The US central bank has raised interest rates for the first time in 15 years as it fights to rein in soaring prices in the world's largest economy.

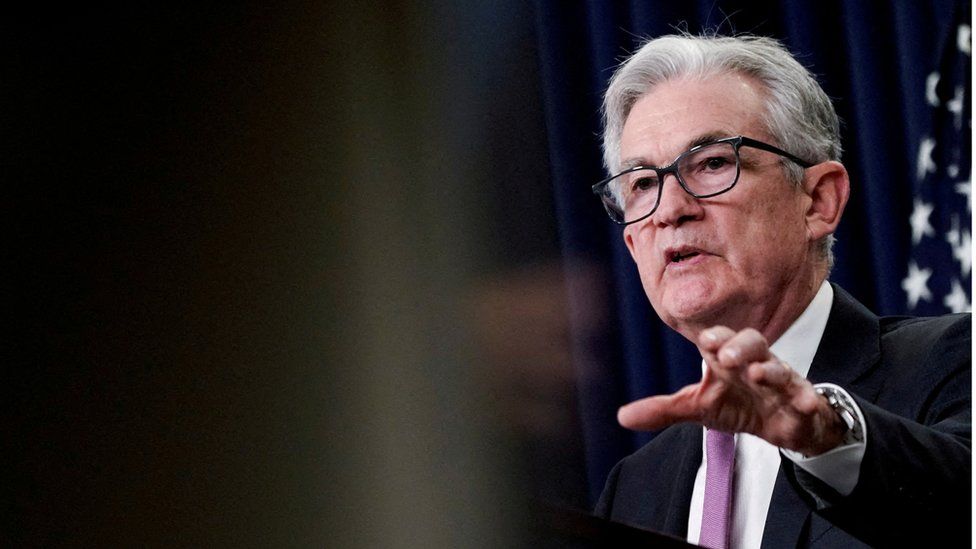

The Federal Reserve raised its key rate by 0.75 percentage points to 2.5%.

The bank expects borrowing costs to remain high.

The cost of controlling inflation could be a big problem for the economy in the future.

Powell has said that the rate rises are necessary to slow demand in order to avoid damage to the economy.

