Bears kept tight control over Dalal Street for a third consecutive session on September 16, pulling the benchmark indices down by 2% as expectations of aggressive policy tightening by the US Federal Reserve in upcoming policy meetings to tame inflation, rising US dollar & bond yields, FII selling and correction in IT

The Nifty50 plummeted 350 points to 17,531 and formed a bearish candlestick pattern on the daily charts. If you look at the trade of the last three days, you'll see that the market is bearish.

The positive momentum has weakened due to the RSI turning down and placing just below 60 mark.

On the other side, the Nifty has a strong support level of 17,480 and agap support of 17,380.

According to the overall chart pattern and indicator set up, Sawant feels that the Nifty will consolidate in the range of 17,700 to 17,700 for the short term.

The Nifty Midcap 100 index fell over 3% and the Smallcap 100 index fell over 2%.

You can spot profitable trades with 15 data points.

The OI and volume data of stocks in this article are not just of the current month, but of three months as well.

Support and resistance levels on the Nifty.

The key support level for the Nifty is 17,412. The key resistance levels to watch out for are 17,734 and 17,959.

The bank is called Nifty.

The Nifty bank lost 432 points and formed a bearish candle on the daily charts. The important pivot level is placed at 40,465. Key resistance levels are 41,125 and 41,474.

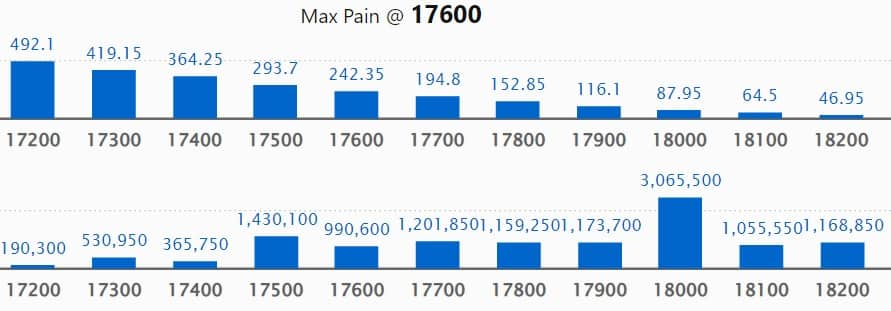

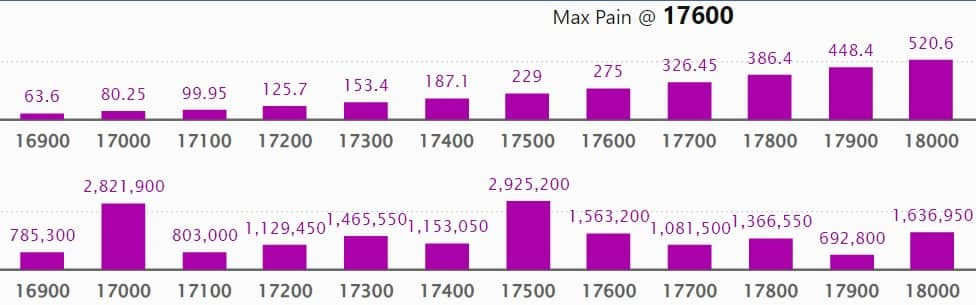

Call option data.

The 18,000 strike is a crucial resistance level in the September series.

There are two strikes, 18,500 and 19,000, which hold 21.49 lakh and 19 lakh contracts, respectively.

The 17,700 strike added 6.92 lakh contracts, followed by 17,800 strike which added 4.15 lakh contracts, and 17,600 strike which added 3.97 lakh contracts.

The 18,800 strike shed over five million contracts, followed by 18,900 strike which shed over one million contracts, and 19,000 strike which shed over one million contracts.

Put option data.

The maximum open interest of 35.72 lakh contracts is seen as a crucial support level in the September series.

There are two strikes, 17,500 and 17,000, which have accumulated 28.21 lakh contracts.

Put writing was seen at 17,600 strike, which added 5.63 million contracts, followed by 16,500 strike, which added 3 million contracts, and 17200 strike, which added 2.37 million contracts.

The 18,000 strike shed 4.9 million contracts, followed by the 17,900 strike which shed 3.4 million contracts, and the 18,100 strike which shed 1.82 million contracts.

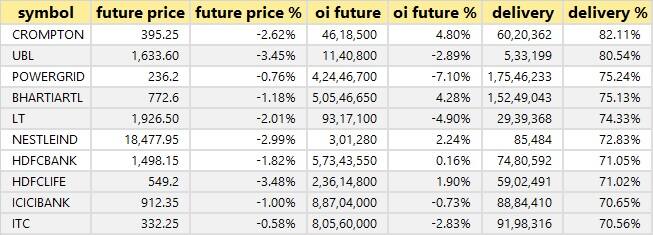

There is a high delivery percentage.

A high delivery percentage indicates that investors are interested in the stock. Among others, the highest delivery was seen in United Breweries, as well as in other companies.

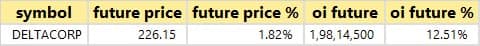

One stock had a long build up.

A build-up of long positions is usually indicated by an increase in open interest. The one stock that had a long build-up was Delta Corp.

There were over 100 stocks that saw long unwind.

