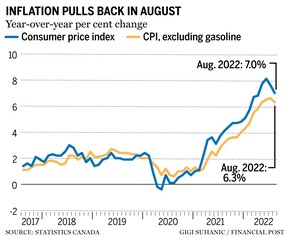

Canada's headline inflation rate cooled for the second month in a row in August, running at an annual rate of 7.0 per cent, lower than expectations of 7.3 per cent and down from July's reading of 7.6 per cent.

The decline in the consumer price index was the largest since the beginning of the COVID-19 Pandemic.

The Financial Post is part of Postmedia Network Inc. There was an issue with signing you up. Try again.

Lower gasoline prices resulted in the biggest monthly decline since April 2020. The price of gasoline fell the most in the two provinces. The price of gasoline has gone up more than last year.

Excluding gasoline, prices were down from a July increase.

Travel and accommodations costs are increasing at a slower rate.

Extreme weather, higher input costs, and the disruption of supply chains caused by Russia's invasion of Ukraine drove the price of groceries to the fastest pace in 33 years.

The prices of meat, dairy, baked goods, and fresh fruit have gone up.

The three core measures of inflation, which the Bank of Canada watches closely, are still a long way from the Bank's 2 percent target.

The annual rate of inflation is still well above the Bank of Canada's target even after today's deceleration.

There is a clearer gap between Canadian and U.S. inflation trends, which should lead to a lower peak from the Bank of Canada.

There will be more to come.

The email address is shughes@postmedia.