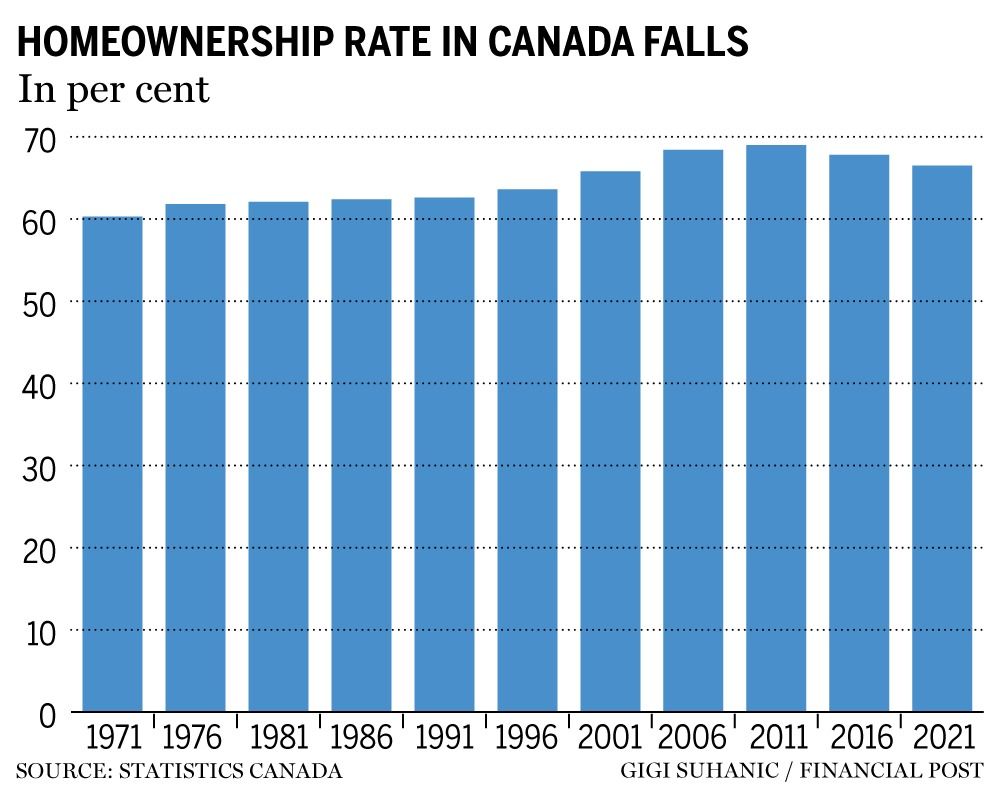

The homeownership rate in Canada has fallen after peaking in 2011.

Statistics Canada said in a release Wednesday that the country's homeownership rate has fallen to 66.5 per cent from 69 per cent in 2011.

The agency said that trying to figure out the right time to buy is a difficult decision that can leave Canadians wondering if they even want to.

The Financial Post is part of Postmedia Network Inc. There was an issue with signing you up. Try again.

Home prices have gone up to such levels that even a correction may not be enough for most Canadians to enter the market.

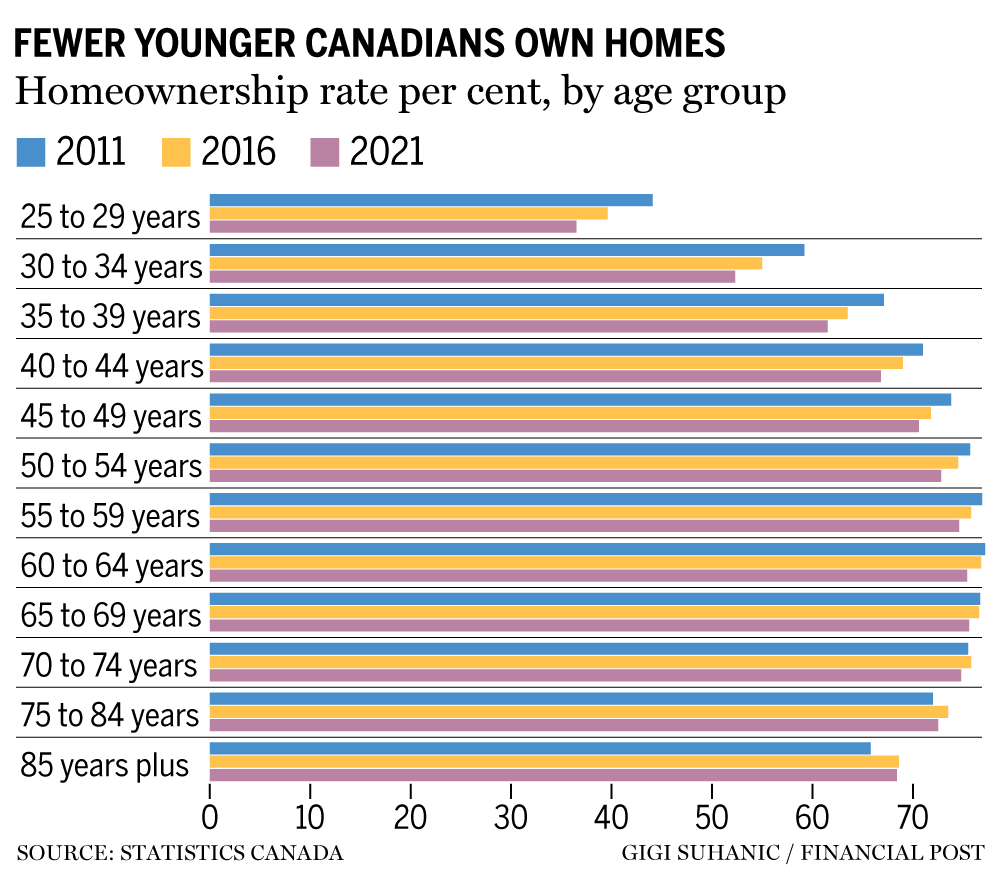

The Portrait of Housing in Canada report shows that people under the age of 75 are less likely to own a home in the future.

The growth of renter households has doubled the growth of owner households. The agency said renter households grew at a faster rate than homeowners.

According to reports by the National Bank of Canada and Royal Bank of Canada, housing is still at its most expensive level in 30 years.

According to Statistics Canada, the number of households that spent more than 30 per cent of their income on housing declined.

Most of the decline in the rate of affordable housing for renters can be attributed to renters earning less than the median household income.

According to Statistics Canada, Canadians had higher incomes in order to make housing more affordable.

Income inequality increased in the first quarter of 2022, despite broad-based increases in wages and salaries.

The city dwellers had high housing costs. In 33 of 42 large urban downtowns, the percentage of renters spending more than 30 percent of their income on shelter costs was higher than the national average.

The largest share of dwellings built in the last five years were occupied by people under the age of 30. The largest share of condominiums were occupied by people who were younger than 30 years old.

Since Statistics Canada collected the data, Canadian housing starts have fallen. There was a decline in the number of units in August compared to the previous month.

Even though rates went down, residents of Atlantic Canada were still the most likely to be homeowners. The biggest declines in the country were in Prince Edward Island and Nova Scotia.

British Columbia had the third-largest decline in homeownership, which was down to 66.8% from 70%.

The homeownership rate in Quebec was the lowest in Canada, even though it had the smallest drop. There was only one increase in the Northwest Territories.

Shcampbell@postmedia is the email address.