The amount of time investors spend looking at pitch decks is going to go down. You have less than 3 minutes to convince them to meet with you. For decks that fail to raise funding, investors give up in less than two minutes. You have to make it count because there is not much time to make a first impression.

It's rare that I get to talk to someone who is as big of a pitch deck nerd as I am, but I was finally able to nerd out with the research lead at Doc Send. The data tells us what makes a pitch deck successful and what doesn't.

The biggest change in the way investors look at pitch decks is that they are spending less time on slides overall, but more time on different parts of the deck

We know that investors are not spending as much time on their pitches. It is unsurprising that the number of links to pitch decks sent out has gone up, and the time spent on decks is not increasing. The product and business model sections of decks are where investors like to lean in for companies at the early stages. At the pre-seed level, investors spend less time on these sections. These sections are still being looked at by investors, but they are doing it more quickly than before. It's important for founders to think about their business but not communicate.

The "Why are you doing this" part of the story is what investors spend a lot more time on.

Izzo says that founders have to think deeply about their business but communicate briefly. It isn't easy to do, but it's what the founders should be aiming for.

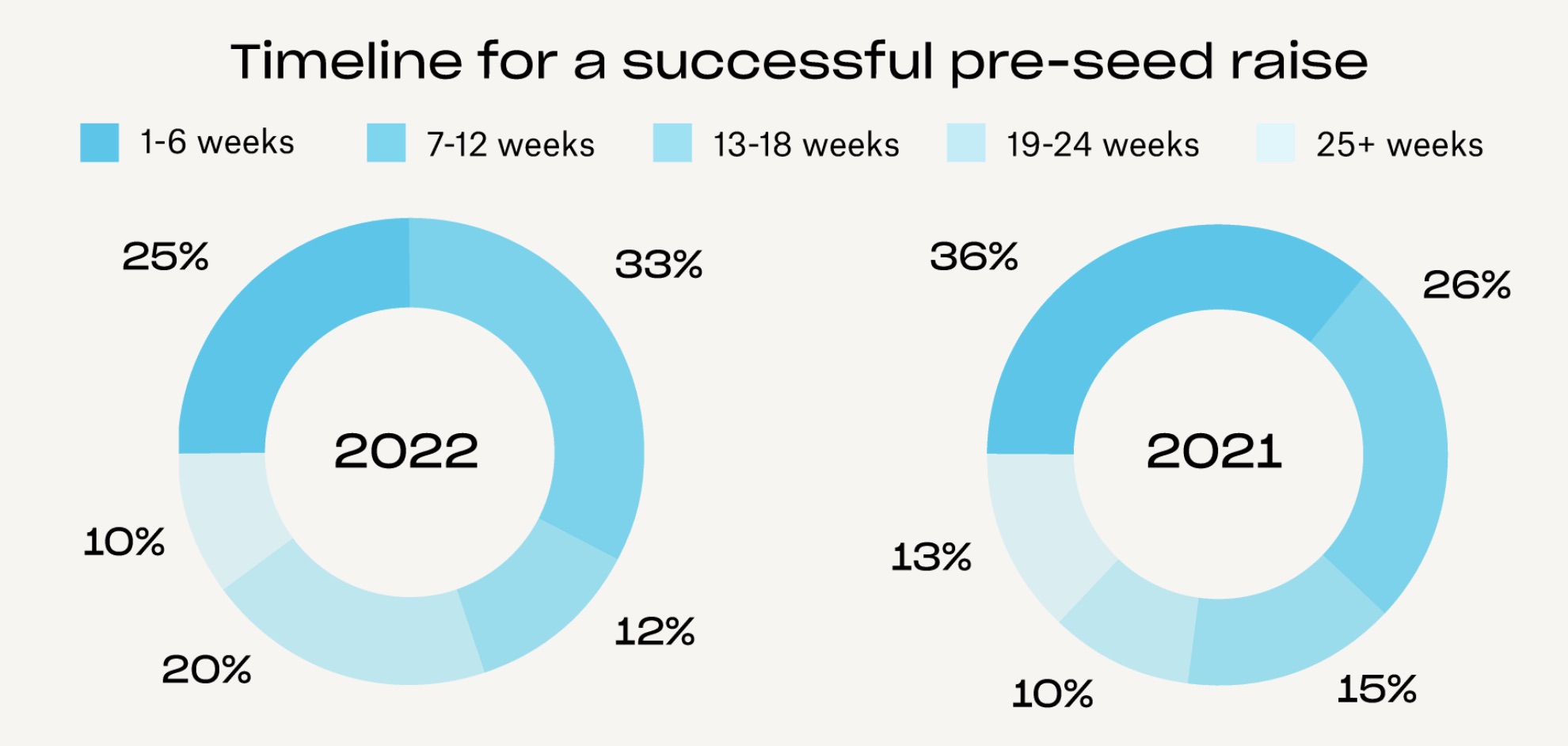

There is a different timeline to raising money. 25% of startup raised in less than six weeks, 42% raised in less than 12 weeks, 70% raised in less than 18 weeks, and 10% raised in less than 24 weeks. The pace wasn't as fast last year. There is a graph credit for Doc Send.

The third-longest-viewed section is the Company Purpose section, which is usually only a small part of the slide deck.

It is usually a pointed and well-balanced statement of what the company is. The front of the deck is where we usually see that. It was shocking to see that over the past couple of years, it had been kind of mediocre in terms of viewing time. The section shot up this year and investors tend to use it as a kind of gateway. They would like to know if this company has a reason to exist before they go through the rest of the deck.

It makes a lot of sense that a business purpose statement is often called Venmo for Fundraising, or Issue- tracking for Physical Product Developers. Those are all examples from our series. Those statements can be used by investors to see if the investment is a good fit for their investment thesis. If you don't care about customer support, if you don't invest in software as a service, or if you don't care about technology, you can give a startup team a "no".

Your investor has an investment thesis. Here’s why you should care

Whether a company can communicate a vision and specificity in a compelling way is up to the founder. "If you can do that, you're hooking investors, you're showing that there is this thesis fit, and then that gets investors ready to read the rest of their story." It's difficult to do in a sentence or a half. It is becoming more important for early-stage entrepreneurs.

