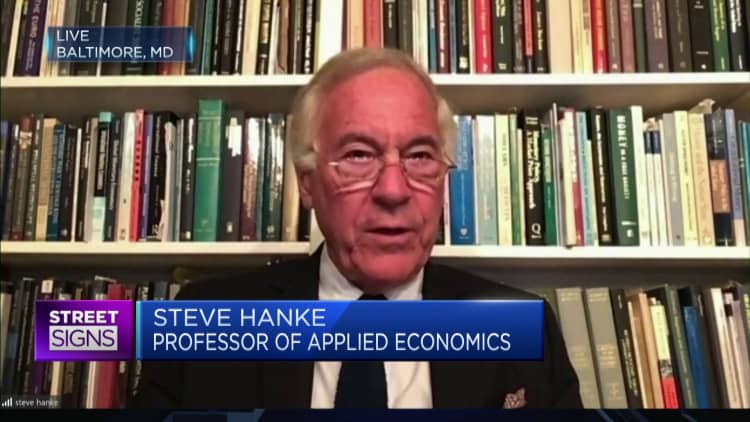

According to Steve Hanke, a professor of applied economics, there is an 80% chance of a recession in the U.S.

According to CNBC's September Fed survey of economists, fund managers and strategists, there is a 50% chance of the U.S. entering a recession over the next year.

I think the chance of a recession is about 80%. Hanke said on Friday that it could be even higher than 80%.

If the growth rate is moved into negative territory, it will be severe.

They have really been searching for inflation and the causes of inflation in all the wrong places. They’re looking at everything under the sun, but the money supply.

The Federal Reserve has failed to manage inflation through keeping an eye on the large supply of money in the US economy.

They have been looking for inflation and the causes of it. The money supply is what they are looking at.

They have tripled down on the idea that money has no relationship to economic activity or a reliable relationship to economic activity and inflation.

A customer shops at a supermarket in Oregon. There’s an 80% chance of the U.S. falling into a recession — much higher than previously predicted, according to Steve Hanke, a professor of applied economics at Johns Hopkins University.He said the U.S. central bank was to blame for inflation.

The Fed didn't want this length to be visible between the money supply and inflation because they exploded the money supply.

That is the real problem if it is.

Consumers are willing to pay more for goods when there is more money in the economy.

Money supply is the culprit for out-of-control inflation according to classical economics.

The professor said that the Fed didn't focus on reducing money supply over time because they flooded the U.S. economy with large amounts of stimuli.

The M2 supply of money has grown by double digits in the last three years.

The growth of M2 money supply could cause the economy to go into a recession.

He said broad money is major in the United States. It doesn't grow at all.

If they keep this up, the money supply will be driven down into negative territory because of quantitative tightening.

Hanke said the best way to get inflation to 2% is to keep money supply growing at a golden growth rate.

It's zero now. The professor thought it would go negative. That is the reason we will see a recession in 2020.