Since the merger of the ethereum network, ether has fallen more than bitcoin.

Developers are able to build apps on top of the ethereum technology. The native currency of the world is ether.

The validation mechanism for transactions from a proof-of-work method to proof-of-stake has been changed. Proponents say this will make transactions on the platform more energy efficient.

ether has fallen more than bitcoins despite the upgrade happening well.

ether is down 15% since the day the merger was completed. In the same period, the price of the digital currency has fallen.

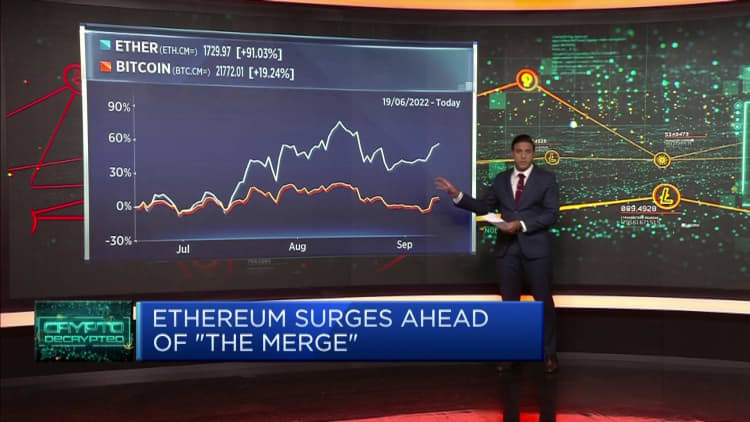

The price of ether doubled from the lows of the year in June, far outdistancing the gains of bitcoin.

The actual event was a "sell the news" situation according to the vice president of corporate development at Luno.

According to Ayyar, traders are shifting investments from ether and other alternative digital coins back into bitcoin since they expect it to perform better in the near term.

Gary Gensler, chair of the Securities and Exchange Commission, said last week that cryptocurrencies that work on the proof-of-stake model could be classified as security. It would be under the control of the regulators.

Gensler did not mention ether in his comments. The proof-of-stake model requires investors to take or lock up their ether and earn returns for doing so.

According to Yuya Hasegawa of Bitbank, PoS may fall under SEC's scrutiny.

The US Federal Reserve is expected to raise interest rates this week.

The world's central banks have raised interest rates to fight inflation. That has hurt the stock market. The stock markets in the U.S. have a close relationship with Cryptocurrencies. The stock market has felt the heat.

The inflation in the U.S. came in higher than expected, which hit the stock market.

Ayyar said that inflation caused a sell off across all markets, but ethereum and altcoins sold off harder due to their riskier nature.

Ayyar says that since June, the price of the digital currency has ranged from $18,000 to $25,000.

He said that a change in the macro environment in terms of inflation of interest rate surprises is cause for concern.