Wall Street banks are poised to realize $600 million of losses, the culmination of months of work to try and mitigate the damage from pledge made early in the year before a sharp repricing of risk assets.

A group of banks led by Bank of America led the way in finding enough demand to sell $8.55 billion of debt.

Had they tried to sell the entire financing package to money managers, the damage would have been much worse. Banks are keeping a large amount of risk on their balance sheets for what is likely to be a long period.

Market participants familiar with the deal are to blame for the losses. The final losses are dependent on how much flexibility the banks received in the original underwriting commitments and the fees they were originally expected to earn on the deal.

Representatives for the lead banks on the debt declined to speak. More than 30 banks and other firms were involved in the deal.

The secured bond portion of the financing was priced at a discount of 83.6 cents on the dollar for an all-in yield of 10%. According to the people, who asked not to be identified discussing a private transaction, losses exceed $500 million after accounting for the fees that banks typically receive.

The euro- denominated loan equivalent in size to $500 million was sold at a discounted price of 92 cents on the dollar. Banks typically have some flexibility on the discount they can offer, but at 91 this would have exceeded that level. There were losses on this portion of the deal, according to people familiar with the situation.

It was a coup for the underwriters to get in on the debt financing for the acquisition of Citrix. It was a large package.

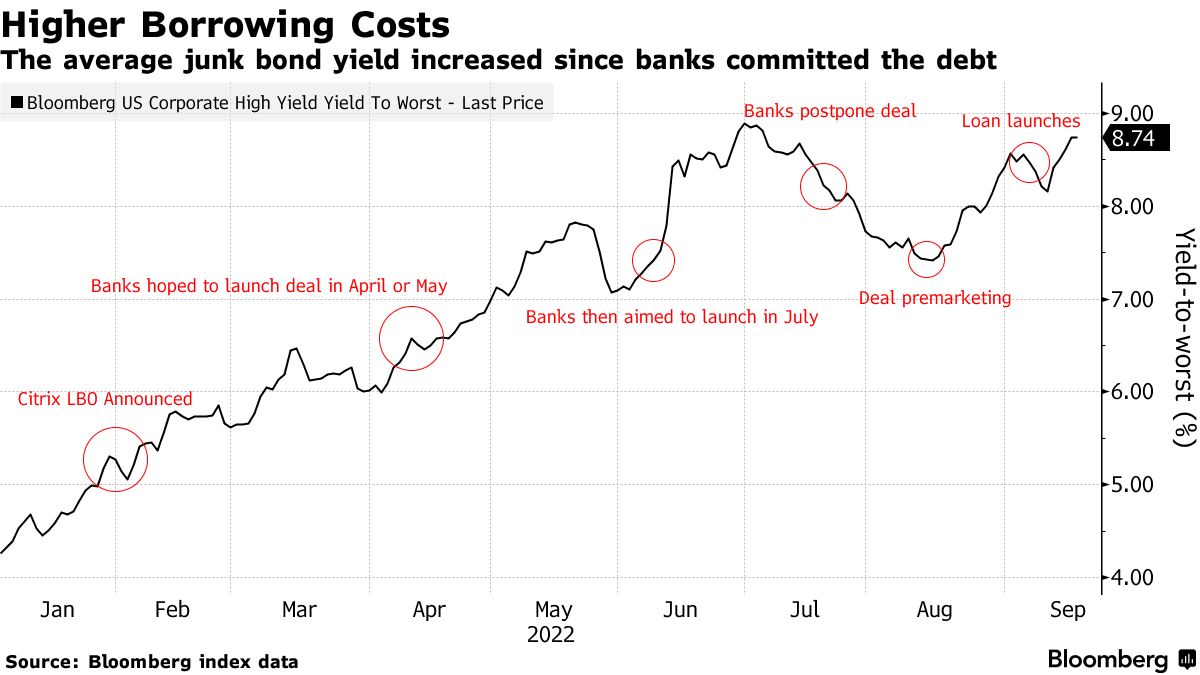

The market turned because of Russia's invasion of Ukraine, inflation, interest rates, and recession fears.

The banks spent months trying to get people to buy. The debt sale was supposed to start in April or May, but it didn't happen. After the US Labor Day holiday, the banks decided to wait.

They began pre-marketing the debt deal in August with a fresh structure in an effort to get investors interested before the formal launch and decided to hold a portion of the loan on their balance sheets.

Wall Street faces billions of dollars in losses due to sinking buyout debt.

At higher yields than the banks were hoping for, investors are comfortable with pricing risk. He said that high leverage, add-backs on earnings, and egregious covenants made it difficult to complete the deal.

Banks will lick their wounds and move on.

There are no lessons learned. This has happened many times. Something bad is going to happen because banks are going to aggressively underwrite deals.

The banks were aware of the pain that would be caused by Citrix and other similar commitments. In the second quarter, six major US banks recorded more than a billion dollars of paper losses on these types of loans.

The banks aim to move debt commitments quickly so they can use that capacity to do the next deal and make money, but keeping 40% of the financing package on their books is a double-edged sword. They can't fund new acquisitions if their balance sheets are not in good shape. Capital requirements are also present for holding the risk.

The banks have the ability to clip the hefty coupons. If the market improves, they will try and sell this debt.

As borrowing costs continue to rise, the rocky marketing process could make other debt financings more difficult for banks.

The $8.35 billion of bonds and loans for the acquisition of the TV ratings company was the first transaction to be launched.

Even if banks are able to distribute the financings, it's not certain if higher funding costs will deter private equity firms from doing new deals.

At a conference last week, Apollo Global Management Inc.'s co-head of private equity David Sambur said that even the successful financing of the Citrix debt package won't be enough to convince banks to commit to funding the next wave of private equity deals. He said banks are unlikely to finance big deals until the fourth quarter because of economic uncertainty.

DavideScigliuzzo and Crystal Tse assisted.