The Bank of Japan stood by its ultralow interest rates just hours after the Federal Reserve raised its benchmark rate for the first time in nearly a decade.

The yield curve control program and asset purchases were not changed. The decision was made about nine hours after the Fed raised rates. All 49 economists predicted the decision of the BoJ.

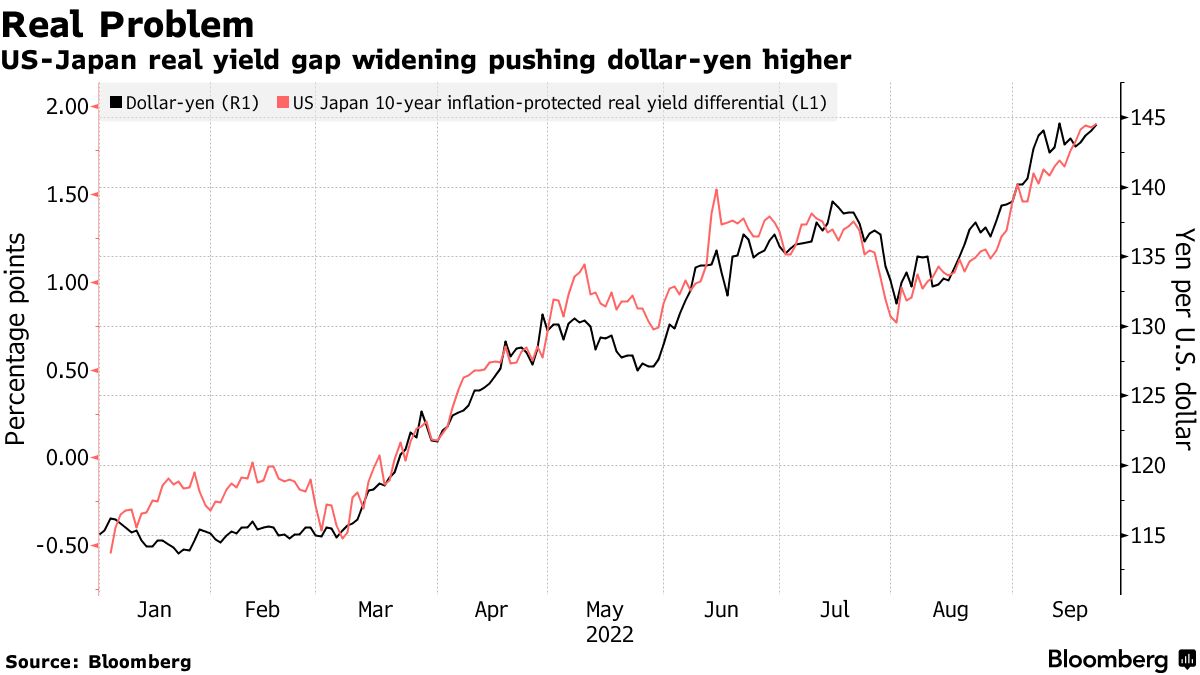

Immediately after the decision, the currency hit a high of 146 against the dollar.

The central bank decided to phase out its Covid funding program in a sign that it's still worried about the recovery from the swine flu. The entire program was ended at the meeting.

There is still a long way to go before Japanese policy can be normalized. The possibility of rates going lower, not higher, is still being flagged by the Bank of Japan.

