Shaw likes to run.

In 2009, the serialentrepreneur joined activity and fitness tracking platform Strava as a co- founder and lead engineering. He spent eight years there, and as of its most recent raise in 2020, it had 70 million members globally and a cult-like following from its users.

Guidewire was started by Shaw before that. He helped the company grow to a different level before it went public.

Shaw, Josh Wyss and Graham Gerlach formed Inclined in 2020 after a short break from their previous jobs. Even if it doesn't land tens of millions of users or go public, the startup is growing in its own right. It just raised 15 million dollars in Series A funding to continue to grow.

Shaw admits that Inclined is a different kind of company. He said that the startup wants to digitizing many of the traditional time- intensive operations involved in the process.

In the US alone, there is a trillion dollars of cash value. We want to take advantage of it.

Inclined's initial focus is on the current lending market which is $150 billion.

Shaw said that they believe they can increase the lending rate.

Inclined had a Series A financing that included participation from Anthemis Group. Since its founding in 2020, the startup has raised $19 million.

Shaw said that the Series A was raised in the most brutal environment he had ever experienced.

He said that their business is a countercyclical one and that it's very safe. People need access to these loans. It is the right time for us to grow and make a difference.

Term life insurance policies only pay for coverage, whereas whole life insurance policies accumulate value over time. Shaw compares it to buying a home.

He says that when whole life policyholders want to access their cash value, they prefer to use a loan rather than withdraw the money directly.

Inclined opens up the option to borrow against whole life insurance policies to more people, something that has historically been reserved for the wealthy, as well as giving banks a way to better participate in the market at scale. Shaw said that banks often have lower interest rates than insurance companies. Their money can be grown over time.

Shaw said that they can realize 10 times more value from their life insurance.

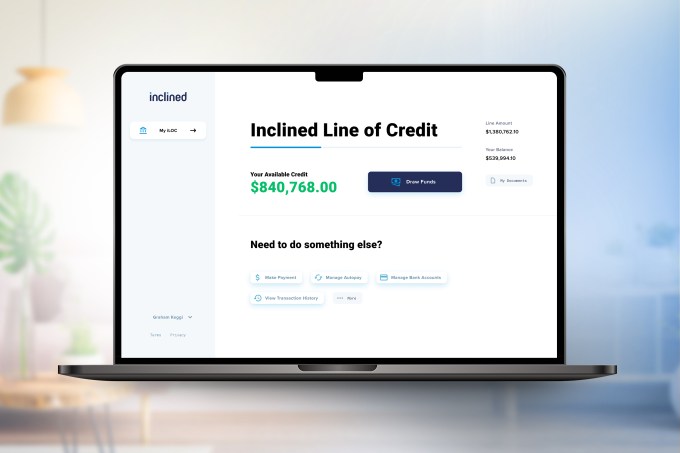

The image is called Inclined.

Inclined is live with a large bank. It has millions of dollars on its platform.

In a single digitally-enabled financial transaction, Inclined engages four distinct but important constituents: insurance companies, agents/brokers, lenders and banks.

Singhal wrote that the financial transaction delivered immediate value to the ultimate customer, but also provided very aligned and equally important value to all the other constituents. Financial democracy is at its best. Refinancing existing policy loans has been going on for a while, but it hasn't always been accessible to everyone, and a digitally enabled solution unlocks the ability for everyone to benefit.

Inclined's offering is just the beginning, according to his firm.

Singhal said that the entire market can benefit from banking products that are built with it as the basis.

I launched my weekly newsletter on May 1st. It will be in your inbox if you sign up here.