Now is the time to apply for the Marriott Bonvoy Brilliant American Express card.

The Marriott credit cards are issued by American Express and Chase. The Marriott Bonvoy Brilliant American Express Card is the most premium credit card in the portfolio. The card is more compelling now that it has undergone a full refresh.

Marriott has a credit card called the Bonvoy Brilliant Card. The perks of the card should more than justify the annual fee. The Marriott Bonvoy Platinum Elite status is available without a spending requirement. I have a card that I find to be valuable.

The details of the card include a welcome offer, incredible benefits, and a lot more.

Within the first three months of card membership, the Marriott Bonvoy Brilliant Card will give a welcome bonus of 150,000 Marriott Bonvoy points. I value Bonvoy points at 0.7 cents each, so the bonus is worth over a thousand dollars to me.

There are a lot of restrictions on eligibility for this card.

The welcome offer is not available to applicants who have had a product like this or a card like this.

The welcome offer is not available to those who apply.

If you have good credit, it's easy to get an Amex card. It shouldn't be hard to be approved for this card because most people have reported instant approvals. Make sure you're aware of that.

All major credit card application restrictions can be found in this post.

The Marriott Bonvoy Brilliant card has an annual fee. You can add additional card members for free.

The Bonvoy Brilliant Card has no foreign transaction fees so it is a good option for purchases abroad.

The Marriott Bonvoy Brilliant Card has some bonus categories, but I wouldn't use it for my daily spending. The card has an incentive to spend $60,000 per year and the math could work out. We will discuss how the bonus categories work.

6x Bonvoy points are offered on eligible purchases at Marriott hotels around the world.

If I valued Bonvoy points at 0.7 cents each, that would mean a 4.2% return on hotel spending. I like to use the Chase Sapphire Reserve for my Marriott hotel spending as it offers 3x Ultimate rewards points.

There are bonus categories on the Marriott Bonvoy Brilliant Card that give 3x points.

It's like a 2% return on spending based on my valuation of 0.7 cents per point. There are better credit cards for restaurant purchases.

All eligible purchases with the Marriott Bonvoy Brilliant Card get 2x points. I don't consider 2x points per dollar spent to be particularly compelling since I think there are better cards for everyday spending.

When you spend $60,000 a year on the Marriott Bonvoy Brilliant Card, you will be able to choose a Choice Reward benefit.

If you cross 50 or 75 elite nights in a year, you would normally get Choice Benefits. There is a chance to get a free night certificate worth up to 85,000 points if you spend money on the card.

The Marriott Bonvoy Brilliant Card has a variety of perks, ranging from Platinum Elite status to an annual dining credit of up to $300. The benefits are more important than the annual fee. The card has a number of benefits.

If you have the Bonvoy Brilliant Card, you will get complimentary Platinum Elite status in the Marriott Bonvoy program. The status usually requires 50 elite nights per year.

If you have a credit card, you can get Platinum Elite status without spending a dime.

You can get up to $300 per year in restaurant statement credits for having the Marriott Bonvoy Brilliant Card. You can use the credit for purchases at restaurants around the world. The benefit is available for the first year and every year thereafter.

You should get the full value out of this if you spend $25 a month at restaurants.

You can get a free night award every year on your renewal month if you stay at a property that costs up to 85,000 points. On your first anniversary, you receive your first one of these.

The free night certificates offered on most other Marriott cards are valid at properties costing up to 50,000 points per night, so using these at properties costing 85,000 points per night is great. You can get access to all types of hotels.

Marriott lets you top off free night certificates with up to 15,000 points so you can redeem them at hotels that cost up to 100,000 points.

The Bonvoy Brilliant Card entitles you to 25 elite nights per year. The only Marriott credit card that offers elite nights is one that is co- branded. You can only get this benefit on one card.

You would start every year with 40 elite nights if you had this card.

If you want to earn Marriott Bonvoy Choice Benefits or Marriott Bonvoy Titanium Elite, those elite nights could be useful.

You can get a $100 on-property credit at the Ritz-Carlton and St. Regis hotels when you book at least two nights. You have to book an eligible rate which is equivalent to the best available rate.

I don't think that's worth much What's the reason?

The Bonvoy Brilliant Card gives you access to 1,300+ lounges around the world. You can bring two people with you to the lounge. It's a good way to make your airport experience better.

Priority Pass restaurants don't give credits to Priority Pass memberships.

There is a statement credit for Global Entry on the Marriott Bonvoy Brilliant card. You aren't eligible for both programs. You can simply charge the membership fee to your card. If you charge the fee to your eligible card, it won't matter who pays it.

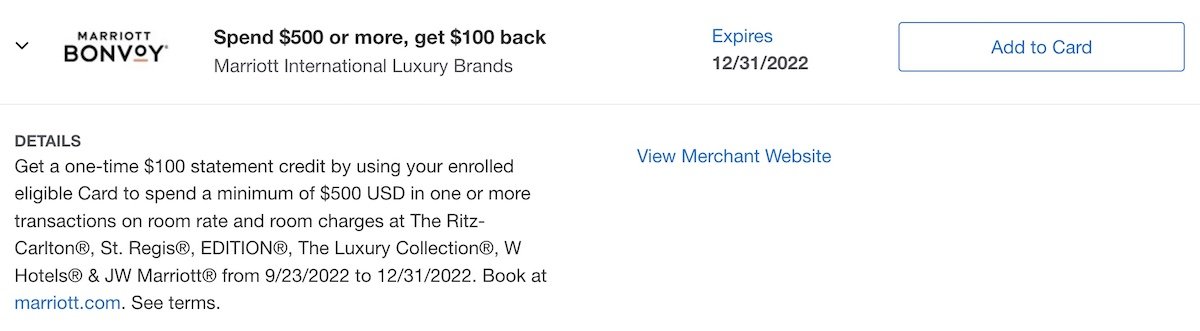

One of the great features of Amex cards is access to Amex offers, which allows members to save money on purchases at all kinds of retailers. If you get as many Amex cards as you can, you can get the offers on multiple cards.

The Bonvoy Brilliant Card is a great way to stay at Marriotts. Platinum Elite status is the biggest perk and it's only for having a credit card.

The yearly fee is easy to justify. The free night certificate valid at a property that costs up to 85,000 Bonvoy points is easily worth $350, while the $300 restaurant credit to more or less is worth face value.

That is a great deal to me. There are a lot of other perks that are also worth something.

The Marriott Bonvoy Brilliant Card has an annual fee of $650 and the Marriott Bonvoy Boundless Credit Card has an annual fee of $95. The major differences are what they are.

The Bonvoy Brilliant Card is more valuable than the elite status, free night certificate, and more. Marriott guests who are more casual may prefer the Boundless Card.

Marriott has a credit card called the Bonvoy Brilliant Card. The card has a $650 annual fee, but offers perks like Platinum Elite status, a $300 annual restaurant credit, an annual free night certificate, and much more. You should be able to come out ahead with this card if you add in all the money-saving offers.

You can learn more about the Marriott Bonvoy Brilliant Card by following this link.

The rates and fees can be found in the links. The Marriott Bonvoy Brilliant card has rates and fees.