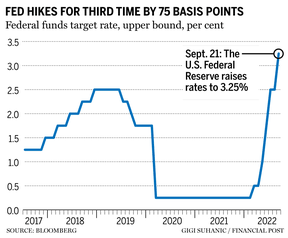

The Federal Reserve raised interest rates by 75 basis points for the third time in a row, signalling more hikes to come.

He told a press conference in Washington on Wednesday that the policy stance would be to return inflation to 2%.

The Financial Post is part of Postmedia Network Inc. There was an issue with signing you up. Try again.

By the end of this year, officials expect rates to rise to 4.5 per cent, which is more than they had anticipated. There is a chance of a 75 basis-point hike in November, about a week before the elections.

Powell said that officials were determined to bring inflation down to the Fed's two per cent goal and that "we will keep at it until the job is done." The title of the memoir was " Keeping at It."

Policy makers now think the key rate will rise to 4.5 per cent by the end of the year and to 4.6 per cent by the end of the decade.

In the years to come, rates were expected to fall to 3.8 per cent in 2024 and to 2.9 per cent in 25 years.

The two-year Treasury yield jumped above 4%. The dollar index hit a new record high as the S&P 500 index plummeted.

The funds rate is now expected to end the year at 4.31 per cent, up from 4.22 per cent before the meeting.

The Fed is determined to cool inflation despite the risk that rising borrowing costs could tip the U.S. into recession.

Powell and his colleagues were slammed for a slow initial response to escalating price pressures and are now delivering the most aggressive policy tightening since the Fed under Volcker four decades ago.

Unemployment is projected to rise to 4.4 per cent by the end of next year and 4.1 per cent by the end of the year in the updated forecasts.

Estimates for economic growth in the next two years were marked down due to tighter monetary policy.

The 12-month change in the U.S. consumer price index shows the rate of inflation. Fed officials had hoped that it would come down as quickly as possible.

The unemployment rate is still below what most Fed officials consider to be sustainable in the long run, and job growth has remained robust.

The tightening path at the U.S. central bank has been made more aggressive by the failure of the labour market to weaken.

Against the backdrop of tightening by other central banks, the Fed is taking action. Half of the 90 people who have raised interest rates this year have hiked by 75 basis points or more.

There is a website calledBloomberg.com.