Mortgage rates went up last week after the Federal Reserve said it would continue to take action. According to the Mortgage Bankers Association, mortgage application volume dropped 3.7% last week compared with the previous week.

After a bounce the week before, applications to refinance a home loan fell for the week and were much lower than a year ago. They are at a 22-year low because there are very few borrowers who can benefit from a lower rate.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances increased to 6.52% from 6.25% with points rising to 1.15 from 0.71 for loans with a 20% down payment It's the highest level since 2008.

Over the past six weeks, mortgage rates have increased more than a percentage point after a brief pause in July. Mortgage rates are volatile due to uncertainty about the impact of the Fed reducing its holdings.

The number of mortgage applications to purchase a home was 29% lower than a year ago. The annual price gains are now decreasing at a record pace, but potential buyers are still competing with high prices.

Because of the recent jump in rates, the share of mortgage applications with an interest rate of 2.5% or higher has increased to 10% of applications and 20% of volume.

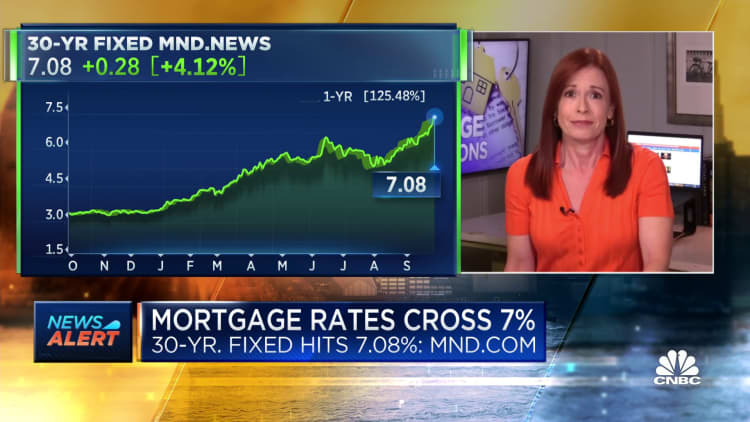

According to a survey by Mortgage News Daily, the 30-year fixed rate increased to 7.05%. It's the highest rate in over two decades.