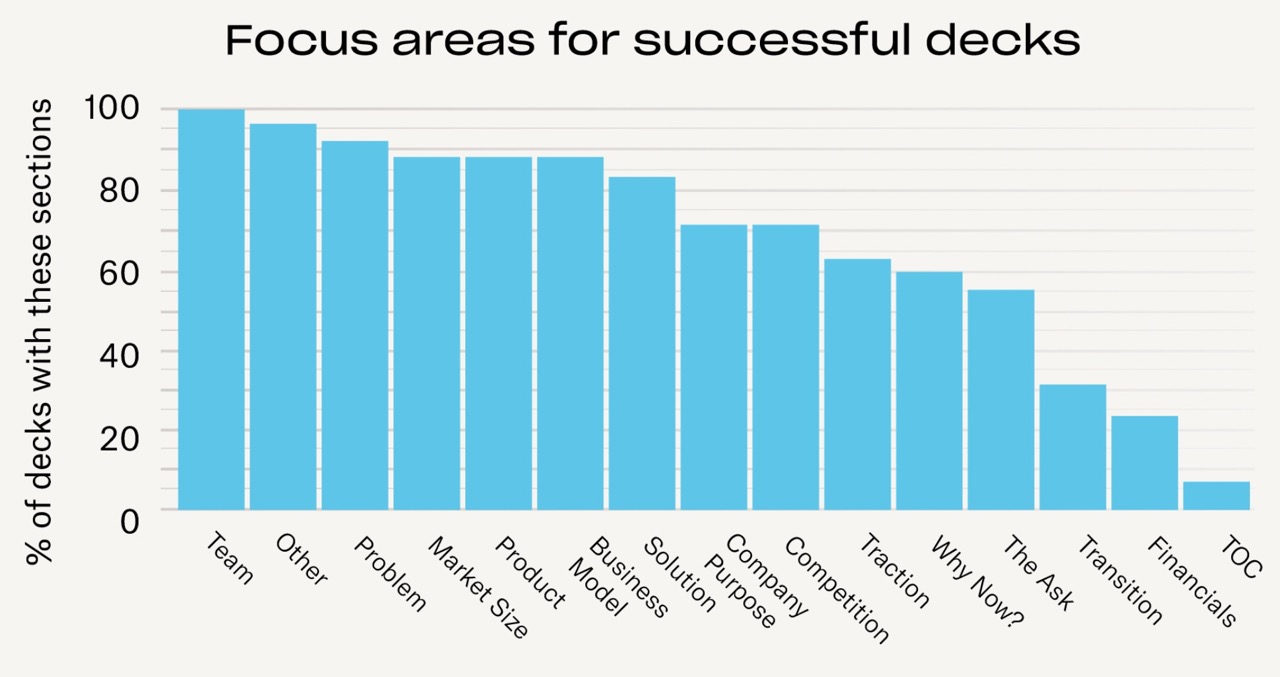

The team looked at which slides were in each deck. Team was the only slide that was available in all of the decks.

The decks were successful. There is a graph credit for Doc Send.

I was surprised that only a quarter of the startup decks had financials, but I was not surprised that no of the failed decks had financials.

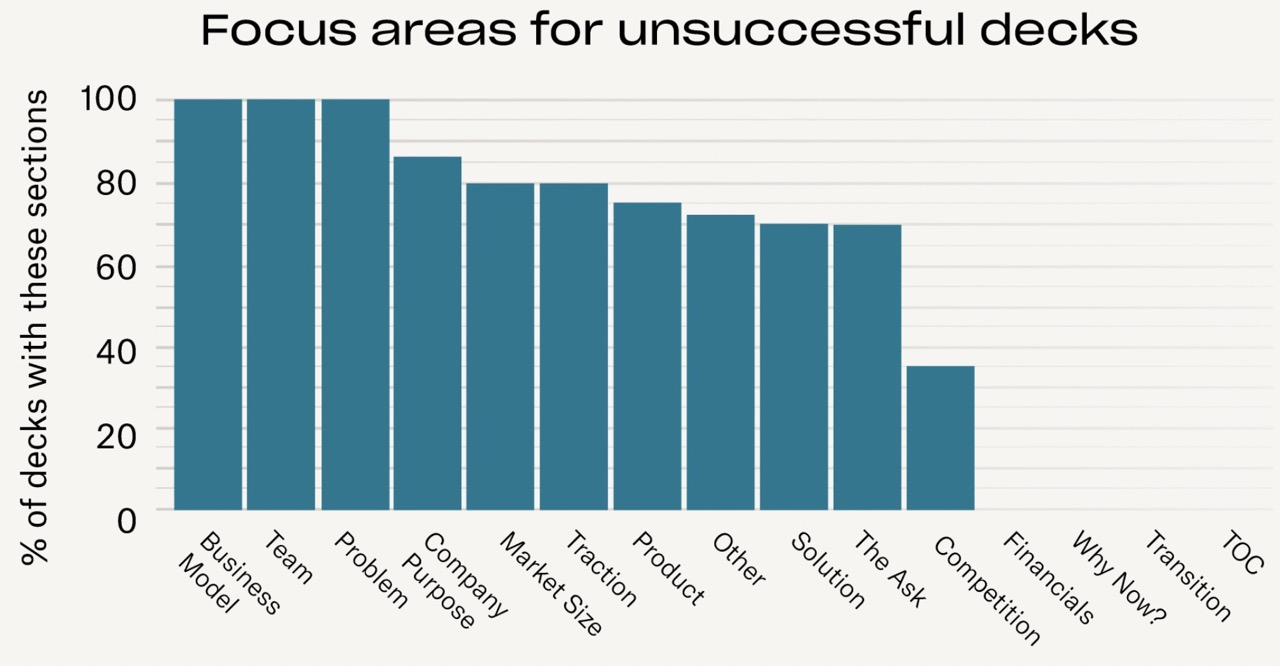

There are slides in failed decks. There is a graph credit for Doc Send.

All decks should have an overview of the competitive landscape.

Competition slides are the first thing that is missing. When founders include it, they use it as an indicator that there is no competition. I always tell them to include some type of analysis of other players in the field.

A state of the union report for fundraising, created by DocSend, compares the shifts from 2021. to 2022, which makes for a fascinating in-depth read to inform how you are looking at your fundraising process.

Everything you need to know to make a great startup pitch deck