Email audiofeedback@marketwatch.com if you would like to give feedback.

The bear outruns the average.

The blue-chip gauge fell 1.1% on Monday and closed at 29,260. 81. The index was 20.5% below its January record finish of 36,799.65. A bear market is marked by a 20% or more pull back.

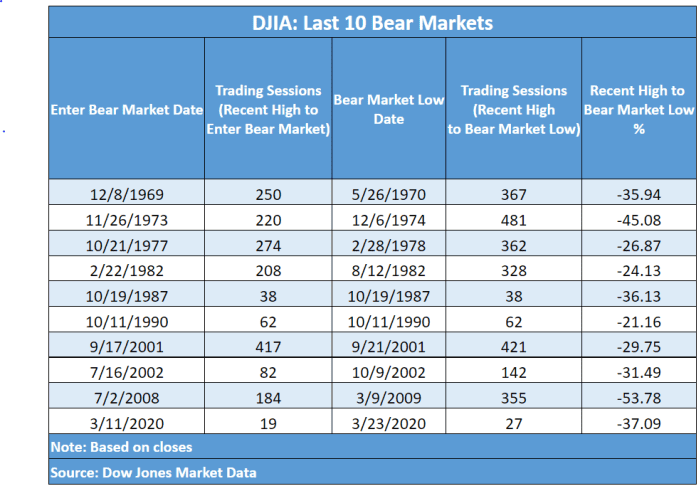

The stock market fell into a bear market in early 2020 as the COVID-19 epidemic shut down the global economy and wreaked havoc on financial markets. The peak of the bear-market low for the DOW was in March of 2020. On March 26, 2020, it exited the bear.

The average bear market has a decline of 35.3% and a decline of 35.9%.

There have been 182 trading days since the peak of the DOW. The median time it takes for a bear market to fall from its high is 114 days. The average number of days it takes to reach a bear-market low is 202.

The S&P 500 fell more than 20% from its January record after it confirmed it was in a bear market. On Monday, the large-cap benchmark fell 38.19 points, or 1%, to close at 3,655.04.

According to a key technical indicator, the stock market may be on the verge of a rebound.

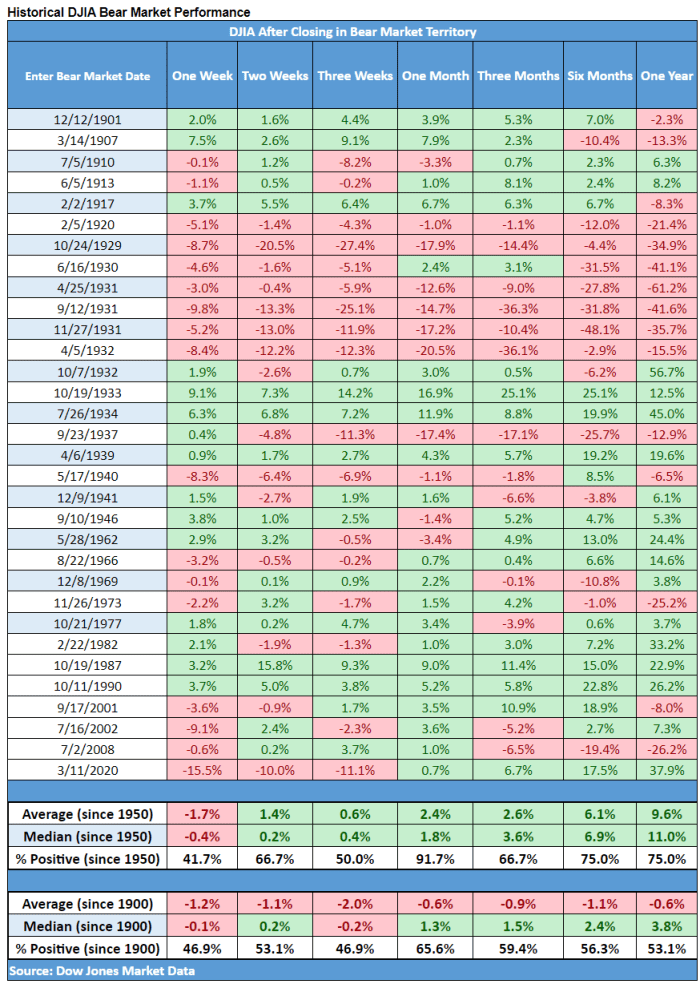

After entering a bear market, the average and median returns for the Dow were negative in the week, while the average and median returns for the next year were positive.

Performance went back to 1900 in the table below.

Morgan Stanley warns of an "untenable situation" for the stock market due to the surging U.S. dollar.