Do you want to know about European markets? It's in your inbox before the opening. If you sign up, you'll get notifications.

According to Italian bond markets, investors are unperturbed by the possibility of a right-wing coalition taking power. Many are worried that the calm will not last.

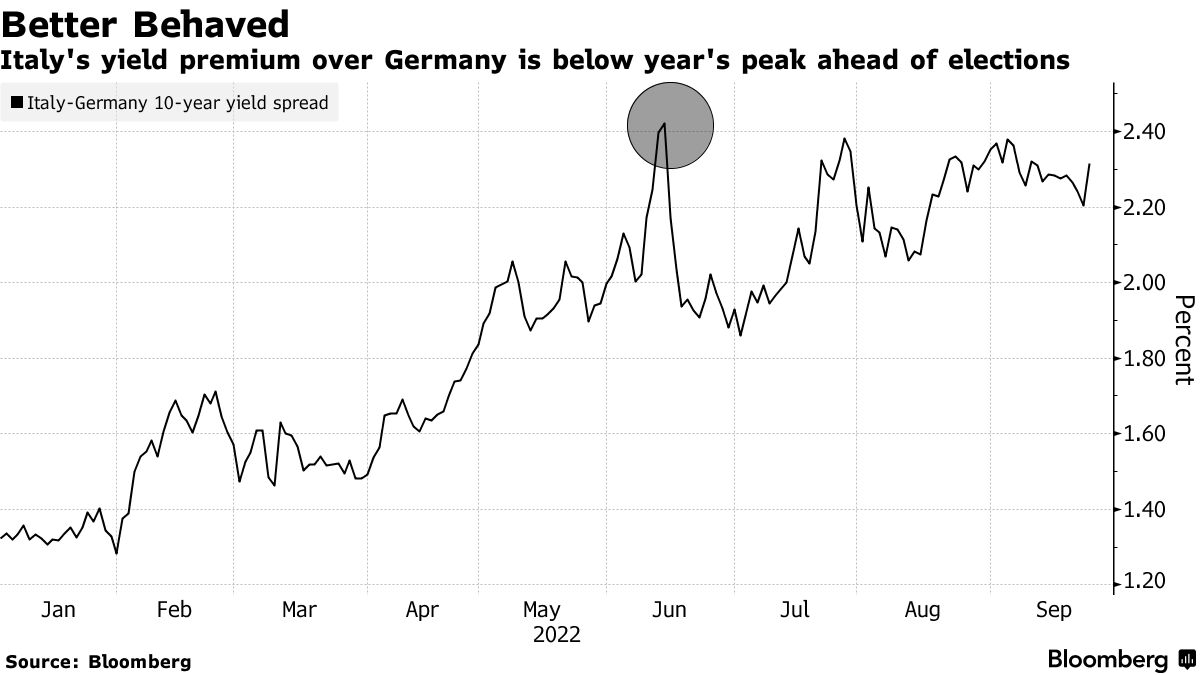

The nation's debt has been swept up and pushed 10-year borrowing costs to levels not seen in three years. Italy's yield premium over Germany is still lower than at the beginning of the month, suggesting bondholders don't expect the election to cause a lot of upheaval.

The bonds of Italian companies have performed less poorly than their European counterparts this year. The gaming company raised 350 million euros on bond markets, despite its junk credit rating, and received orders three times greater than the amount.

The coalition pledges to honor fiscal commitments made to the EU. The coalition will sharply increase spending if the promise is not kept. Hundreds of billions of euros in EU funding are at risk because of that.

There will be massive fiscal expansion if you look at their political program.

The public deficit will run foul of previous commitments towards the EU if tax cuts are thrown into the mix.

The economic outlook will be worse as a result of Italy's welcome gift to meloni.

Policies moving away from alignment with the European Union would only make matters worse for local borrowers, who are already facing surging inflation and the retreat of central bank support

Losing access to EU recovery funds would be catastrophic for companies that are already facing higher borrowing costs.

The system could be affected by a strong hit to Italians. Italian corporations weigh in more than any other country on the European high yield index.

The bonds of the construction firm Webuild SpA were at risk of being lost. They fell more than 4.5 cents on the euro after the next prime minister said the EU recovery plan needed tweaking.

Pietro Salini, chief executive officer of Webuild, told an industry event this week that political leaders need to respect the framework and terms of the reform package.

Italy has been seen as Europe's weakest link due to high debt, slow growth and volatile politics. There is a lot of precedent for election-linked volatility, with the biggest monthly losses since records began for bond investors in the wake of the Italian election.

Italy's debt-to-GDP ratio is already Europe's second highest and worsening would make it worse.

Capital is becoming more expensive after a long time. Money markets think the European Central Bank will raise its interest rate by 75 basis points in October. Policy makers are looking at ways to reduce the balance sheet of the European Central Bank.

Italy was able to extend the average maturity of its debt by exploiting years of ultra-low rates. Stephane Monier is chief investment officer of Lombard Odier Private Bank.

The length of Italy's debt has been shortened. If there is a recession that lasts several years, the situation is more precarious.

If the yield spread over Germany passed 300 basis points, Monier would consider buying more Italian bonds. It was more than 10 basis points below the high it reached in June.

The investor concern is mitigated by the fact that the ECB will purchase debt from southern European countries through at least 2024. The transmission protection instrument is designed to mitigate against unwarranted jumps in borrowing costs for weaker euro zone members

Some investors may be putting too much faith in the backstop. The facility should be seen as a way to prevent the spread of the debt crisis across the bloc.

The coalition between Matteo Salvini's Lega and the Brothers of Italy looked shaky.

He said that they have different opinions on what Italy should be. If those parties can't keep it together, we don't rule out an open crisis at some point.