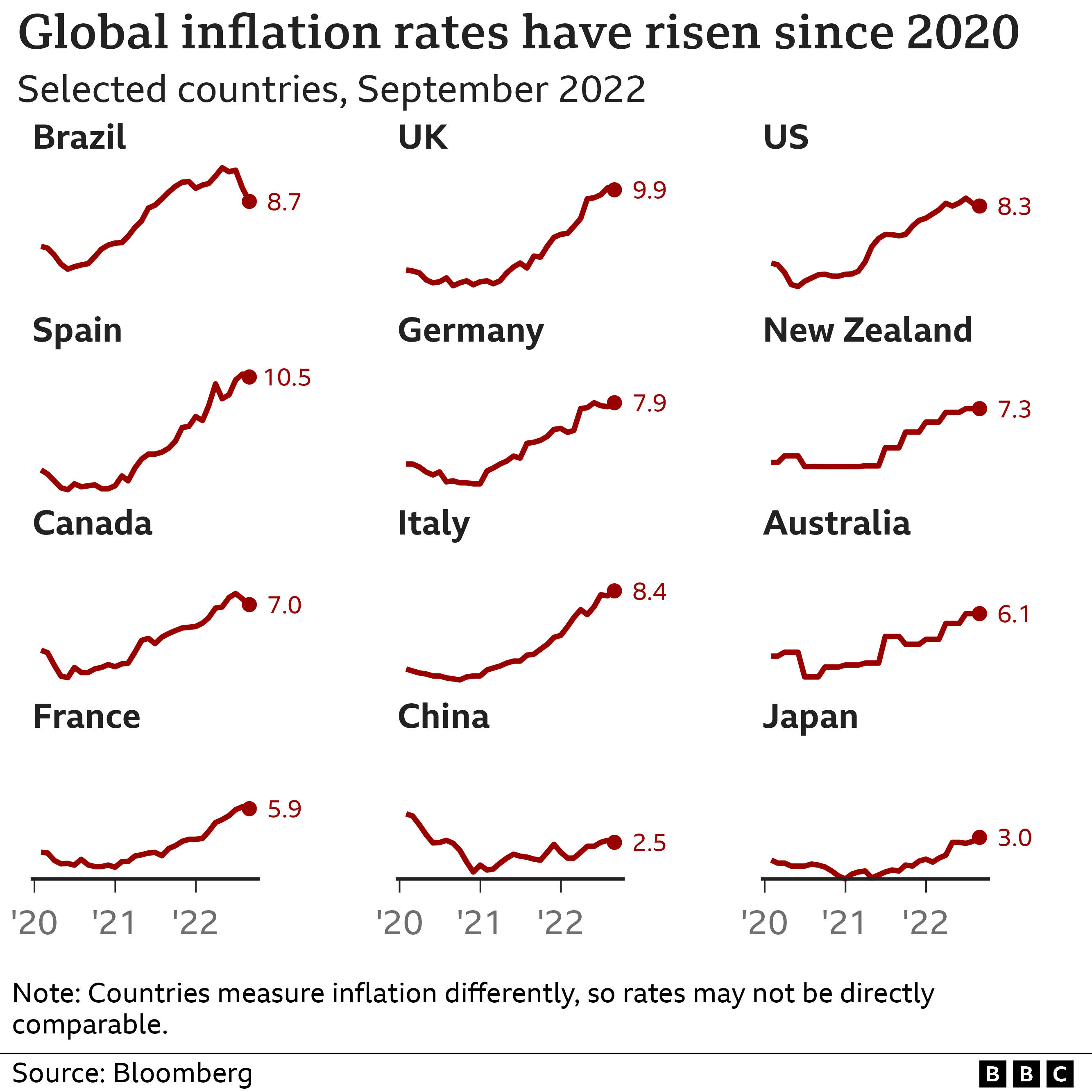

In almost every country, banks are taking the same steps as they wrestle with their own inflation problems.

The Bank of England is expected to raise its rate for the seventh time in a row on Thursday, while Indonesia and the Philippines are also expected to do the same.

Analysts are starting to worry that the rate hikes could lead to a bigger economic downturn than policymakers think.

The synchronised nature of the tightening could make it more powerful.

After years of low borrowing costs, the Fed is raising rates at one of the fastest rates in its history.

The rate the Fed charges banks to borrow from near zero at the beginning of the year was 3% on Wednesday for the first time since early 2008.

According to forecasts released by the Fed on Wednesday, policymakers expect it to reach 4.4% by the end of the year and then go up to 4.6% in the years to come.

The speed is striking. It is more likely to be a surprise to firms and households because they are having to move very quickly.

Sean V bought a two-bedroom condo in New York last year and locked in a mortgage rate of 2.5%.

The 30-year-old works in the home loan industry, which has seen business plunge as mortgage rates increase.

He was cutting back on spending and holiday plans because he was worried about losing his job.

He said he didn't know what the future would hold. It's not just on me but on everyone.

I don't know how the economy is being held up.

By raising borrowing costs for businesses and households, central banks intend to reduce demand for big-ticket items like cars, homes or business expansions, which should ease the pressures on prices.

Less economic activity leads to job losses and other economic pain.

Ben May, director of global macro research at Oxford Economics, said that the world economy is expected to be at its weakest in more than a decade if it avoids two quarters of contraction.

The choice between allowing inflation to remain high for a sustained period or pushing the economy into a recession is what has become clear.

Growth in the US is expected to slow to a crawl this year according to forecasts by the Fed. They think the unemployment rate will go up to 4.4% next year.

Inflation won't return to the bank's 2% target until 25 years from now.

Many analysts are forecasting a recession in the US next year but are hopeful that it will be mild because household finances are in better shape than in previous downturns.

At a congressional hearing on Wednesday, Jamie Dimon, the boss of JP Morgan Chase, said the war in Ukraine and concerns about energy supplies raised the risks.

There is a chance of a soft landing, but there is also a chance of a hard recession. There is a chance that the global energy supply and food supply could be worse because of the war inUkraine. Policymakers should be prepared for the worst.