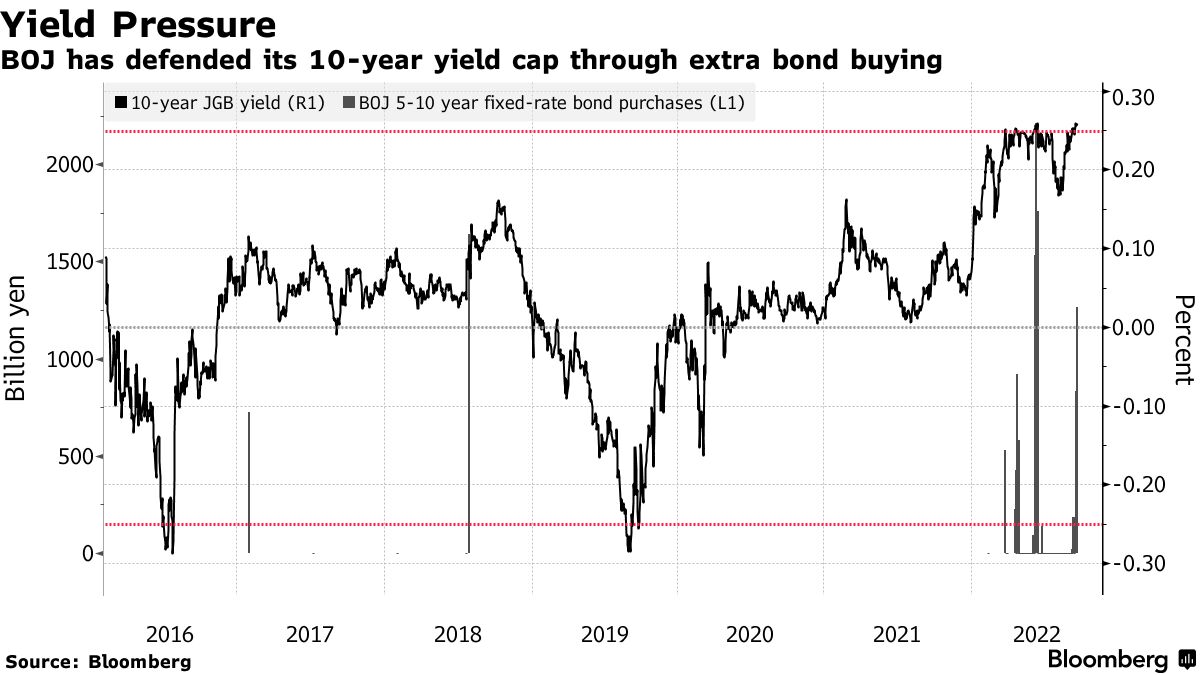

With little more than six months left in his decade-long run in the top job, the governor seems determined to stick to his task of achieving stable inflation, even as that stance fuels the rapid fall of the Japanese currency and forces the bank to buy more bonds to defend its cap on yields

The long-held stance of the BoJ hasn't changed. According to Harumi Taguchi, principal economist at S&P Global Market Intelligence, if they shift on policy there will be more of a negative impact than a positive one. They think that the impact of energy prices will start to fade out after the fiscal year ends.

After the decision, the yield on 10-year government debt fell below the cap. The yield cap is likely to remain under pressure as global rate hikes continue.

The Bank of England, the Norges Bank and the Swiss National Bank are all expected to raise rates on Thursday.

The Bank of Japan is the last major central bank in the world with a negative interest rate.

The Bank of Japan kept its forward guidance on keeping rates low or lower and repeated its commitment not to hesitate to add easing if necessary while watching the economic impact of the swine flu.

The central bank is still concerned about the continued stress on smaller firms despite the fact that parts of its Covid-funding program have been extended.

The recent rise in prices has made it difficult for smaller firms. They haven't been able to pass on those costs to consumers. I think it's a reasonable response from the BoJ.

There was a gathering after a series of warnings from Japan's top officials. The finance minister mentioned the possibility of swift currency intervention after the currency hit 144.99. Market rates were checked by the central bank, which is seen as a step towards an intervention.

There is no chance of policy adjustments being made to stop the slide of the Japanese currency. He said the economy needs monetaryStimulus until higher wage gains can make the cost push sustainable.

The cap on long-term bond yields and the short-term interest rate are not going to change. The central bank has spent over 20 billion dollars on bonds in the last five days.

While the daily purchases have been required again after a lull of more than two months, that amount is less than half the amount the central bank spent in five days up to its June decision.

The unchanging message of Kuroda has convinced an overwhelming majority of economists that there will be no change in policy before he leaves office on April 8.

Political pressure could be a game-changing factor in monetary policy. The next central bank chief and two deputy governors will be chosen by the Prime Minister, making it hard for the bank to refuse government requests.

(Adds economist comments)