The housing, labour, and consumption conditions are all pointing to a slowing economy.

There is a person named Dennis Paglinawan.

There are 8 comments on Sep 19, 2022.

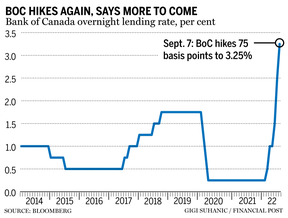

The signs of a recession in Canada are starting to pop up, and economists are not predicting a soft landing, but rather a bumpy one as the Bank of Canada continues its fight against inflation. Since March, the Bank of Canada has increased its key rate by 300 basis points, which will likely further hurt the housing market.

The Financial Post is part of Postmedia Network Inc. There was an issue with signing you up. Try again.

There has been a decline in listings and a drop in sales volume in Canada. The Canadian economy will be hurt by more rate hikes, which will push residential investment to contract and weigh on the economy. He said that there will be continued weakness on the price side going forward. He said this will push the economy into a recession in the first half of next year.

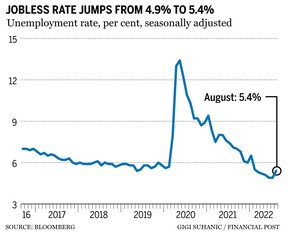

Unemployment rates are still low and the labour market is strong. According to economists at Royal Bank of Canada, this strength won't prevent a downturn. The unemployment rate in Canada rose to 5.4 per cent in August, and is expected to go up as the economy gets worse. The year ahead is expected to bring recessions for Canada, the United States, the Euro area, and the United Kingdom, according to a note from the team at Royal Bank of Canada. The coming downturn in Canada is expected to be moderate.

Although households have accumulated excess savings, they will feel less wealthy as house prices fall and borrowing costs rise, and will be less likely to spend from this cash pile, according to economists at the Royal Bank of Canada. The government's removal of benefits will cause consumer consumption to fall, according to an economist. He said in a column for the Financial Post that the drag on household income is going to be even worse because of the downward pressure on organic income from stagnant job creation. He said that the Canadian recession outcome is all but set in stone because of the negative wealth effect from falling home prices and equity markets.

FedEx issued a profit warning on Friday and withdrew its earnings forecast for the next two years. The package delivery giant is signalling that consumers are saving money as prices go up. A quick drop in the number of transactions is often a clear and up-to-date signal that the global economy is cooling very quickly.

In a report released Thursday, the World Bank said the global economy is in the midst of one of the most internationally synchronous episodes of monetary and fiscal policy tightening in the past five decades. With several countries withdrawing monetary and fiscal support to curb the risk of high inflation, which has risen to multi-decade highs in many countries, the World Bank said this could cause larger impacts than intended. The degree of policy tightening needed to achieve the desired disinflation should be communicated clearly by the central banks.

Dpaglinawan@postmedia.com and denise.pglnwn are email addresses.