new low for the year.

"While the world is focused on all the black swan events, there will be white swans that emerge." Staying invested in these markets is one of the hardest things to do.

A black swan is an event that results in panicked selling, while a white swan is a crisis that can be solved.

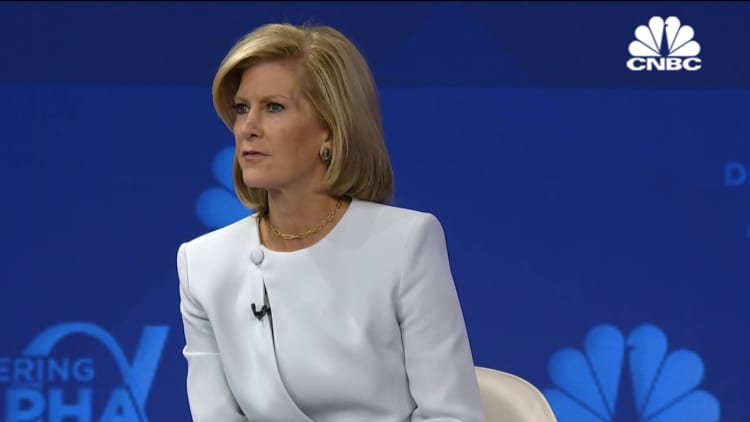

Mary Callahan Erdoes, JP Morgan, at CNBC’s Delivering Alpha, Sept. 28, 2022.Finding the right opportunities is what staying invested is all about.

The leader said there is alpha everywhere. It's in the stock market. That is in bonds. It's in a foreign currency. It's in the real world. Private markets are where it is. It is in a public market. We are in such a state of change that it is inescapable.

A return that beats the market's performance is referred to as alpha.

Although she admits the country's complex market might not be for everyone, she sees a lot of opportunity in China.

She urged investors to invest in China. The country will emerge from Covid. The country is going to put 22% of its young people back to work. The economy is going to continue to invest in electric vehicles.

She said that China is moving towards its goal of being a global leader in technology.

She thinks U.K. banks are the most interesting thing you can invest in. The country's economy has been in trouble. The Bank of England bought U.K. bonds in order to calm the market.

She said that last week people told them not to invest in the U.K.

Most of John Vaske's investments are in the private market. He wants to get back in at a lower price down the road because he expects a bearish few quarters. He said that included companies like Bill.com.

Roger Ferguson is a former Federal Reserve vice chairman and former CEO of TIAA.

He said that the chances of a recession are high.

Investing is an activity that lasts a long time. He said that investors should look for four or five major trends that will create investable opportunities for the next decade or so.

Ferguson hopes that an aging population and increasing longevity will come back. He said to look in the health-care space.

Some version of globalization is one of the trends. Ferguson said that investors would have to get used to inflationary pressures.

The Fed is going to do everything in its power to bring inflation down. He said that even their own projection doesn't have them getting there as fast as they want.

If you're scared off from investing because of inflationary pressure or the possibility of a recession, history shows you the best way to go. She said that the best returns are usually within 10 days. She said that if you miss the best 10 days in a market environment, your returns will be halved.

She said that it is irresponsible to be passive in what you are doing when you consider people who are responsible for a lot of money.