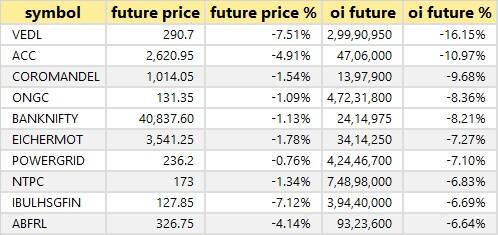

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Vedanta, ACC, Coromandel International, ONGC, and Bank Nifty, in which long unwinding was seen.

There were 78 stocks that saw short build up.

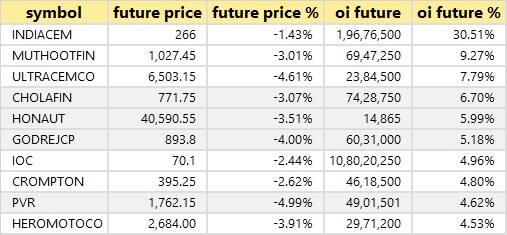

A build-up of short positions is usually caused by an increase in open interest and a decrease in price. The top 10 stocks in which a short build-up was seen include India Cements, Muthoot Finance, UltraTech Cement, and Cholamandalam Investment.

Four stocks saw short-covering.

A decrease in open interest is usually a sign of a short-covering. Based on the open interest future percentage, four stocks were seen as being short-covered.

There are bulk deals.

Integrated Core Strategies (Asia) sold 26,52,17 equity shares in Aptus Value Housing Finance at an average price of Rs 327.74 per share.

The Singapore-based investment company Integrated bought over 6 million shares in the company at an average price of Rs 890.23 per share.

The Vanguard Group Inc, an investment advisory firm based in the US, bought 27,29,411 equity shares of the company. Over 27 million shares were sold by Integrated Core Strategies (Asia) at an average price of Rs 490.64 per share.

The Vanguard Group Inc, an investment advisory firm based in the US, bought 5,61,350 shares of the company. An investment company based in Singapore sold 6,67,116 shares in the company at an average price of Rs 667.67 per share.

Click here for more deals.

The meetings on September 19 are for investors.

The officials of the company are going to meet several companies.

Prince Pipes and Fittings, Max healthcare institute, ONGC, Grasim industries, Tata Steel, Lemon Tree Hotels, Piramal Enterprises, Medplus Health Services, Macrotech Developers, IDFC First Bank, Ajanta pharma, Tech Mahindra,Info Edge

The company's officials are going to meet Kotak Securities.

The company will meet with B&K Securities and Omkara Capital.

Royal Orchid Hotels officials will talk to Ananta Capital.

The officials of the company are going to meet many people.

The officials of the company are going to meet the leader of the group.

The company's officials will meet with the asset management firm.

The officials of the bank are going to the virtual conference.

There are stocks in news.

The company has withdrawn its offer to delist. The delisting of the company's shares from the BSE and theNSE was approved by its shareholders in July 2020. Due to delay and commercial viability, the company is withdrawing its offer to delist from the exchanges.

The Adani Group has completed the acquisition of Ambuja Cements. This has made it the second largest cement player in India. The acquisition of Holcim's stake in the two entities was part of the deal. The Holcim stake is worth $6.50 billion. The CEOs and CFOs of the two cement firms resigned. The preferential allocation of warrants by the board of Ambuja Cements resulted in an increase in the company's capital.

Bimal Dayal resigned as Managing Director and CEO of the company and as a director from the board. The Chief Operating Officer and the Chief Financial Officer will be responsible for the functioning of the company until the vacancies are filled.

The South East UP Power Transmission Company was acquired by Resurgent Power. The 26 percent stake in Resurgent Power is held by the Singapore based subsidiary of the company. In order to implement and operate the specified transmission system for a period of 35 years under a public private partnership model, a special purpose vehicle was formed. Resurgent Power now has a controlling interest in SEUPPTCL.

ferro chrome will be supplied by the company to the engineering firm. For the same, it has entered into a supply agreement for 3 years withAIA Engineering on a non-exclusive basis, which will be used to repay its loan or for working capital.

The offer will close on October 11 and will be opened on September 27. The price for buying back shares will be Rs 400 per share.

The National Company Law Tribunal gave the go-ahead for the merger of Exide Life Insurance Company with itself.

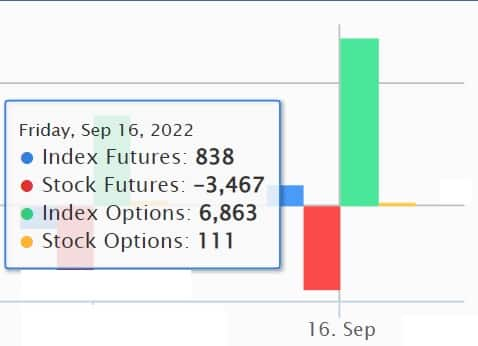

There is fund flow.

DII and fii data are included.

Foreign institutional investors have sold shares worth a total of 3,260.05 million dollars, while domestic institutional investors have sold shares worth 36.57 million dollars.

There are stocks under F&O ban on the stock exchange.

Indiabulls Housing Finance, India Cements, PVR, and RBL Bank have been placed on the F&O ban list by the National Stock Exchange. Companies that have crossed 95 percent of the market-wide position limit are banned from securities.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.