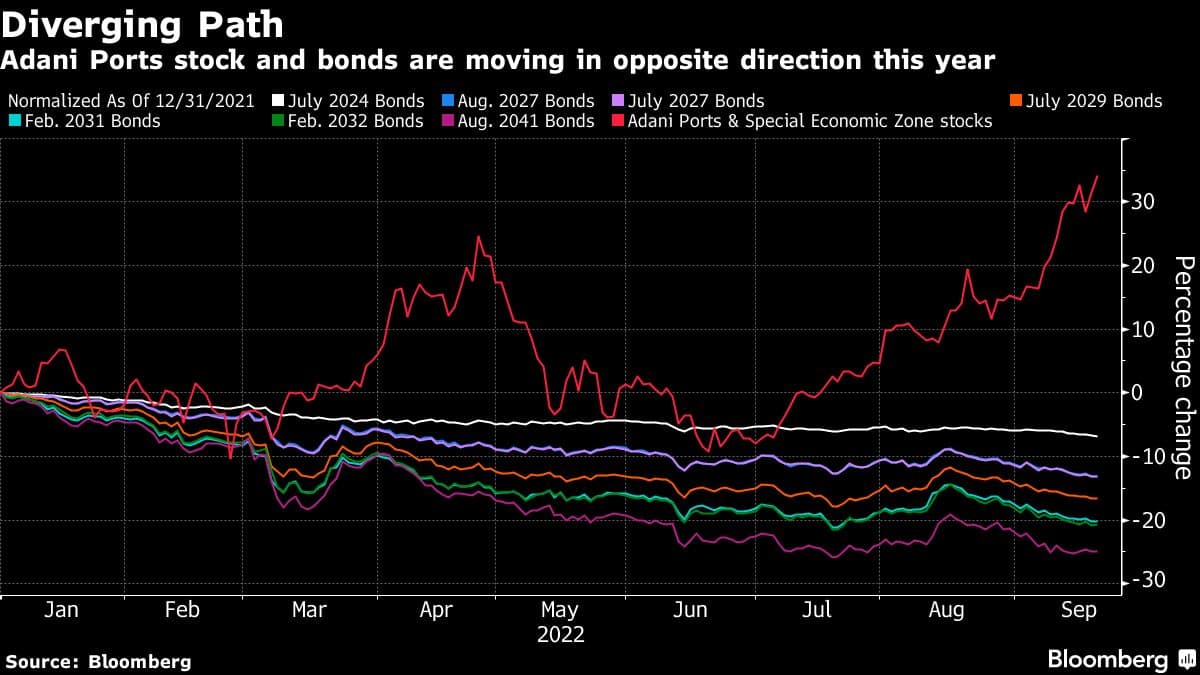

The share prices of Adani's companies have helped him become the second richest person in the world. The bond market is a bit less enthusiastic.

His Indian business empire has seen its stock prices rise in part due to soaring energy prices. In the past two years, shares in some of his other companies have surged more than 1,000%.

Adani Ports' dollar bonds have dropped more than Indian peers on concern about the group's debt, and its notes have fallen to an all-time low. The bonds of group companies did not perform as well as the Indian market.

The moves suggest that high debt poses risks to Adani's success story that saw his net worth go up to trail only Musk's.

