Since the beginning of the year, investors in the Semiconductor industry have had a hard time. If you want to see how bad this year has been for chip investors, you need to look at the VanEck SemiconductorETF. A leading chip stocks fund with more than $6 billion in net assets has fallen in value in the last ten months.

MarketBeat.com - MarketBeat

MarketBeat.com - MarketBeat It wasn't always this way. Semiconductor companies expanded their production capacity to address global shortages. Premium margins were generated for the companies that manufactured the chips. Concerns that the expanded capacity could lead to a supplyglut have caused investors to sour on chip stocks. The multi-month sell-off is the reason.

Concerns over the potential weak demand for chips have scared off some investors. The U.S. government's decision to restrict the sale of certain chips to China has increased uncertainty for investors in the Semiconductor industry. The drop in chip stocks from their recent peaks has been dramatic. It may be the best time to look for oversold Semiconductor stocks. There are two stocks that are worth looking at for a rebound play.

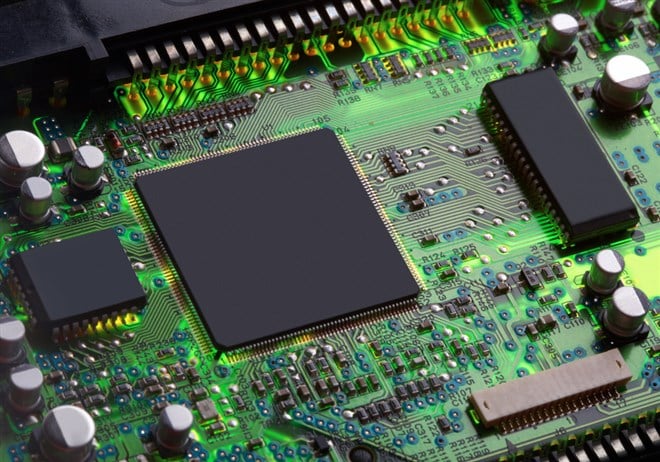

Many people are involved in the chip supply chain. T SM is involved in the production side of things. The company is located in Taiwan, a global chip production capital, where they handle contract chip production and are the world's leading provider in that space.

The new generation of gaming graphic chips were manufactured by TSM, which is a big win for them, as the previous generation of those chips were manufactured by Nvidia at the same factory. Over the years, the company has invested in improving its manufacturing technology, making it easy for them to make advanced Semiconductor components.

The passing of the Chips Act made investors nervous. Many worried that the U.S. domestic Semiconductor Subsidy Program could hurt Taiwan's competitiveness in the chip manufacturing market. The Chips Act doesn't threaten Taiwan's chip industry, but Taiwan has gone out of its way to reiterate its position.

Tsm stands to benefit from the chips act. The company will be able to take advantage of the U.S. chip industry subsidy and tax credit program as a result of their new plant in Arizona.

Tsm shares recently fell to a new 52 week low, but looking at the charts, there is a bullish setup emerging. The RSI reading of 35 indicates that the stock is extremely oversold, and there is a strong argument that a low could soon be put in.

Graphics processing chips designed by Nvidia are used in a variety of gaming devices. Artificial intelligence chips are made by the company. In a show of their market might, they maintained high price tags on the new and advanced generation of their flagship GeForce graphics chips. The company won't be affected by the U.S. ban on the sale of advanced Semiconductor components to China.

Its shares have been decreasing in value. The mixed earnings report for the most recent quarter caused investors to be upset.

With the stocks RSI approaching the 20s, you have to be thinking that they will soon be very oversold. It is around this level that the bulls consolidated in 2020 and 2021.

You might want to think about backing up the truck if you are a fan of the industry.

Some of the largest publicly traded companies founded and run by entrepreneurs are tracked by the entrepreneur index.