After years of building up foreign-exchange reserves, it is time for emerging Asian markets to start reaping the benefits.

Indonesia, South Korea, and the Philippines are reaping the benefits of a quarter-century of preparing for a repeat of the Asian financial crisis of the late 1990s. Even as the dollar rallied, emerging Asia's currencies are mostly better than their counterparts in Europe and Japan. The region's bonds are a bright spot in a year that saw global debt enter its first bear market for a generation.

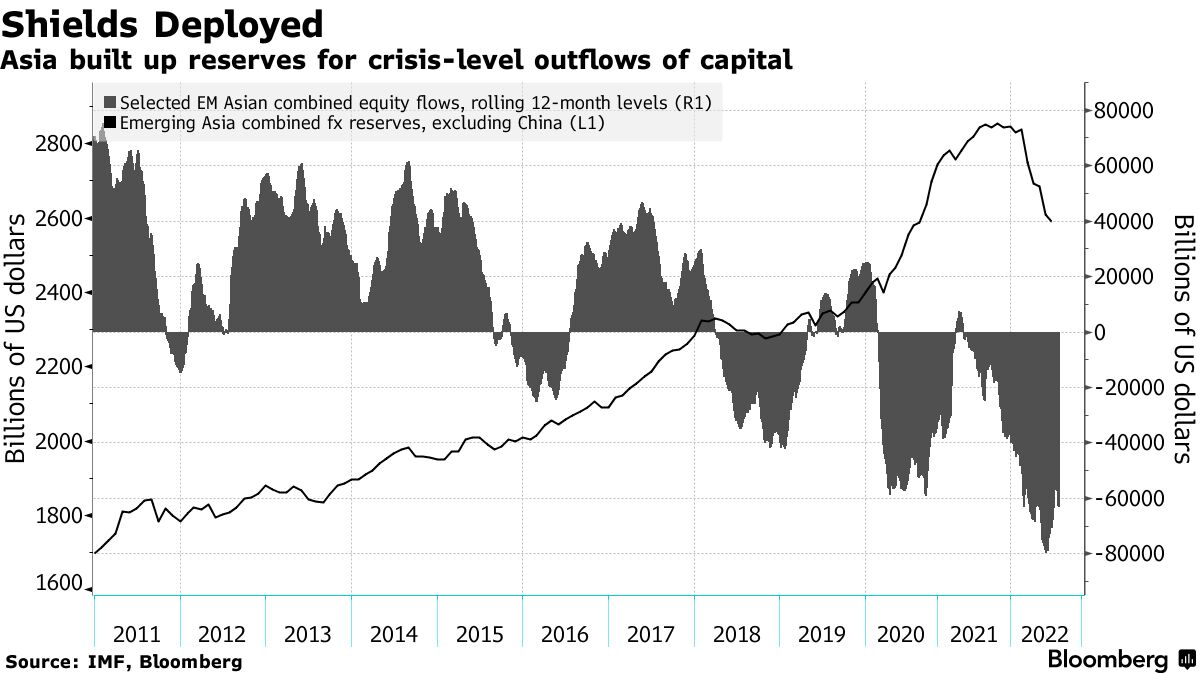

Good management is helping Asia. Local policy makers have been moderate in their deployment and built up record foreign-exchange reserves because inflation is weaker than most of the world. Despite the fact that the reserves have shrunk at the fastest pace on record, they are still higher than they were a decade ago.

The Chief Economist of Swiss Re said that emerging Asia was leading the race to keep inflation low. Most of Asia will be able to gain competitiveness if countries can avoid the type of conditions we think will happen in the near future.

The year-to-date performance may have given some reason for optimism. The total losses of emerging Asia bonds this year were 9%, better than a gauge of US Treasuries which had a loss of 11%.

Global investors are moving back into Asia. India and Indonesia recorded net foreign bond inflows in August, their first additions in at least six months. According to a strategist at Natwest Markets in Singapore, foreign bond positioning has not recovered to pre- Covid levels in most Asian economies.

Lower factory gate prices in Asia are a sign of a better outlook for the region, according to Swiss Re. The region has good fortune in avoiding the worst shocks of the commodity price because it is less dependent on energy from Russia.

The impact of this year's market turmoil on Asian economies has been mitigated by their built up foreign-exchange reserves. The reserves have been drawing down, but they are still above where they were at the end of the year. The combined holdings of Emerging Asia have risen to over $2 trillion.

Other key bond markets have suffered bigger losses.

There is a source for this.

Public and private debt has increased substantially, fiscal spending has increased, higher commodity imports are eating into current account surpluses, and real interest rates are negative, suggesting less of a buffer against capital outflows.

South Korea and Taiwan are showing contraction in the manufacturing sector, but Southeast Asia is showing expansion in the manufacturing sector. The problems afflicting China and Japan could be the region's biggest problem. Thailand and Japan are among the weakest, with China, South Korea and India in the next weakest tier.

Seven out of 30 major economies were found to be less vulnerable to hard landings, and five of them are in Asia.

The domestic outlook and demand for exports from the region have been affected by China's Covid-Zero strategy. The depreciating yuan crossed the psychological level of 7 against the dollar last week. Recent August industrial production, retail sales and fixed-asset investment data show signs of a recovery in China, which has pursued fiscal and monetary easing to cushion the impact of a hard landing.

Asia has the ability to weather the storm, according to an investment manager. He believes there are opportunities in Malaysian, Indian and Chinese debt. Asia has been more cautious in their policies vis-a-vis structural changes.