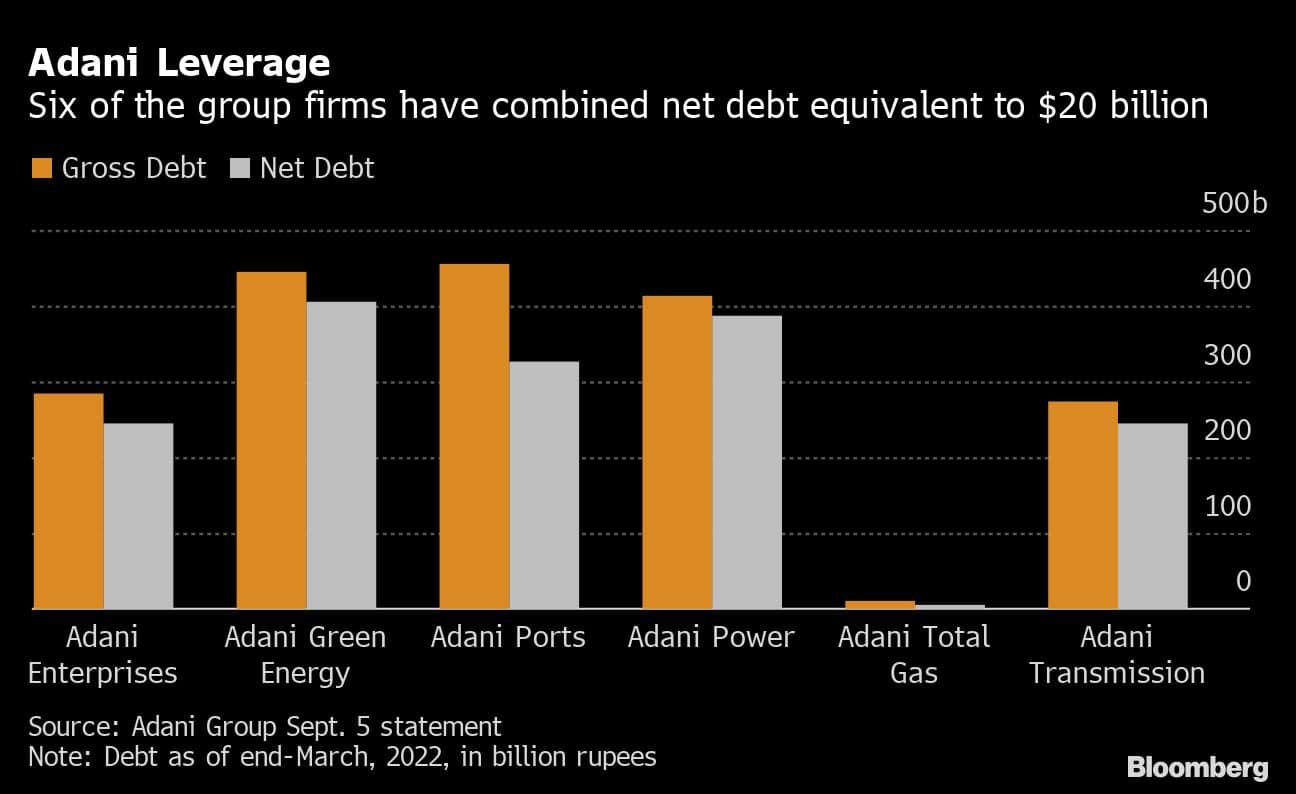

The conglomerate has a lot of leverage due to its rapid expansion into areas such as renewable energy and media.

According to an independent research analyst based in Mumbai, equity investors are bidding up the shares, giving a premium for the steep growth targets in place. The debt holders are concerned about the high leverage.

When asked about the performance of its dollar bonds, Adani Group didn't say anything. In the past, the conglomerate has downplayed concerns about the high debt levels, saying that its credit metrics have improved in the past few years.

The seven dollar-denominated notes of Adani Ports have lost about 14 percent of their value so far this year, while the notes of Adani Electricity Mumbai and Adani Transmission Step-One have lost more than 12 percent each. That surpasses a 10% decline for Indian dollar debt as rising borrowing costs in the US drag down the region's dollar debt.

Even though they've lost money, not all Adani bonds have performed worse than the market as a whole. The securities of Adani Green Energy and Adani Ports fell in the same year.

The recent run of investments by Adani includes a plan to inject 200 billion rupee ($ 2.5 billion) into a cement firm that he acquired to bolster his infrastructure empire.

There is a visible path for debt to increase, but a less transparent path for growth in the future, according to a note written by analysts.

The Adani Group says it has improved its debt metrics over the past decade with its portfolio companies now healthy and in line with their industries.

At the end of March, the group's total debt stood at 456.4 billion rupee. It would be the highest in at least a decade.

Future potential big-ticket acquisitions by the company could damage its credit profile if they are largely debt-funded, and its leverage ratio of pro-forma net debt to earnings before interest, taxes, depreciation and amortization could increase past the current 4 times.

Growth prospects are important for share investors. In a report this month, analysts from Citigroup pointed out that Adani Ports had increased its dominance in India's port sector.

The leading market position and strong financial management of Adani Ports could bolster its balance sheet against short-term volume setbacks and it may be able to maintain capital spending and dividends.

Bullishness toward Adani Ports has resulted in its stock trading at 25 times its one-year forward profit, making it among the most richly valued port stocks in Asia, according to Bloomberg-compiled data.